Back

Siddharth K Nair

Thatmoonemojiguy 🌝 • 11m

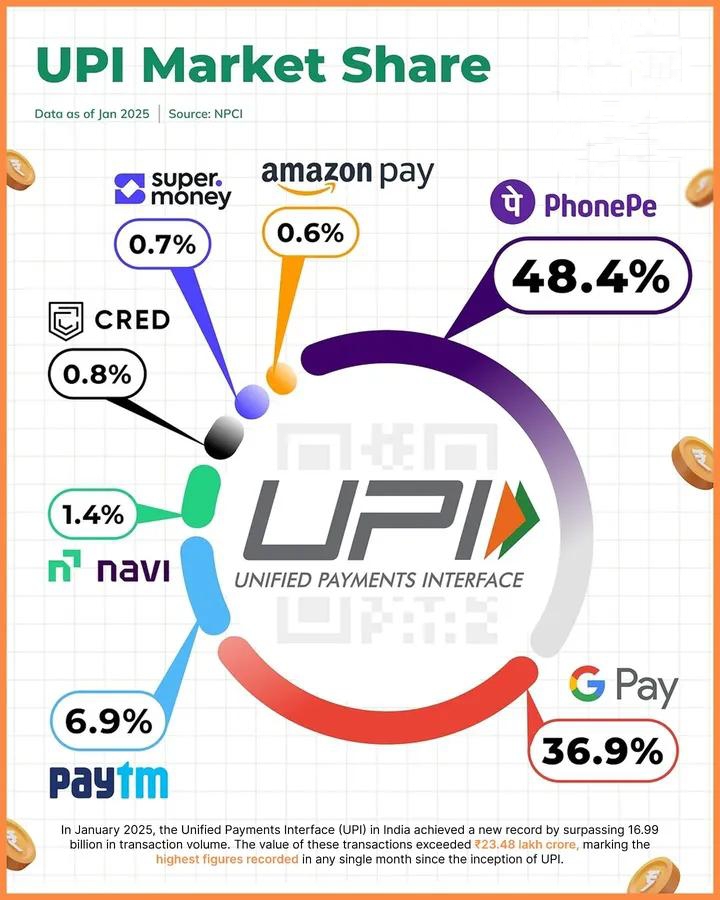

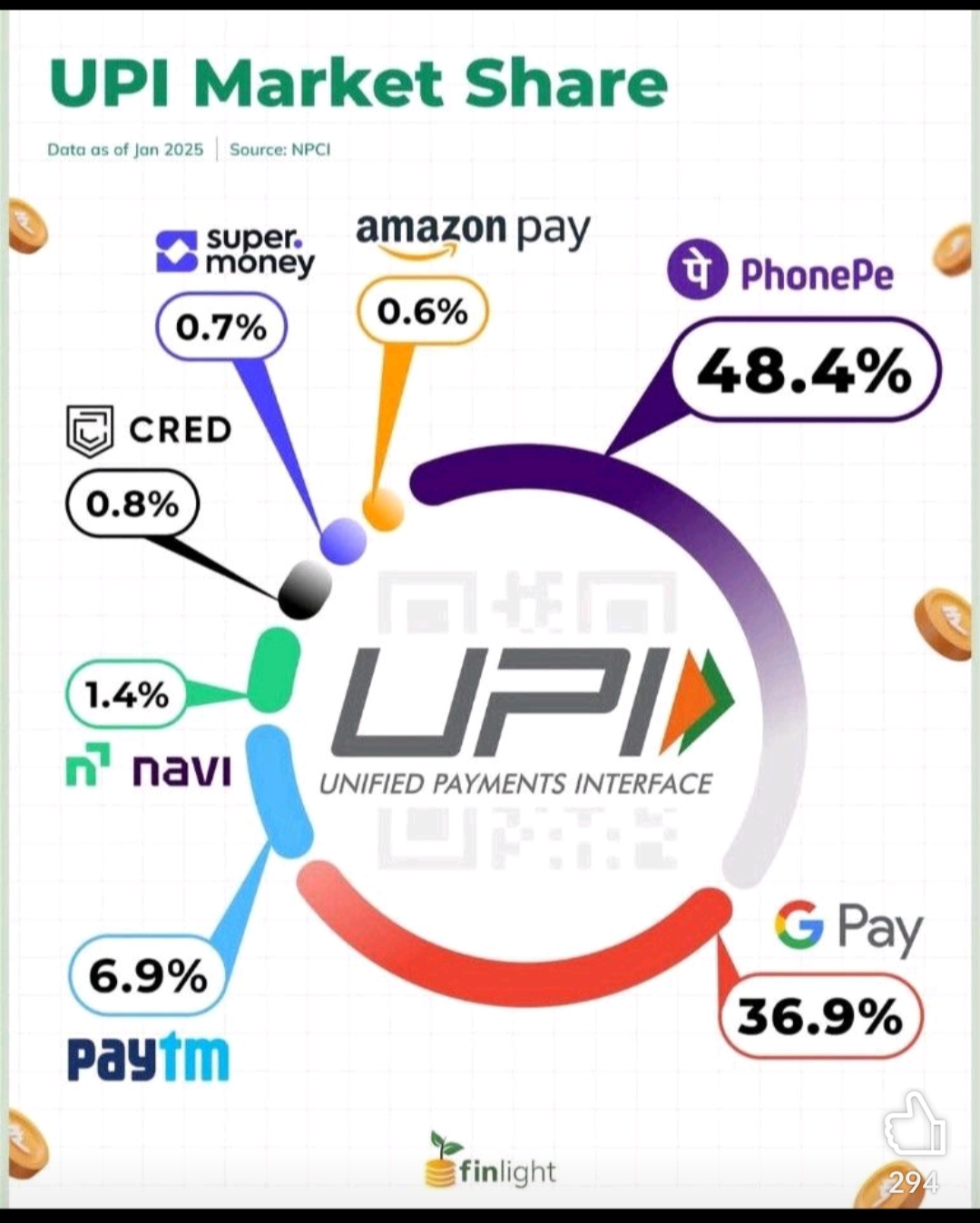

Paytm's fall in UPI dominance is due to regulatory actions, stronger competitors (PhonePe, Google Pay), lack of innovation, and trust issues. While it still holds a presence in digital payments, its UPI growth has been significantly impacted🌝

Replies (1)

More like this

Recommendations from Medial

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: PhonePe – India's UPI Leader Founded in 2015, PhonePe dominates India's digital payments landscape. Stats: Users: 350M+ registered Market Share: 40%+ of UPI transactions Business Model: Transactions, financial services, advertising. R

See More

Kimiko

Startups | AI | info... • 9m

🚀 UPI hits historic highs in January 2025! PhonePe leads with 48.4%, Google Pay follows at 36.9%, and Paytm holds 6.9%. 📊 Over 16.99 billion transactions worth ₹23.48 lakh crore — marking the highest figures recorded in any single month since UPI's

See More

Account Deleted

Hey I am on Medial • 12m

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Poosarla Sai Karthik

Tech guy with a busi... • 7m

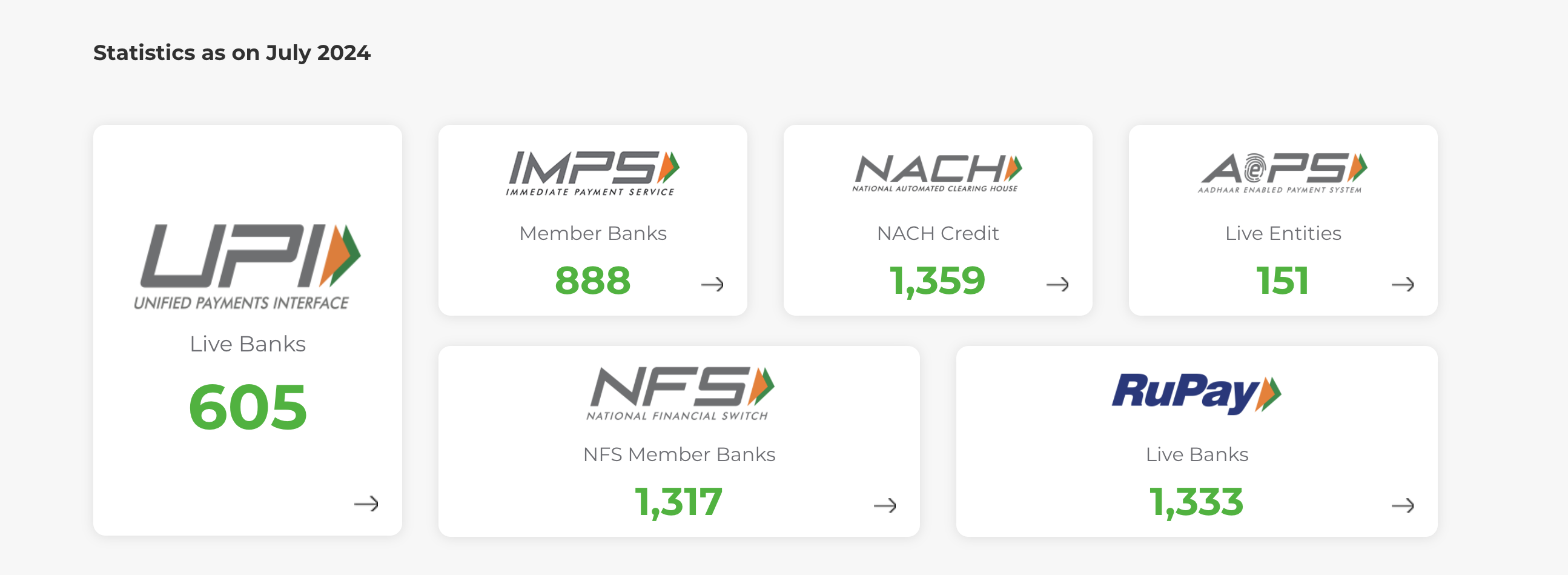

UPI on Credit? PhonePe’s Boldest Bet Yet In partnership with HDFC Bank and NPCI, the card is powered by Rupay and allows UPI payments through credit. NPCI had enabled this back in 2022, but PhonePe had to wait almost ten months to get RBI approval.

See MoreAccount Deleted

Hey I am on Medial • 1y

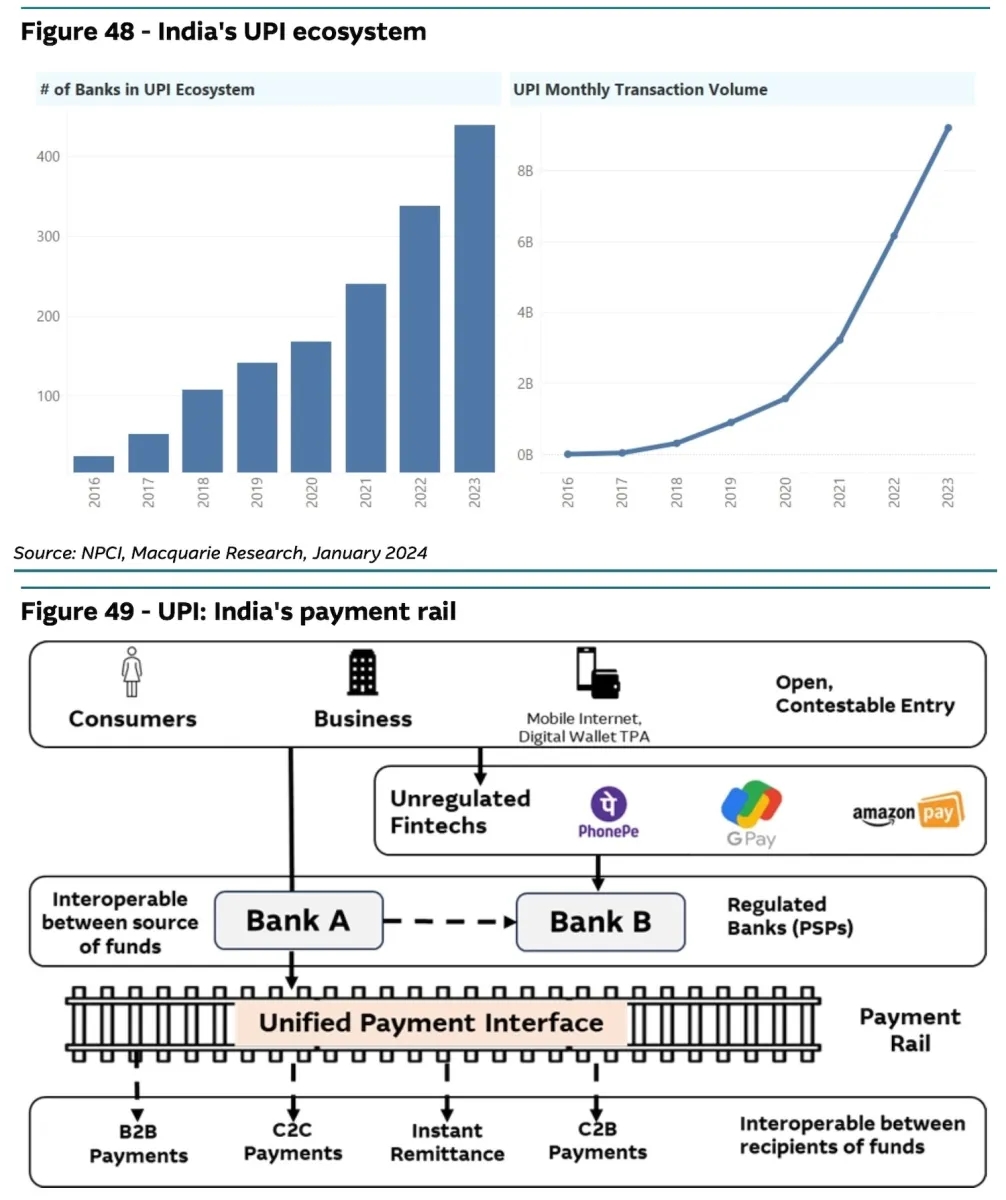

As you see in the picture , UPI is skyrocketing since 2016 to 2024 to approx . 8B transactions . • companies like Phonepe,Google pay are dominating the market with atleast 80% market share , Paytm market share fall from 13 to 9%. • Government will

See More

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: Paytm – India's Payments Pioneer Founded in 2010, Paytm revolutionized India's digital payments landscape. Stats: Users: 330M+ active Merchants: 21M+ partners Business Model: Payments, financial services, e-commerce. Revenue: FY18: $

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)