Back

Havish Gupta

Figuring Out • 11m

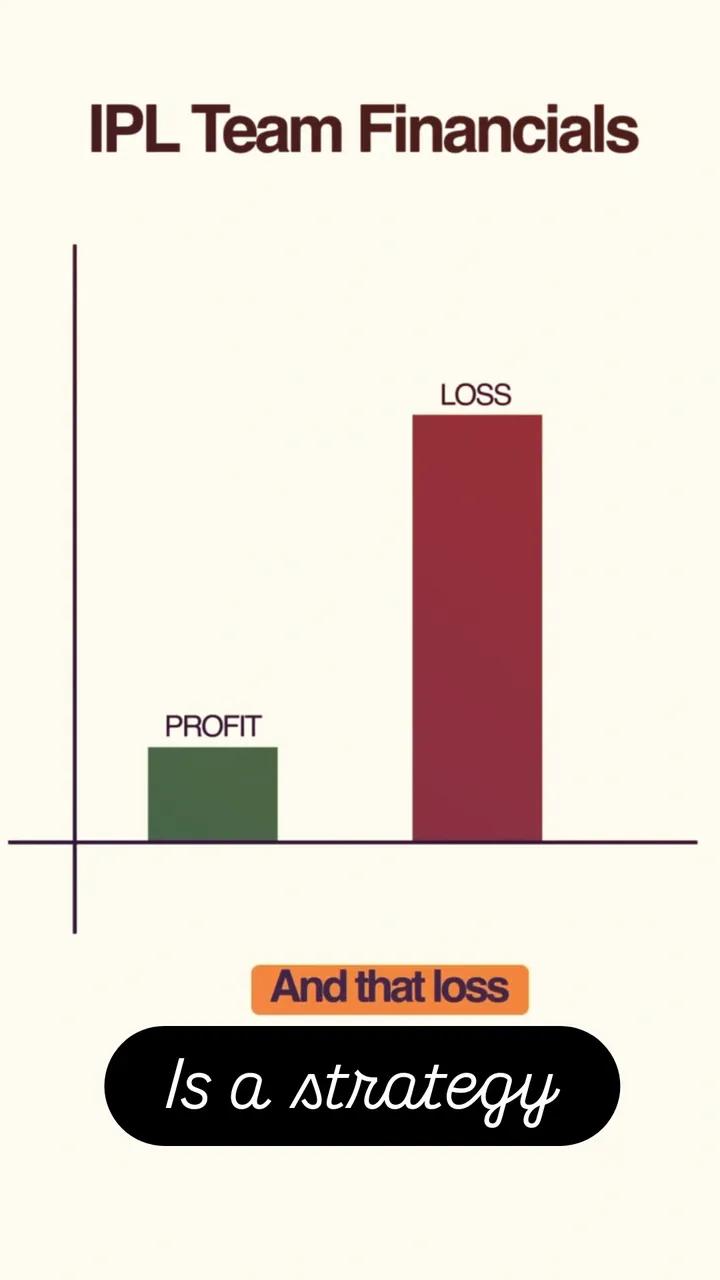

Yup 😁😎. Btw, the losses the start-ups or a company makes in the beginning are eligible to be carry forward to get tax breaks. right?

Replies (1)

More like this

Recommendations from Medial

CA Chandan Shahi

Startups | Tax | Acc... • 11m

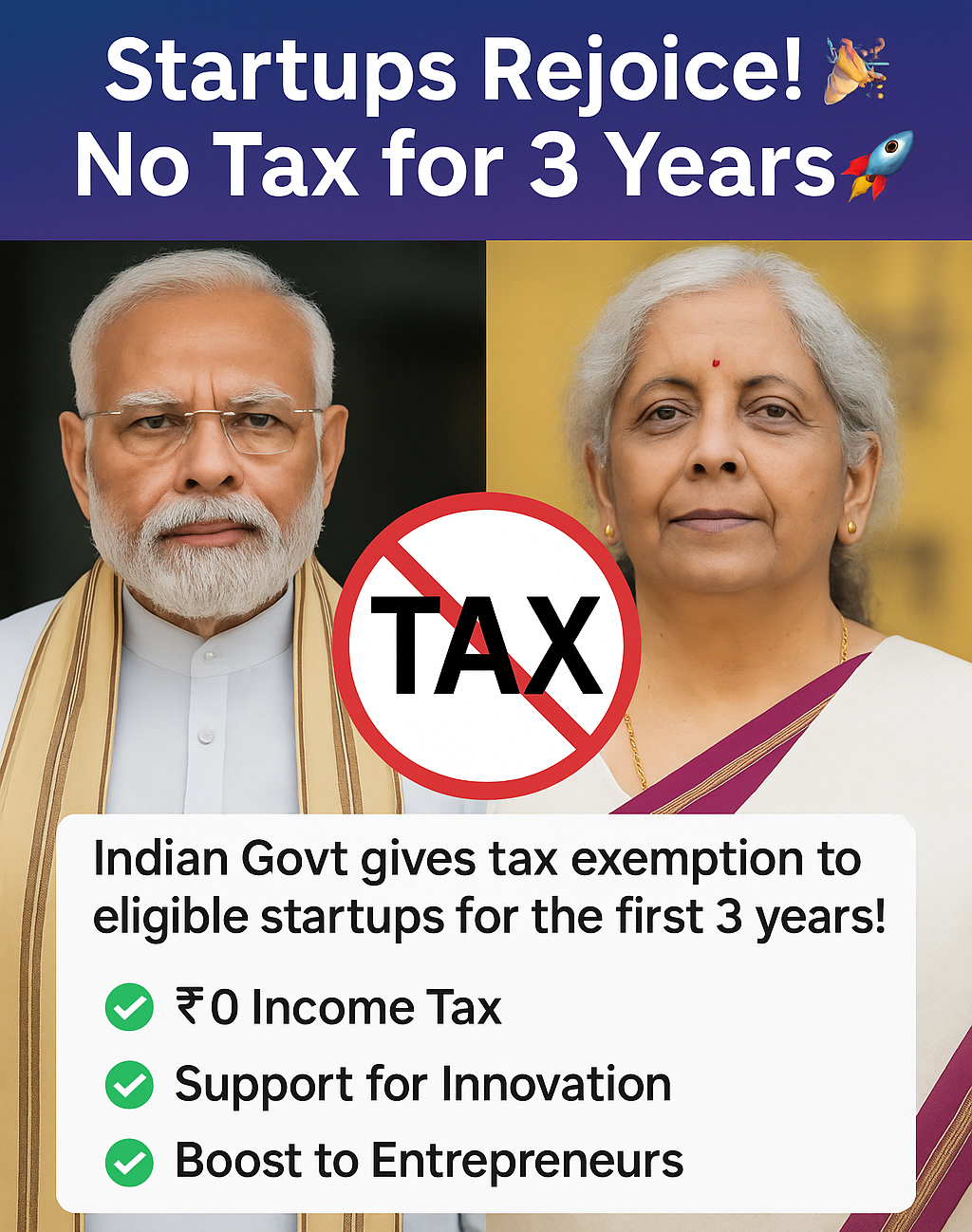

Big Relief for Start-Ups! 🚀 The Finance Act 2025 brings great news for aspiring entrepreneurs! The tax exemption under Section 80-IAC—which allows eligible start-ups to claim a 100% deduction on profits for three consecutive years within their firs

See Morecalculus

Your Bottom Line Our... • 8m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreCA Kakul Gupta

Chartered Accountant... • 11m

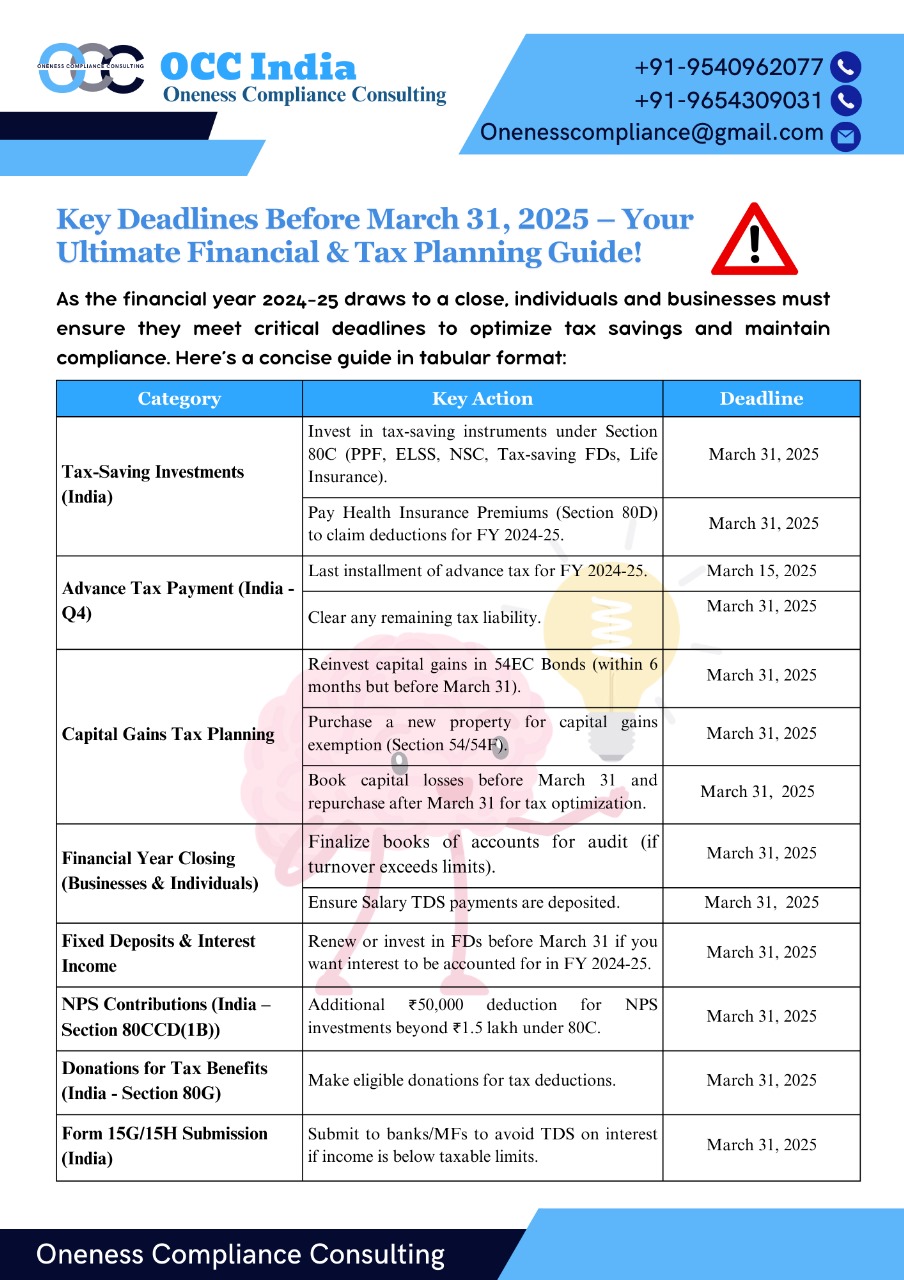

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

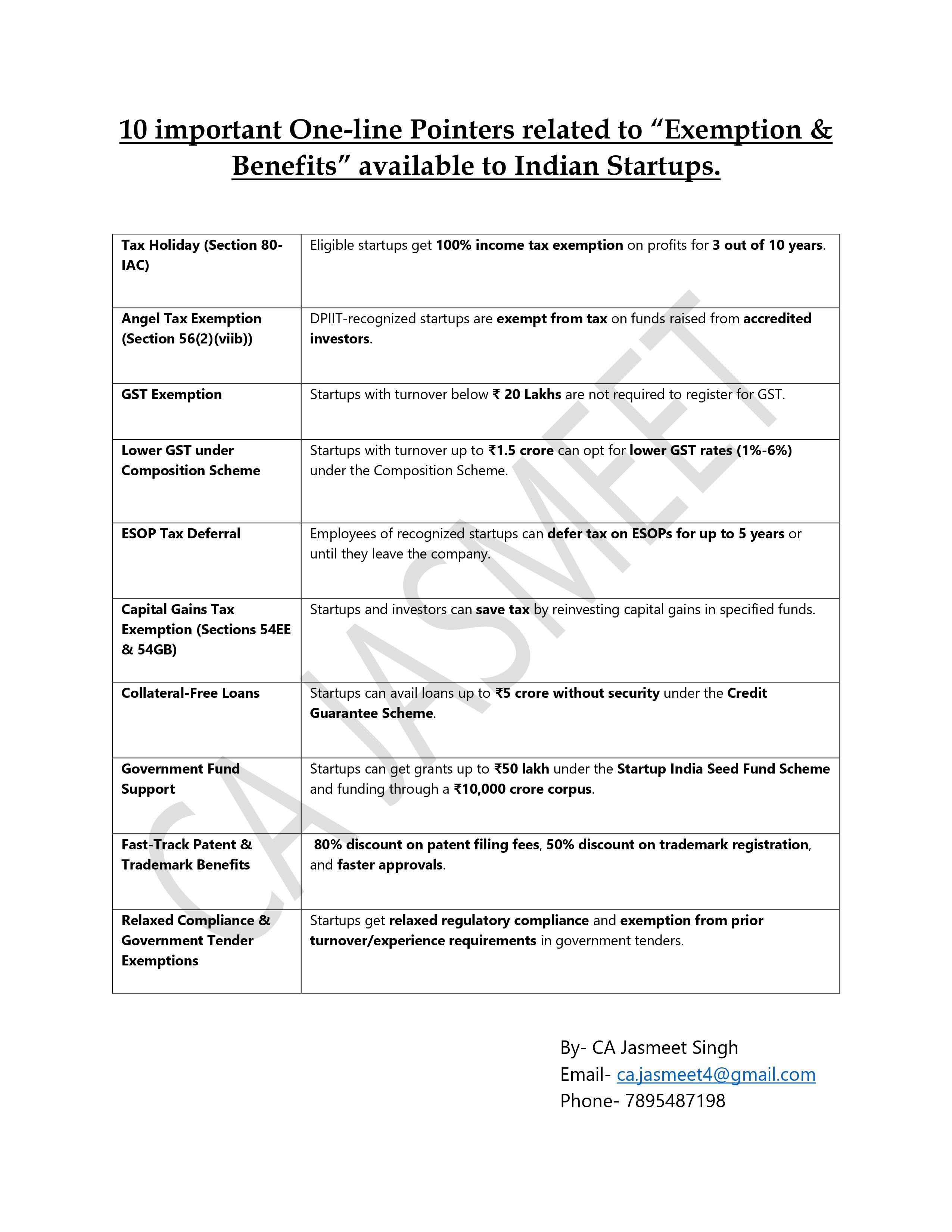

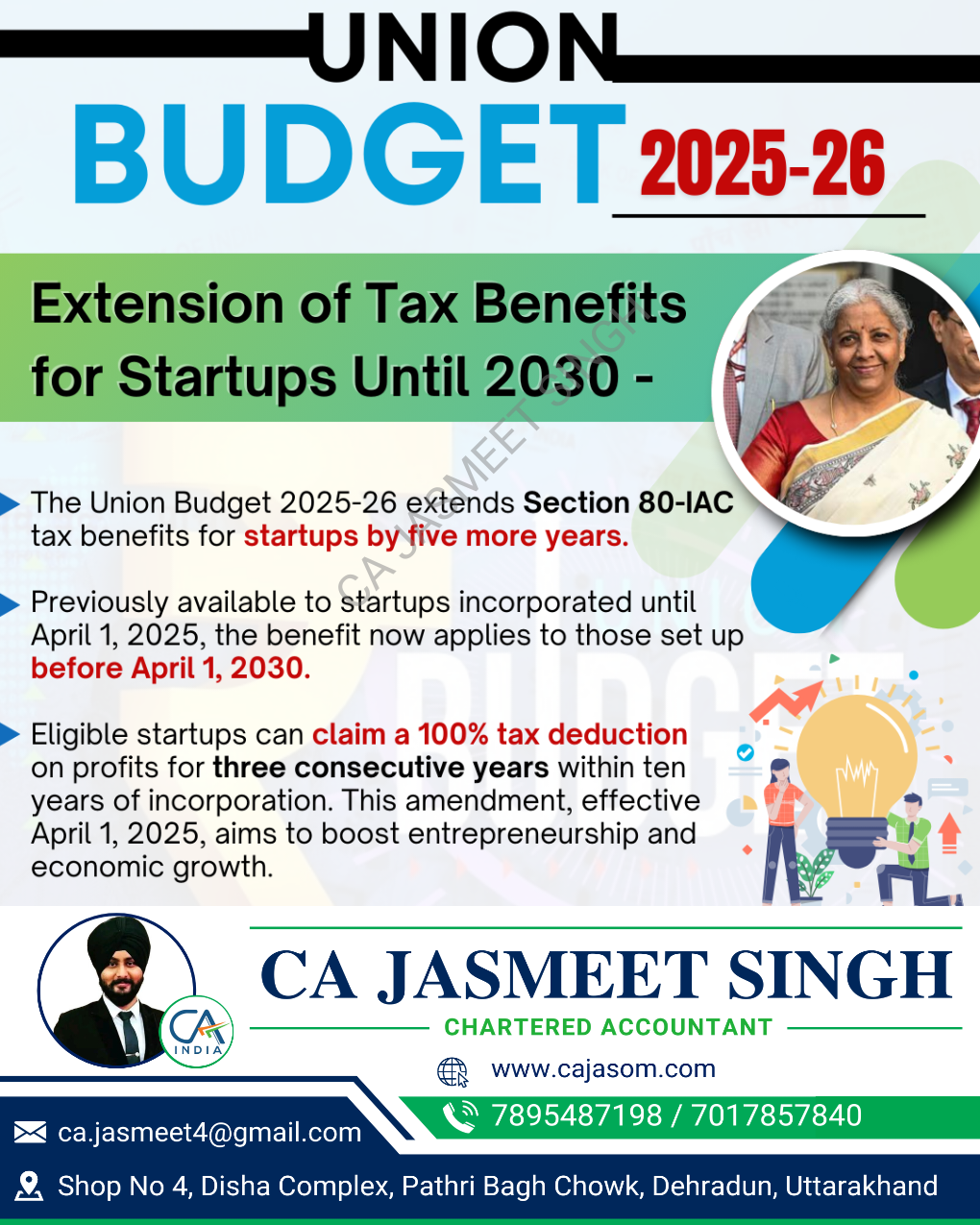

CA Jasmeet Singh

In God We Trust, The... • 1y

🌟 Big News for Startups! 🚀💼 Did you know Indian startups get amazing tax breaks, funding support, and compliance relaxations? 🏦📊 From 100% tax exemptions to collateral-free loans, here are 10 key benefits every entrepreneur must know! 💡✅ 🔥 C

See More

theresa jeevan

Your Curly Haird mal... • 1y

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

Mohammed Zuber Ahamad

Founder @Techzipe | ... • 7m

BIG WIN for Startups in India! 🇮🇳 The Govt is offering ₹0 Income Tax for 3 Years to eligible startups! 🙌 ✅ Boost for innovation ✅ Support for entrepreneurs ✅ Massive growth opportunity If you’re building the future, this is your moment. 🔥 #Start

See More

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

Of course the value of money has changed but it's a great comparison. It does not show Congress taxed the rich btw. Nobody was paying 97.5% tax. They were just paying bribes to Congress to keep money black. That's how they destroyed our economy.

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)