Back

CA Jasmeet Singh

In God We Trust, The... • 11m

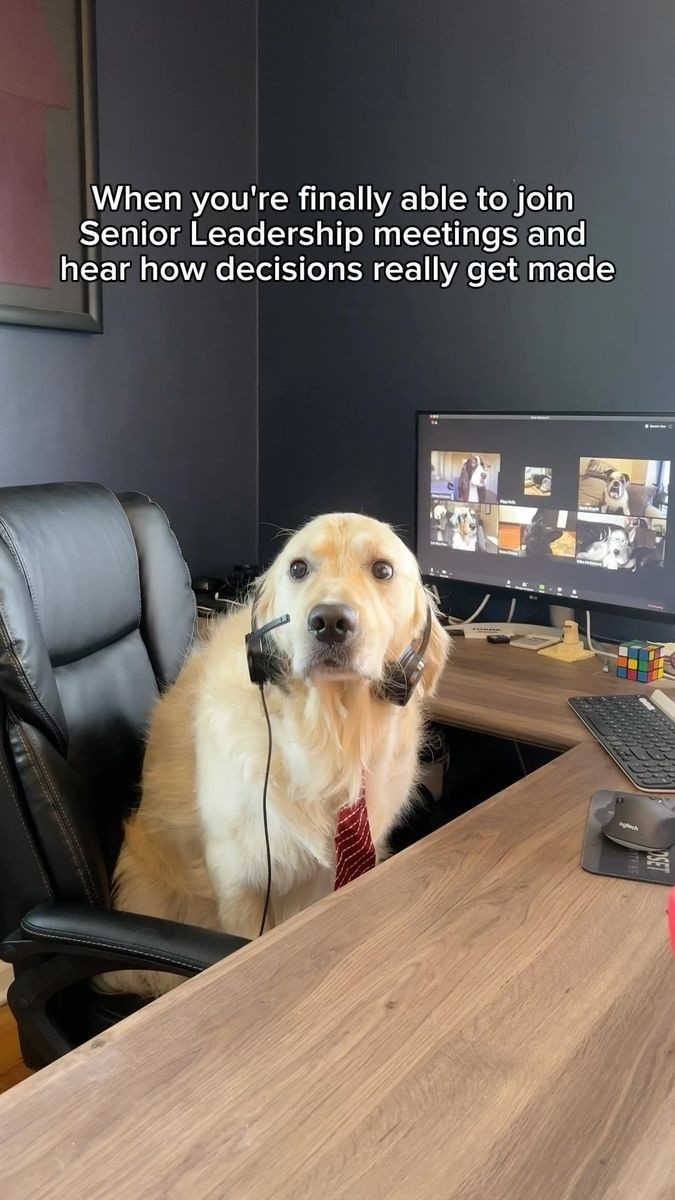

See the benefit of this Section is for 3 consecutive years. Hence no matter in case you have losses the exemption will be exhausted. But on the other hand. The Losses can be carried forward for the businesses.

Replies (1)

More like this

Recommendations from Medial

CA Chandan Shahi

Startups | Tax | Acc... • 11m

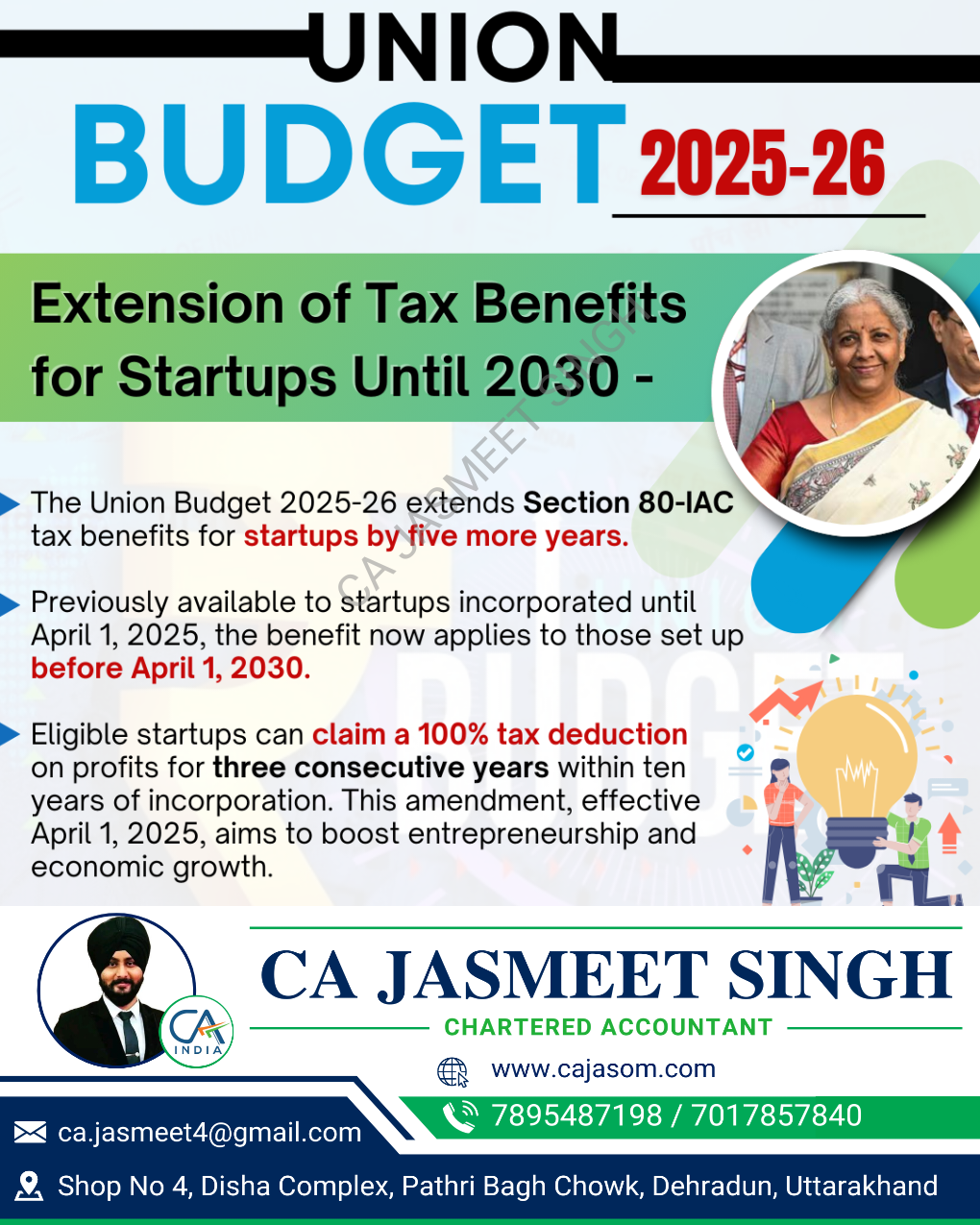

Big Relief for Start-Ups! 🚀 The Finance Act 2025 brings great news for aspiring entrepreneurs! The tax exemption under Section 80-IAC—which allows eligible start-ups to claim a 100% deduction on profits for three consecutive years within their firs

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Anirudh Gupta

CA Aspirant|Content ... • 10m

🤯Understanding Capital Gains – Don’t Miss This! Let’s take an example: Mr. A owns a building along with a large piece of land. He enters into a Joint Development Agreement (JDA) with a builder. 😄What is a Joint Development Agreement (JDA)? In a

See More

Shreyansh Surana

Let's do it. • 11m

I have an idea that isn't just for gaming app but has the potential to transform the entire industry and create a massive impact. What does it solve: 1. Reduce player losses 2. Increase platform profits The only challenge is that if I share it, it

See MoreAman meshram

Finding business gap... • 1y

There is an interesting facts about social based platform across the category , an individual will use any one platform majorly from every catagory hence you have to be a leader of your catagory hence survival of many social media at once seems pret

See More

Anonymous

Hey I am on Medial • 1y

No matter how much we strive to reach the top 1%, let's not forget the importance of working towards improving the lives of the most vulnerable in our society. Ideas that benefit farmers and residents of tier 2 and 3 cities are always more valuable,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)