Back

Anonymous 1

Hey I am on Medial • 12m

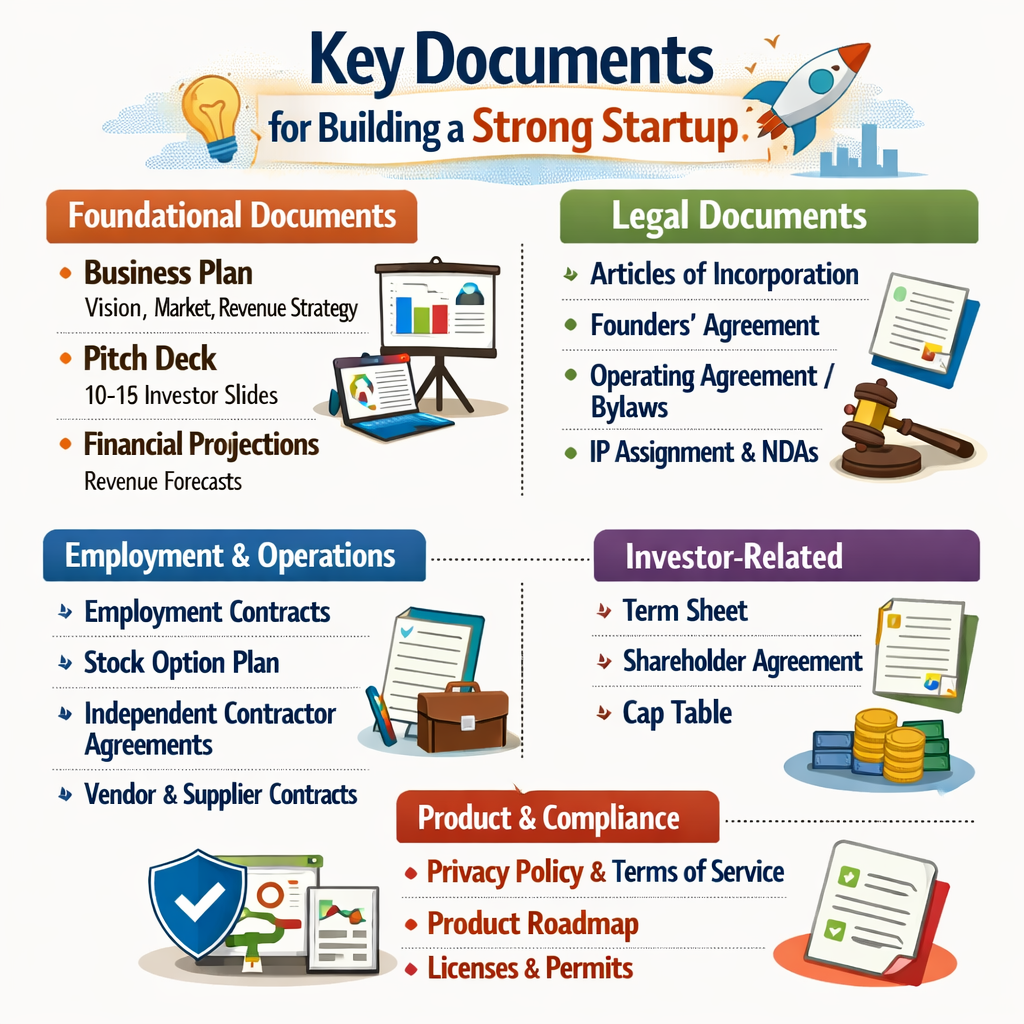

Pre-seed funding is the earliest stage of startup financing, helping founders turn an idea into a business by covering costs like prototype development, market research, and legal setup. It typically comes from friends, family, angel investors, or accelerators. Since the startup may not be registered yet, investors often use SAFE agreements, convertible notes, or informal loans, which convert into equity once the company is officially formed.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

In this insightful video, we explore "Unlocking Potential: Innovative Financing for Turnarounds," where we delve into groundbreaking financing strategies designed to transform struggling businesses into thriving enterprises. Discover how Revenue-Base

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Unlocking Potential: Innovative Financing for Turnaround Projects Turnarounds aren’t just about survival—they’re launchpads for reinvention. But even the best strategies stall without smart financing. Here’s how innovation is changing the game: 1. R

See More

Nikhil Raj Singh

Entrepreneur | Build... • 11m

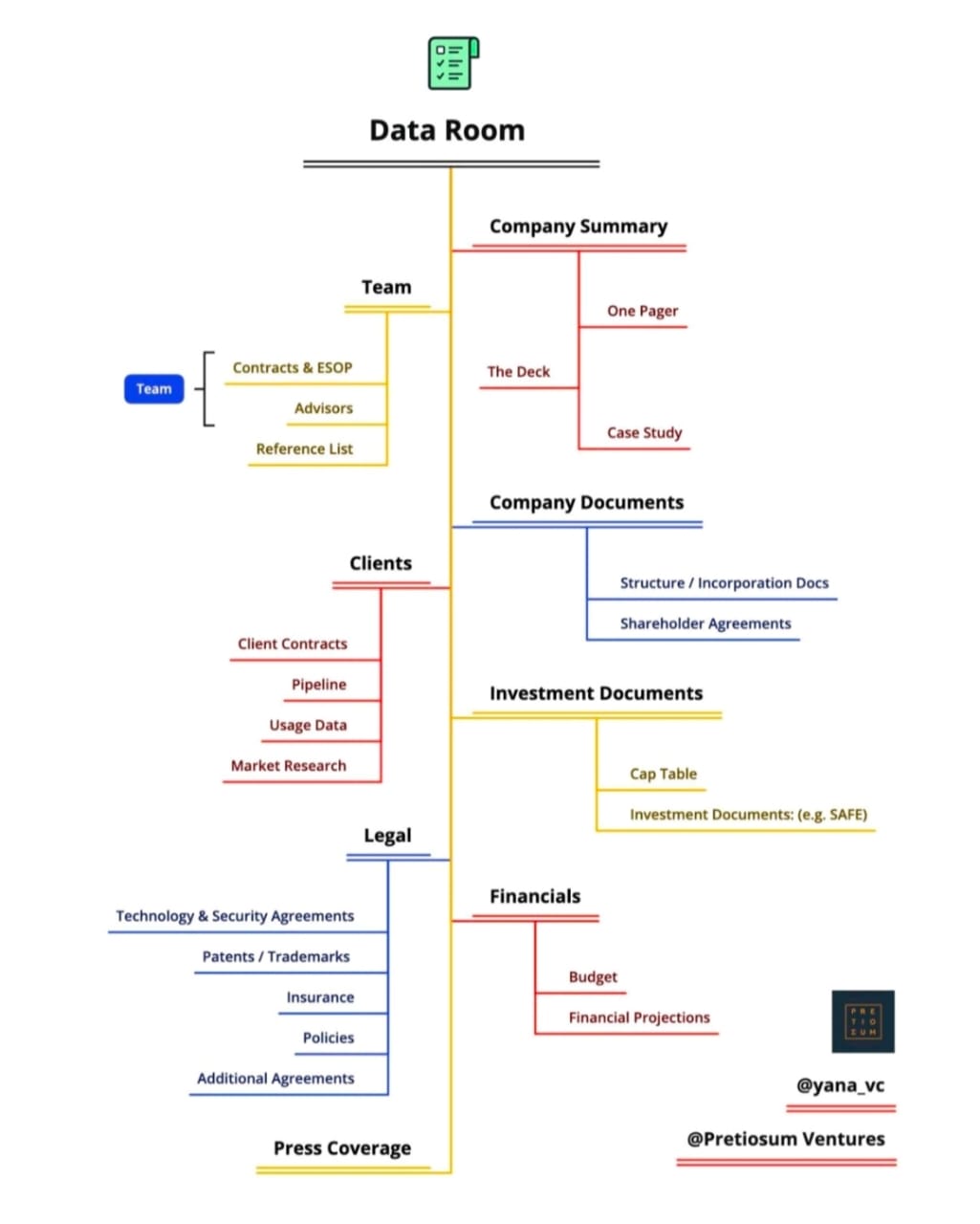

Founders, don’t overlook this! If you're raising funds, having a well-structured Data Room is a game-changer. It shows investors you're professional, transparent, and ready to scale, making the due diligence process smoother and faster. Here’s what

See More

Tushar Aher Patil

Trying to do better • 9m

Did you know that one of the world's major financial institutions, the London Stock Exchange (LSE), has its roots in a coffee house? It's true! The LSE initially operated out of Jonathan's Coffee House in London. This wasn't a formal trading floor t

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Navigating the world of financing can be daunting, especially when comparing private funding to traditional bank loans. In this video, we explore the reasons why private funding often proves to be a tougher nut to crack. Discover how risk appetite, r

See MoreDaya Juwatkar

Founder at Mridakran... • 1m

Hi, I’m Daya Juwatkar, founder of Le’Udhaar — a fintech infrastructure startup formalising India’s informal lending using auto-debits, legal e-agreements, and recovery workflows. Where we are now: • Fully working demo app ready • End-to-end flow: le

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)