Back

Arcane

Hey, I'm on Medial • 1y

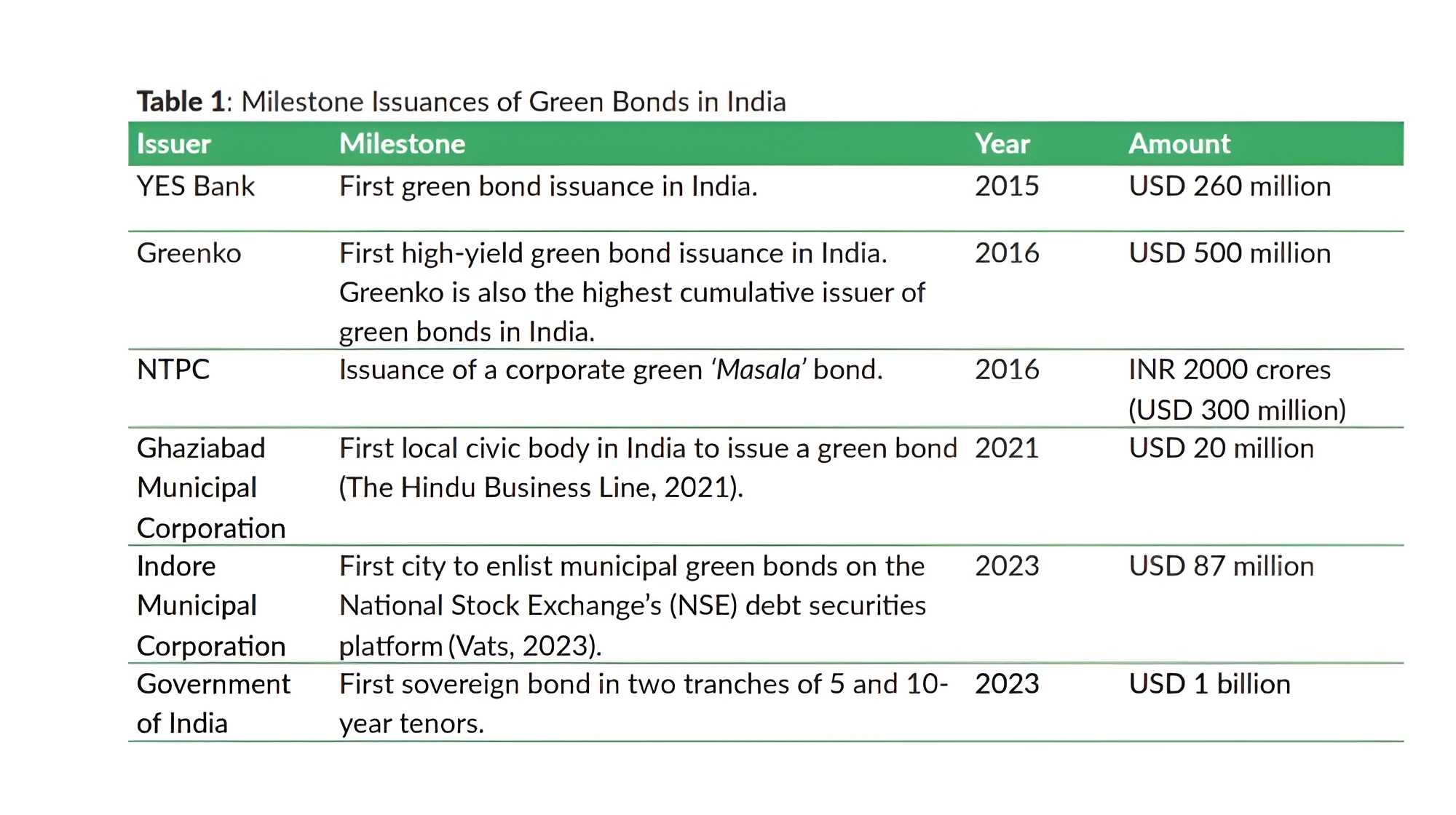

India's green financing journey began early, with USD 15.7 billion in climate-aligned bonds used for clean energy by 2016. Officially, the market started in 2015 with YES Bank's renewable energy bond. Since then, major players like EXIM Bank and ReNew Power have joined in, with some bonds listed on international exchanges. The private sector issues most Green Bonds (84%), but there's also potential for public sector involvement. Currently, financing focuses on clean energy, but the regulations allow for expansion into other sustainable sectors. India's Green Bond market has a strong base and is gaining traction. Encouraging broader participation and exploring financing across various sustainable sectors is key for its growth in the future. What are your thoughts on Green Bonds?

More like this

Recommendations from Medial

Rajesh Shukla

Hey I am on Medial • 4m

Sugar funding attracts investors by fueling ethanol, green energy, and sustainable projects. It transforms sugar into a growth-driven investment sector, creating opportunities in renewable fuels, boosting farmer incomes, and shaping the future of sus

See More

Account Deleted

Hey I am on Medial • 12m

Tata Power has signed a Memorandum of Understanding (MoU) with the Assam government to develop 5,000 megawatts (MW) of renewable energy projects in the state. The initiative, which involves an estimated investment of ₹30,000 crore, aims to boost As

See More

VIJAY PANJWANI

Learning is a key to... • 3m

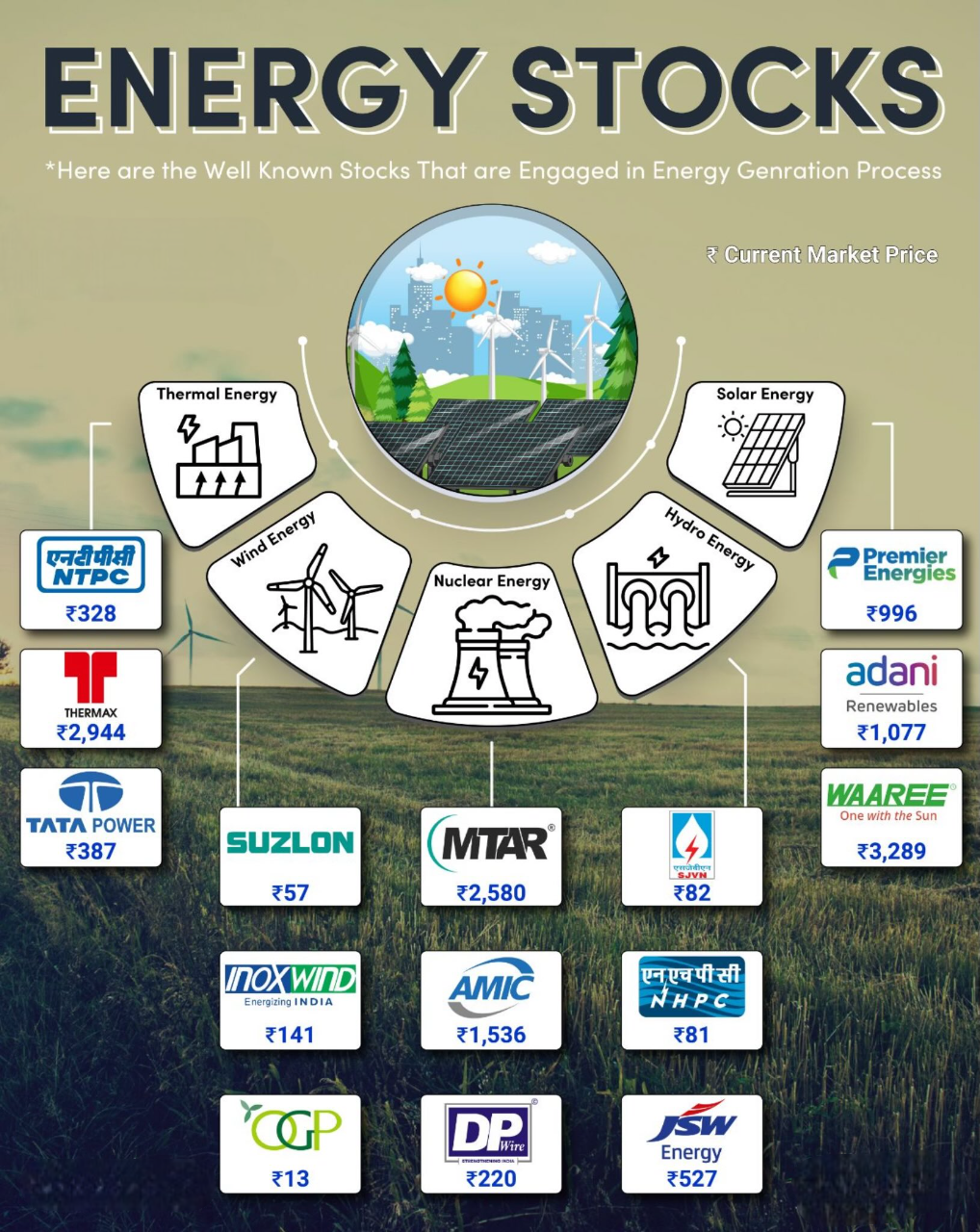

Top Energy Stocks to Watch in 2025! From Solar to Wind, Hydro to Nuclear, these companies are powering India’s clean energy future. 🌱🔋 🔥 Whether you’re a beginner or a pro investor, knowing the right sectors matters! Here are some of the most p

See More

REDWOODTRADEWORKS

Connecting Buyers & ... • 6m

Exclusive Green Energy Investment Opportunity We at Mursan Kamalpur Green Energy Pvt. Ltd. are setting up a ₹19 Cr Bio-CNG & Organic Fertilizer Plant in India under the Govt.-backed SATAT Scheme with additional revenue from Carbon Credits. Seeking

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)