Back

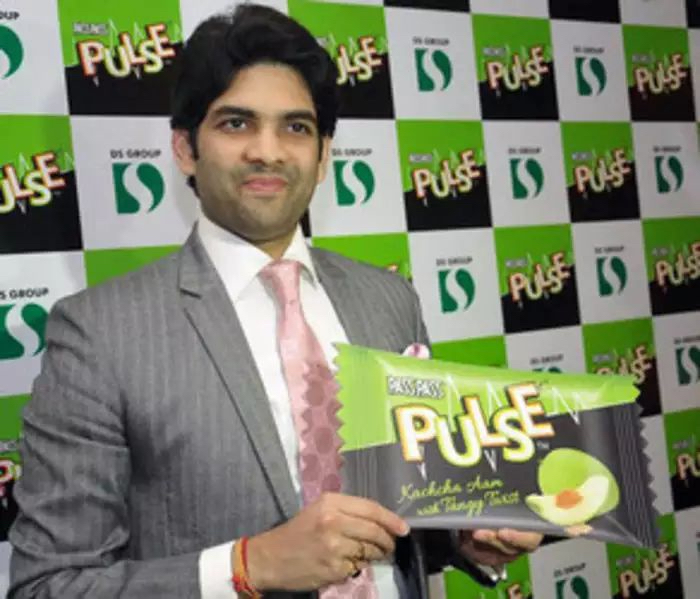

Aditya Arora

•

Faad Network • 1y

How did Pulse become a 350 CR brand with NO marketing? 1. In 2015, DS Group, known for Rajnigandha and Pass Pass, saw an opportunity in India’s ₹8,000 crore candy market. Instead of another sweet candy, they launched Pulse, a tangy raw mango candy with a salty kick. Many called it a failure before it hit the market. 👎 2. Pulse had a negative customer segment. So they had zero ad spend—no TV commercials, celebrity endorsements, or digital promotions. The candy hit stores quietly, but its intense flavour got people talking. Word-of-mouth became its biggest marketing tool. 🗣️ 3. DS Group still had to make the hype bigger. They use a scarcity strategy, launching Pulse in only a few states like Gujarat and Rajasthan. Limited supply created urgency, making people hunt for it. Some even paid a premium to get it. Retailers rationed stock, making it appear even more exclusive. ✅ 4. Pulse hit ₹100 crore in sales in just 8 months—the fastest FMCG brand in India to achieve this. Another thing Pulse had was its price. At just ₹1, it was an easy impulse buy. Its bright green-yellow packaging also stood out. But the DS group knew that any candy success was not possible without retailers.👇 5. As demand surged, retailers stocked it in bulk and hid stock under the counter to sell at higher margins. Some stores bundled Pulse with other items, others offered free samples, and others even created waitlists, making Pulse exclusive. Within two years, sales skyrocketed to ₹300 crore, beating giants like Melody, Alpenliebe and Eclairs. 📉 6. By 2018, Pulse was available in over 2 million retail outlets across India. Indian travellers took Pulse abroad, making it popular in the US and UAE. DS Group launched new flavours like Orange, Pineapple, and Guava to sustain demand. But Raw Mango remained the star. ⭐ 7. The company also introduced larger packs and gift packs to expand its reach. By 2019, Pulse doubled its sales to cross ₹350 crore. 💪 ➡️ At 48% market share in the Indian Candy market today, Pulse proves that a great product, coupled with scarcity, retailer strategies, and organic virality, can achieve massive success without any marketing spent. 🙏

Replies (8)

More like this

Recommendations from Medial

Shanu Chhetri

CS student | Tech En... • 7m

Pulse candy, manufactured by Dharampal Satyapal (DS) Group, is on track to become a ₹1,000 crore brand within the next two years. Having already surpassed ₹750 crore in sales during FY25, the company is strategically expanding into new product catego

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 9m

Frooti Forever: The Childhood Drink That Grew Into a ₹1000+ Crore Icon Launched in 1985 by Parle Agro, Frooti wasn’t just a mango drink, it was a category disruptor. Packaged in an innovative Tetra Pak, Frooti became India’s first ready-to-drink man

See More

Rohan Saha

Founder - Burn Inves... • 10m

Jio Financial Services reported a net profit of ₹316 crore this time, and the company also announced a dividend of 0.5 paise per share. Along with that, the company’s market cap is ₹1,56,609 crore. Honestly, if it were any other company in its place,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)