Back

Havish Gupta

Figuring Out • 1y

Snapdeal is now almost profitable! So Snapdeal recently released its financials, and they’ve killed it! Their cost-reduction measures have led to their EBITDA loss dropping to just ₹16 crore in FY24, down from ₹144 crore in FY23. While their revenue only just a 2% increase to ₹379 crore, the overall performance is still commendable. Snapdeal’s primary revenue streams include marketing services, e-commerce enablement, and other ancillary sources. Marketing services remain the largest contributor, generating ₹252.55 crore in revenue. The cost reductions were primarily driven by two factors: 1. A 48% reduction in employee benefits, saving ₹159 crore. 2. A 23% decrease in advertising expenses, bringing the total down to ₹76 crore. Although the overall net loss saw a 43% reduction, reaching ₹160 crore, its still almost cash flow positive. They are also planning an IPO, by the way! Ig, Kunal Bhal'a debut in Shark Tank had a great impact on the company! what do you think?

Replies (10)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

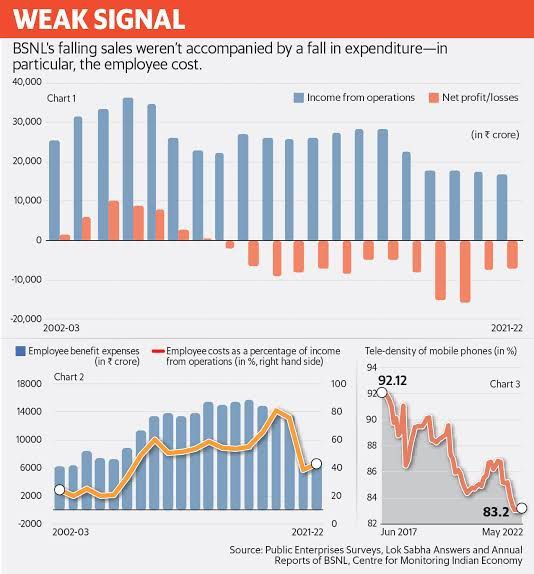

After years of financial strain, BSNL reported a net profit of ₹262 crore in Q3FY25 marking its first profitable quarter since 2007. This comes after a loss of ₹849 crore in Q4FY24. Despite this milestone, the company posted an overall loss of ₹2,24

See More

Mahendra Lochhab

Content creator • 1y

Ola Electric reported consolidated loss of ₹564 crore for the Q3Fy25 as compared to ₹376 crore posted in the year-ago period. The company's revenue from operations stood at ₹1,045 crore, down from ₹1,296 crore reported in the corresponding quarter of

See More

Tushar Aher Patil

Trying to do better • 1y

Ritesh Agarwal-led hospitality giant OYO recorded a net profit of Rs 158 crore and revenue of Rs 1,578 crore in Q2 FY25, PTI reported. This marks a significant turnaround, as the company had posted a net loss of Rs 50 crore during the same period la

See More

financialnews

Founder And CEO Of F... • 1y

1)Precision Camshafts Q3 Results: Auto component-maker posts ₹6.35 crore net loss, revenue tanks 25% YoY 2)Honasa Consumer Q3 Results: Net profit rises marginally to ₹26 crore, revenues up 6% YoY 3)Bharat Forge Q3 results: Net profit falls 16% to ₹

See MoreAccount Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Vishal Kr Mohali

Hey I am on Medial • 6m

Fractal Posts ₹2,765 Cr Revenue in FY25, Turns Profitable Ahead of ₹4,900 Cr IPO AI and data analytics solutions provider Fractal has filed its DRHP with SEBI to raise up to ₹4,900 crore via fresh issue and OFS. The company posted a strong FY25, w

See More

Startopia news

Your daily dose of s... • 9m

For years, Delhivery, one of India's biggest logistics startups, was running at a loss. But FY25 changed the game. In the fourth quarter alone, Delhivery posted a profit of ₹72.6 crore - a big turnaround compared to the 68.5 crore loss in the same qu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)