Back

CS Akshay Vernekar

Practicing Company S... • 1y

Yes, LLP is different from individuals. LLP will have it's own PAN independent of its Designated Partners (DP). However when being appointed as the DP you will need DIN which is PAN based. Having said that is you don't derive any remuneration from LLP you don't have to worry about Income Tax except for giving the details of accounts of LLP in Tax Returns. As long as your employer is unaware of how MCA portal works he won't find out the details of the LLP and your association.

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

PAN Card The PAN (Permanent Account Number) card is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It's crucial for various financial transactions such as opening a bank account, filing income tax returns, and buyin

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Why LLP is the Best Way to Launch a Startup? 🚀🚀 Starting a business is an exciting yet challenging journey. Choosing the right legal structure is crucial, as it impacts taxation, liability, compliance, and growth. Among various options, a Limited

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Why LLP is the Best Way to Launch a Startup? 🚀🚀 Starting a business is an exciting yet challenging journey. Choosing the right legal structure is crucial, as it impacts taxation, liability, compliance, and growth. Among various options, a Limited

See More

Prabhat Singh Chauhan

"Empower Your Busine... • 8m

"I have a business idea for our Bhopal-based investor. It focuses on unique snacks that many people are currently unaware of. If anyone is interested in hearing more, I'd be happy to share the details." For more details contact me Email ID:- prabh

See MoreRaghav Batra

Accounting Professio... • 12m

Tax season is approaching! If you need assistance with filing your income tax, I’m here to help. As an experienced Accounting Specialist, I ensure accurate, efficient, and hassle-free tax filing. Feel free to reach out for more details and pricing!

See More

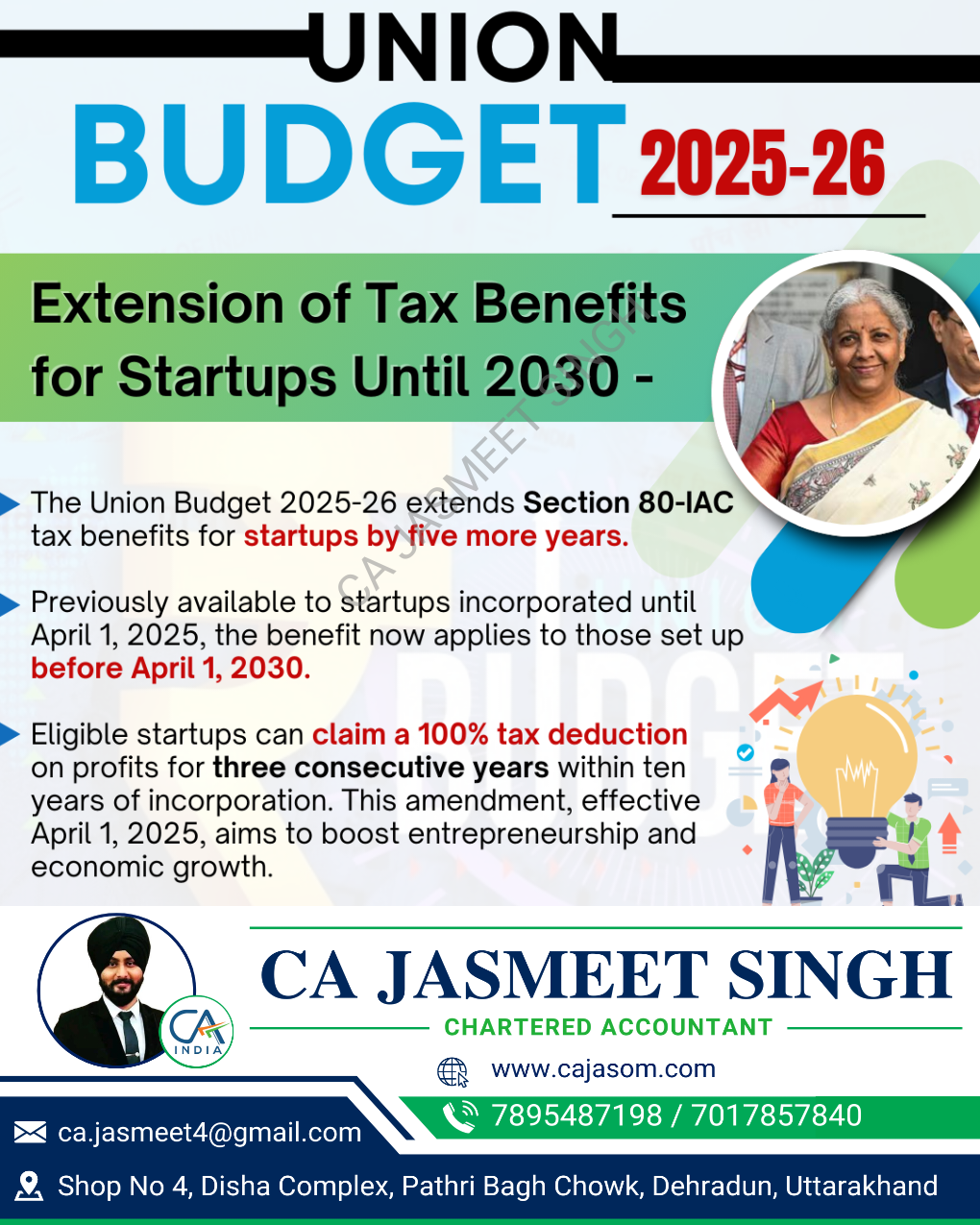

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Anonymous

Hey I am on Medial • 10m

I’m looking to register my business as an LLP to become eligible for funding through incubators and government schemes. I’d like to understand the costs involved in registering an LLP, as well as the yearly compliance and maintenance expenses. Is the

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)