Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

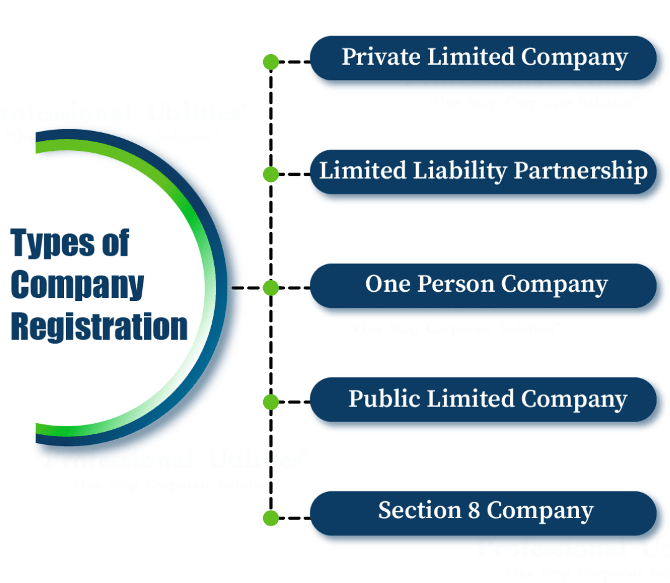

Why LLP is the Best Way to Launch a Startup? 🚀🚀 Starting a business is an exciting yet challenging journey. Choosing the right legal structure is crucial, as it impacts taxation, liability, compliance, and growth. Among various options, a Limited Liability Partnership (LLP) stands out as an ideal choice for startups. LLP is a combination of Partnership and Company. Here's why: 1. Limited Liability Protection🔰 The key advantage of an LLP is the limited liability it offers to its partners. In case of debts or losses, partners’ personal assets remain protected, and only the LLP's assets are used to settle obligations. This feature ensures peace of mind for entrepreneurs venturing into untested markets. 2. Flexibility in Management 📊 An LLP allows flexibility in managing the business. The operational framework can be customized through an LLP agreement, outlining roles, responsibilities, and profit-sharing ratios. This is especially beneficial for startups where partners may have diverse expertise and contributions. 3. Separate Legal Entity 🪪 An LLP is a separate legal entity, distinct from its partners. This means the LLP can own assets, enter contracts, and sue or be sued in its own name. It ensures continuity even if partners change, which is vital for the long-term sustainability of a startup. 4. Simplified Compliance 📑 Compared to a private limited company, an LLP has fewer compliance requirements. For instance, LLPs are exempt from mandatory board meetings, AGM, EGM and have minimal annual filing obligations. This reduces the administrative burden and allows founders to focus on business growth. 5. Tax Benefits 🧾 LLPs enjoy several tax advantages. For example, they are not subject to dividend distribution tax (DDT), and profits distributed to partners are tax-free in their hands. This ensures that the overall tax burden on the business and its partners remains low. 6. Cost-Effective Setup 🪧 The cost of forming and maintaining an LLP is lower than that of a private limited company. For startups operating on tight budgets, this cost efficiency can make a significant difference. 7. Attractive to Investors 💼 Although LLPs cannot issue shares, they can attract investors through flexible profit-sharing arrangements or by onboarding them as partners. For early-stage startups, this structure provides an alternative to traditional equity financing. 8. Ease of Exit and Dissolution🪦 In case the startup doesn’t go as planned, winding up an LLP is simpler and less expensive compared to other business structures. This flexibility reduces the risk and burden associated with starting a business. 9. Conversion of LLP into PVT. LTD. ⛓️💥. Most Importantly LLP can be converted into pvt ltd, proprietorship, Partnership etc. later on when the company grows. If you're an entrepreneur ready to turn your idea into reality. LLP is best. 🚀🚀Reach me out if you want to register your company with minimum cost. i will share you documents required personally in my DM.

Replies (2)

More like this

Recommendations from Medial

Rohan Kute

Business | infograph... • 10m

If you ever wonder to start a company, you should have to know this. There are three types of companies: 1) Private Limited Company Eligibility: Minimum 2 directors and 2 shareholders (at least 1 Indian resident). Pros: Limited liability protecti

See More

Anonymous

Hey I am on Medial • 10m

I’m looking to register my business as an LLP to become eligible for funding through incubators and government schemes. I’d like to understand the costs involved in registering an LLP, as well as the yearly compliance and maintenance expenses. Is the

See MoreCA Chandan Shahi

Startups | Tax | Acc... • 11m

Why should a startup opt for a Private Limited Company only? 1. Easy Fundraising from Investors Investors & VCs prefer Pvt Ltd because they can get equity (shares) in exchange for investment. Proprietorships and LLPs cannot issue shares, making fun

See MoreRohan Saha

Founder - Burn Inves... • 11m

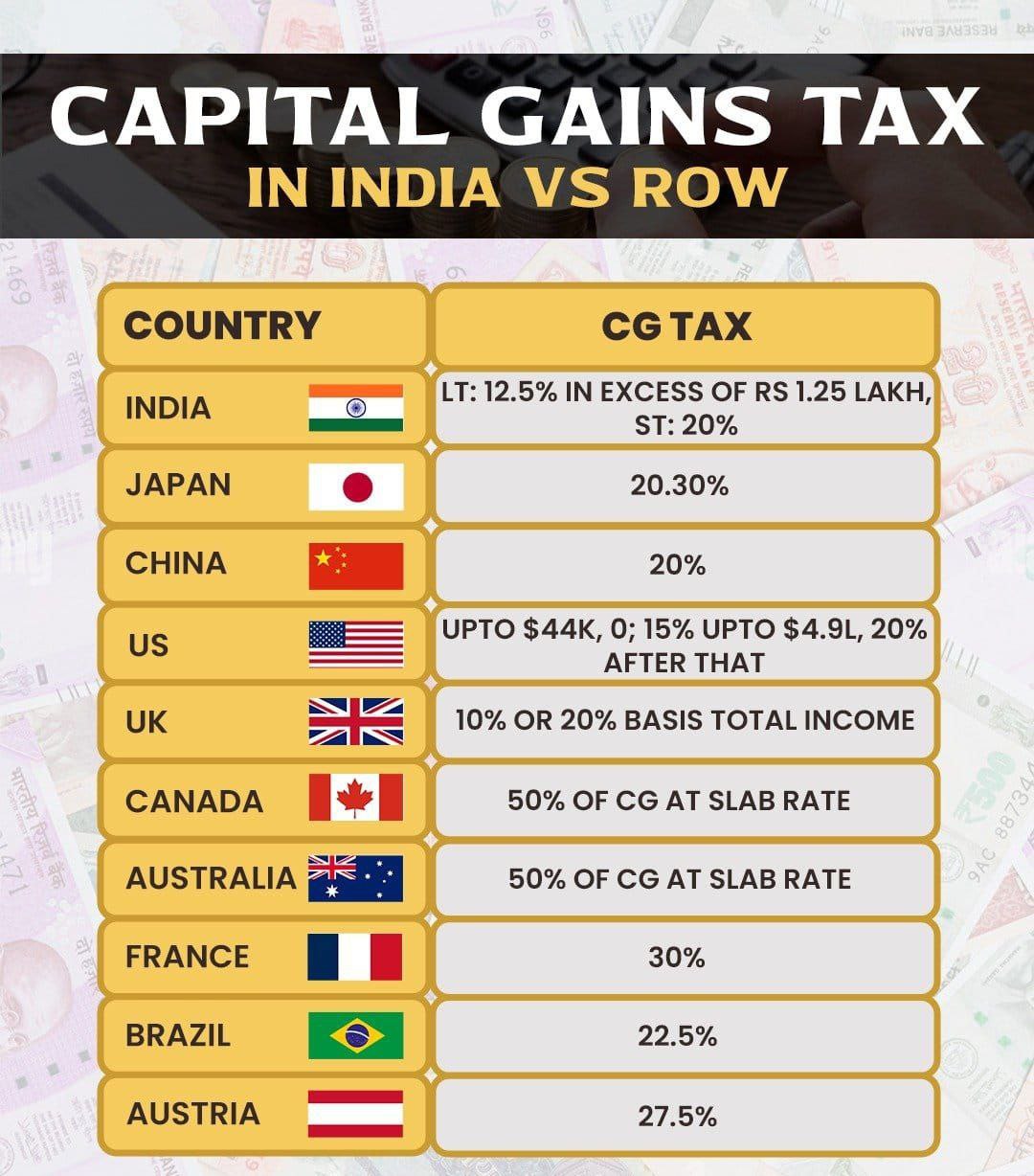

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)