Back

theresa jeevan

Your Curly Haird mal... • 1y

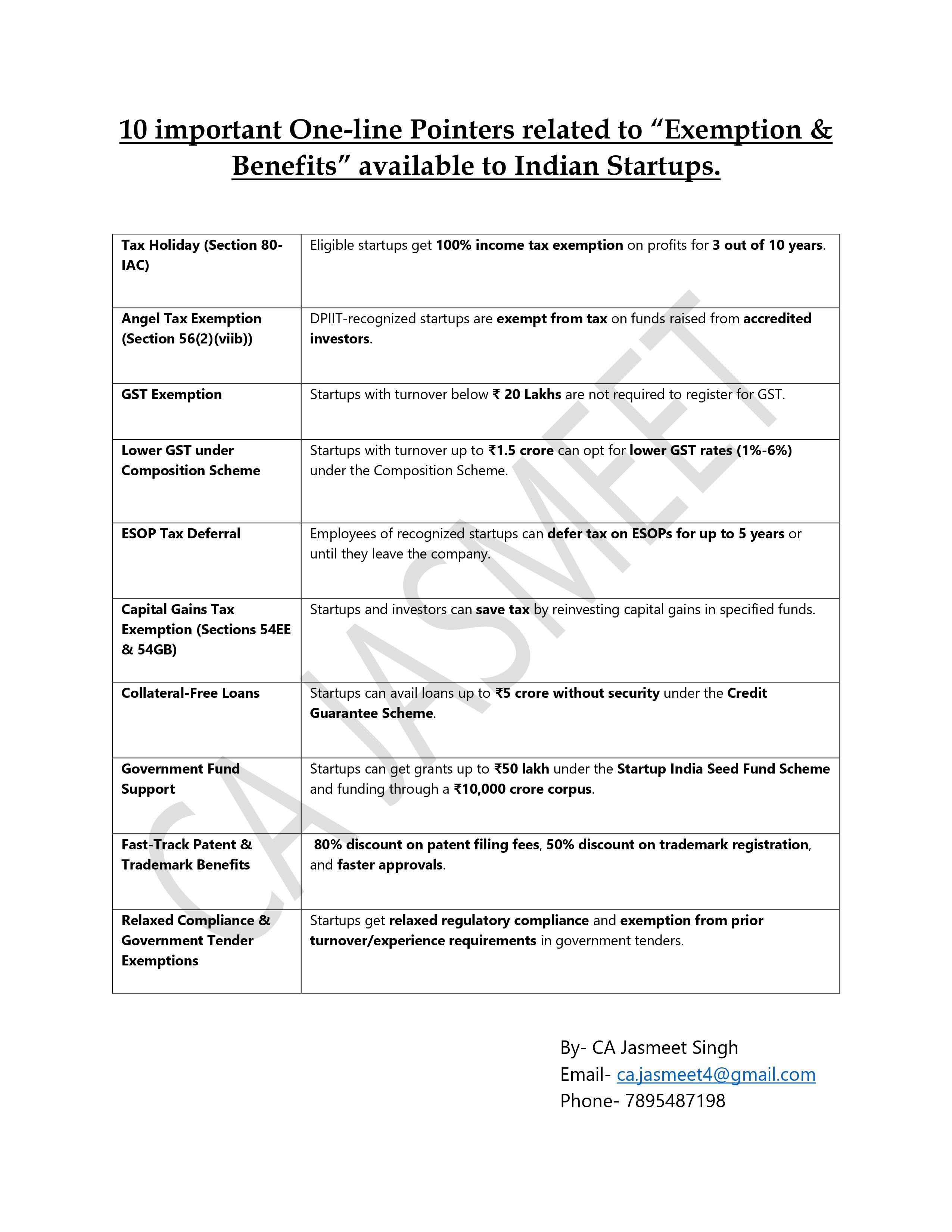

Hi Jasmeet. Thankyou for this valuable information. I have a small doubt. I know someone who has registered with Startup India, like you said they can avail for a tax holiday in any 3 years in the first 10 years How do we showcase that while filing ITR, like how do we say that this year we are opting for the tax holiday?

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 7m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See Morecalculus

Your Bottom Line Our... • 8m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreSaurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreRecouptax Consultancy Services

Onestop solution for... • 10m

Hi Guys, Does anyone need help with book keeping, accounting, Gst filing/TDS filing services. We are offering affordable and reliable services for Individual Tax Filings, Book keeping, Accounting, GST & TDS filings and all other registrations.

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)