Back

Anonymous 1

Hey I am on Medial • 1y

This is such an oversimplified take. PPF and other schemes weren’t just about returns; they offered security. Not everyone has the risk appetite for equities, especially in a country where financial literacy is low.

Replies (1)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"How to Build ₹5 Crore in 20 Years: Top Mutual Fund Schemes to Consider" How to Build ₹5 Crore in 15-20 Years: Best Mutual Fund Investment Strategy If you aim to accumulate ₹5 crore in 15-20 years, it’s crucial to choose the right mutual fund schem

See MoreAccount Deleted

Hey I am on Medial • 8m

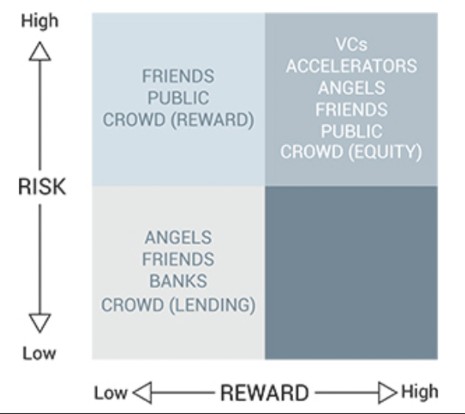

Before You Pitch Your Startup to Anyone, Ask These 2 Questions Most founders don’t raise money because their startup is bad. They fail because they’re pitching to the wrong kind of investor. Here’s what I mean. There are different kinds of investo

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Anonymous

Hey I am on Medial • 1y

We have been conditioned by our rough experiences since childhood,to always be double sure about our vicinty especially in public places.We have this urge to be abnormally attentive when alone,which is involuntary by now.We have exit plan in our mind

See MoreRadhemohan Pal

Let's connect to wor... • 1y

ð ** Exploring India's Startup Ecosystem: Challenges and Opportunities ** ð As the Indian startup ecosystem continues to evolve, it is encouraging to see many new ideas coming into play. But our journey is not without obstacles. Here are some of the

See MoreJayant Mundhra

•

Dexter Capital Advisors • 11m

With all due respect, as much as I applaud SEBI’s slapping Basant Maheshwari, the slap’s size is a joke. Just Rs 4 lakh fine! 🙏🙏 Let’s dissect the rot. Maheshwari’s firm, Basant Maheshwari Wealth Advisers LLP, runs a SEBI-registered PMS, raking in

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)