Back

Anonymous 4

Hey I am on Medial • 1y

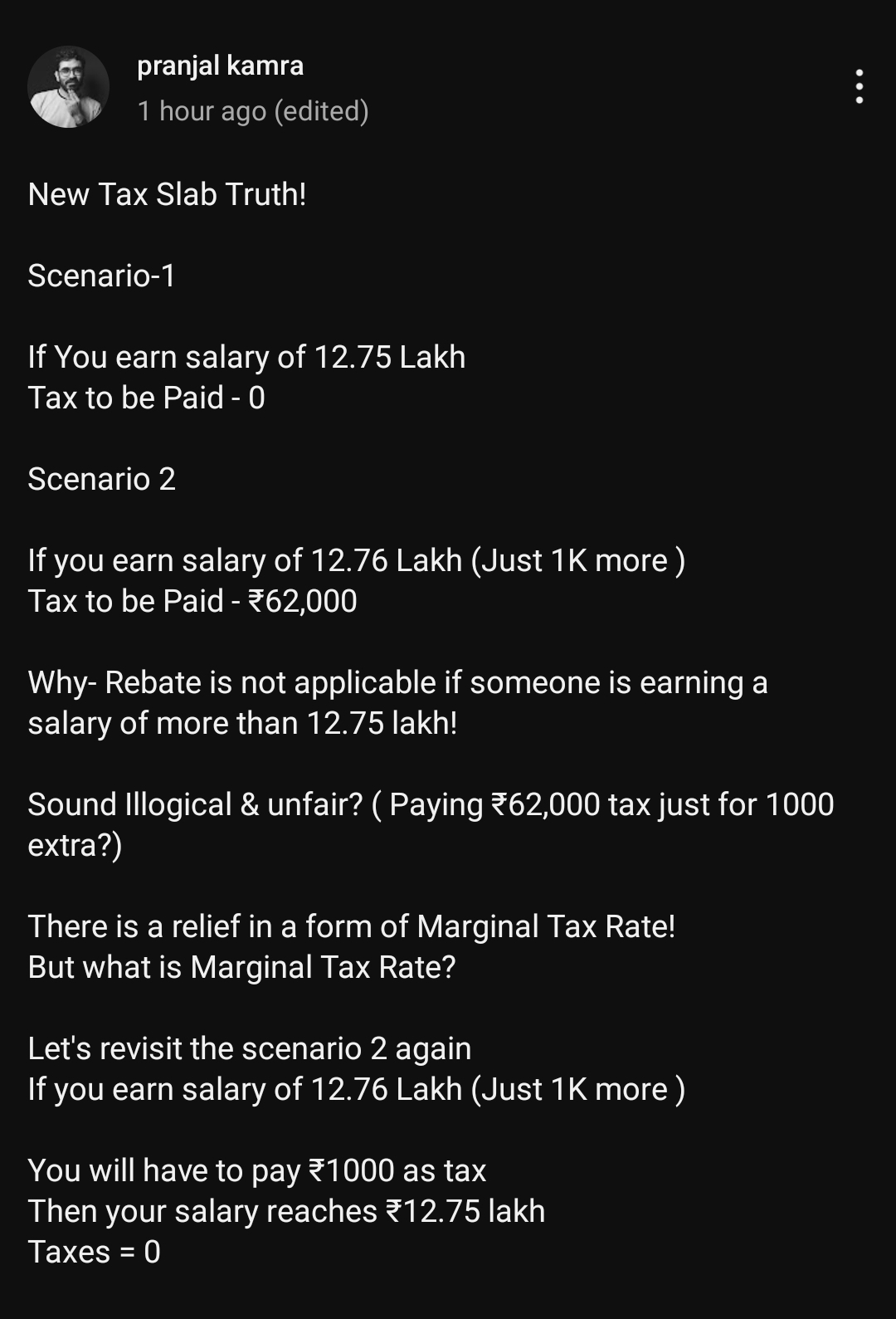

If they would have continued same tax regime as last yr even the guy with 12.75 would have to pay taxes and the by current tax scheme the one upto 12.75 would be paying no taxes and one above 12.75 is actually saving some taxes as compared to last yr. ik it is unfair in some means. but overall everyone is getting benefitted in different proportions.

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreSairaj Kadam

Student & Financial ... • 1y

After a long time. Back to Reality: The Budget's Hidden Cost "Hidden Costs of the New Tax Regime" Everyone's talking about the lower tax slabs in the new income tax regime. But has anyone considered the long-term implications? By drastically redu

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

I won’t waste time on old tax regime for two reasons: -> 70%+ income taxpayers had already switched from it by the end of FY24 -> With what’s announced today, it’s anyway dead. One would have to be a fool to stick with it So, what about the News T

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)