Back

More like this

Recommendations from Medial

Aanya Vashishtha

Drafting Airtight Ag... • 10m

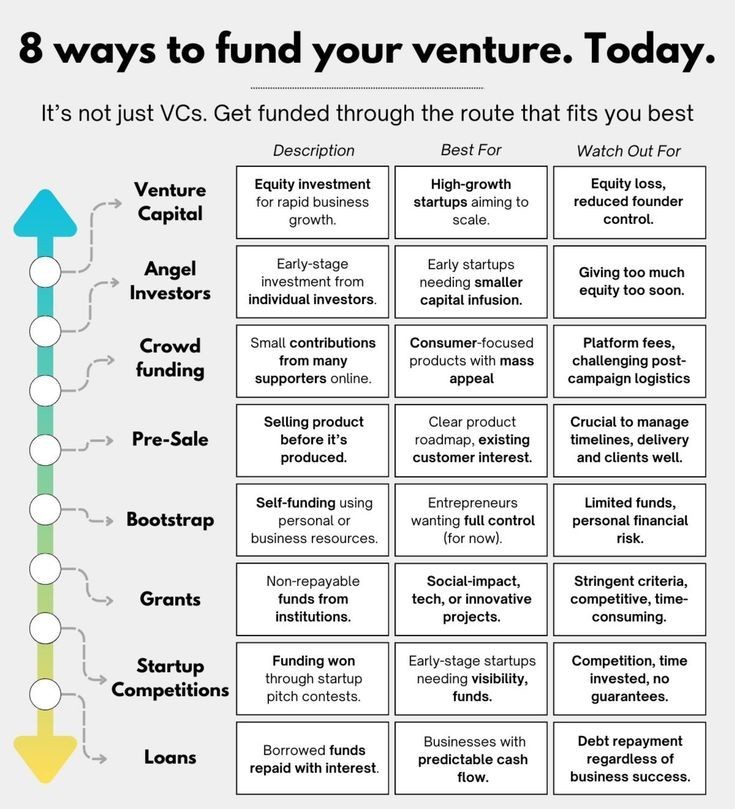

Should You Raise Fund or Bootstrap? Here’s a Reality Check Every founder faces this question: Should you raise external funding or bootstrap your startup? Both paths have pros and cons, and the right choice depends on your business goals, risk tol

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Equity Funding for New Businesses Hello everyone, Let's talk about equity investment today, a crucial component of startup funding. Startups often use this strategy to accelerate growth and broaden their customer base. So, what exactl

See MoreSairaj Kadam

Student & Financial ... • 1y

Exploring the Easiest and Least Risky Funding Method for Startups When you're launching a startup, finding the right funding can be a daunting task. With so many options available, it’s crucial to choose a method that aligns with your business's nee

See MoreBhavani Durga

Looking co-founder • 6m

Medical Tech Startup 🚀 Startup Vision We're building a breakthrough medical technology platform using AI/ML to [insert your focus – e.g., predict early signs of chronic illness, assist in diagnostics, or streamline medical records analysis]. Our mi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)