Back

Labelon

Helps brands shine ... • 1y

I really Appreciate your Idea. But the point here is china directly manufactures a complete vehicle for us. If we fulfill their MoQ quantity and able to set up a recognized brand. Issues come in like getting all the permissions in our country to start up the company. I prefer you to set up the company as an LLP in Dubai as a tax free liability and then import the customized vehicles to india as a global company. so, you can get tax exemption as well as tackle the indo china trade issues.

More like this

Recommendations from Medial

Shiva Prasad

Passionate Software ... • 1y

Hi Guys, I want to know few things about below mentioned points 1. Will we invest in startup(Starting from 2,000 rupees) and become a share holder if you like it? 2. What are the benefits we get, if we invest in Startups? 3. Any tax exemption

See MoreAshutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreRohan Saha

Founder - Burn Inves... • 11m

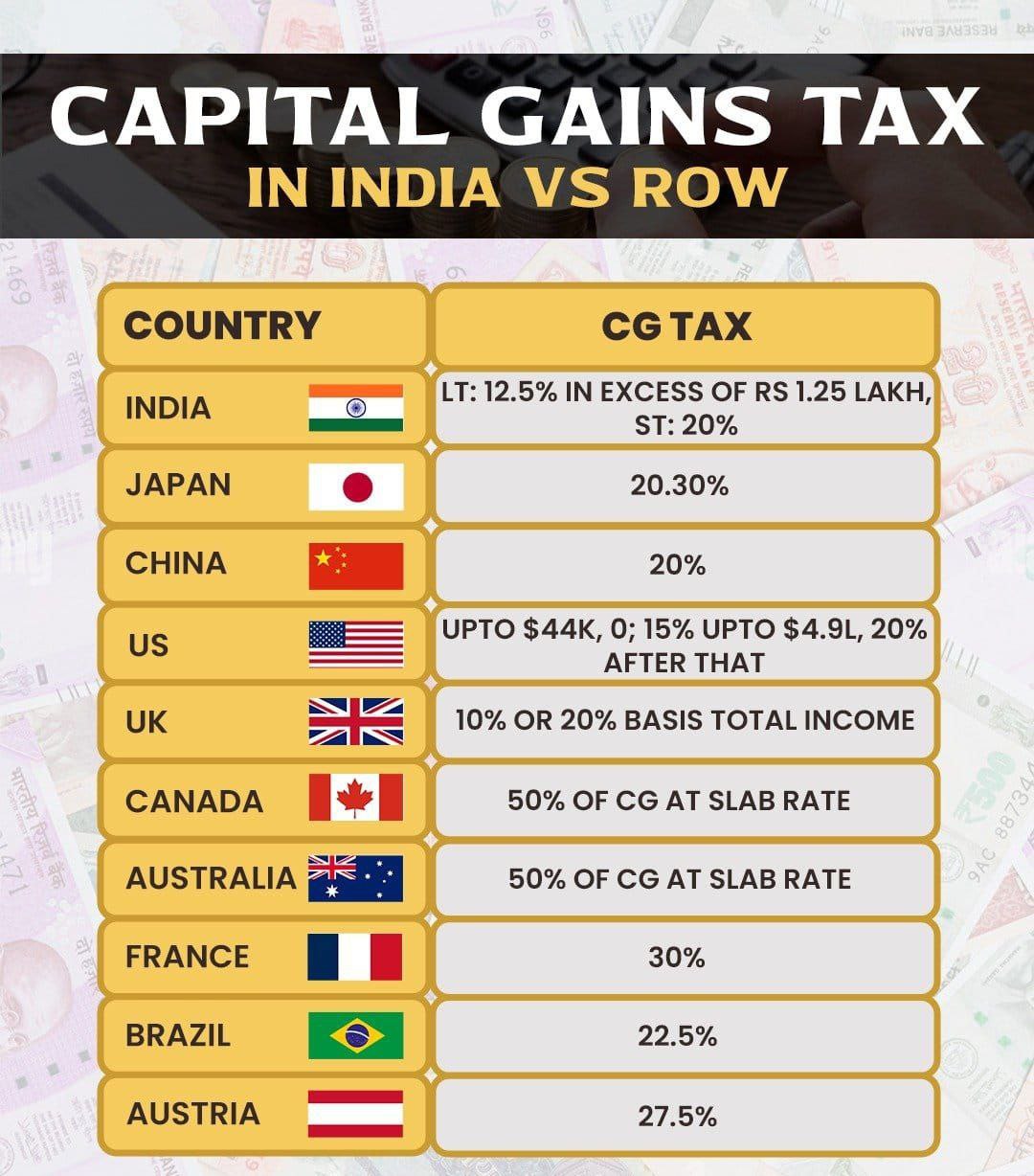

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

CA Chandan Shahi

Startups | Tax | Acc... • 11m

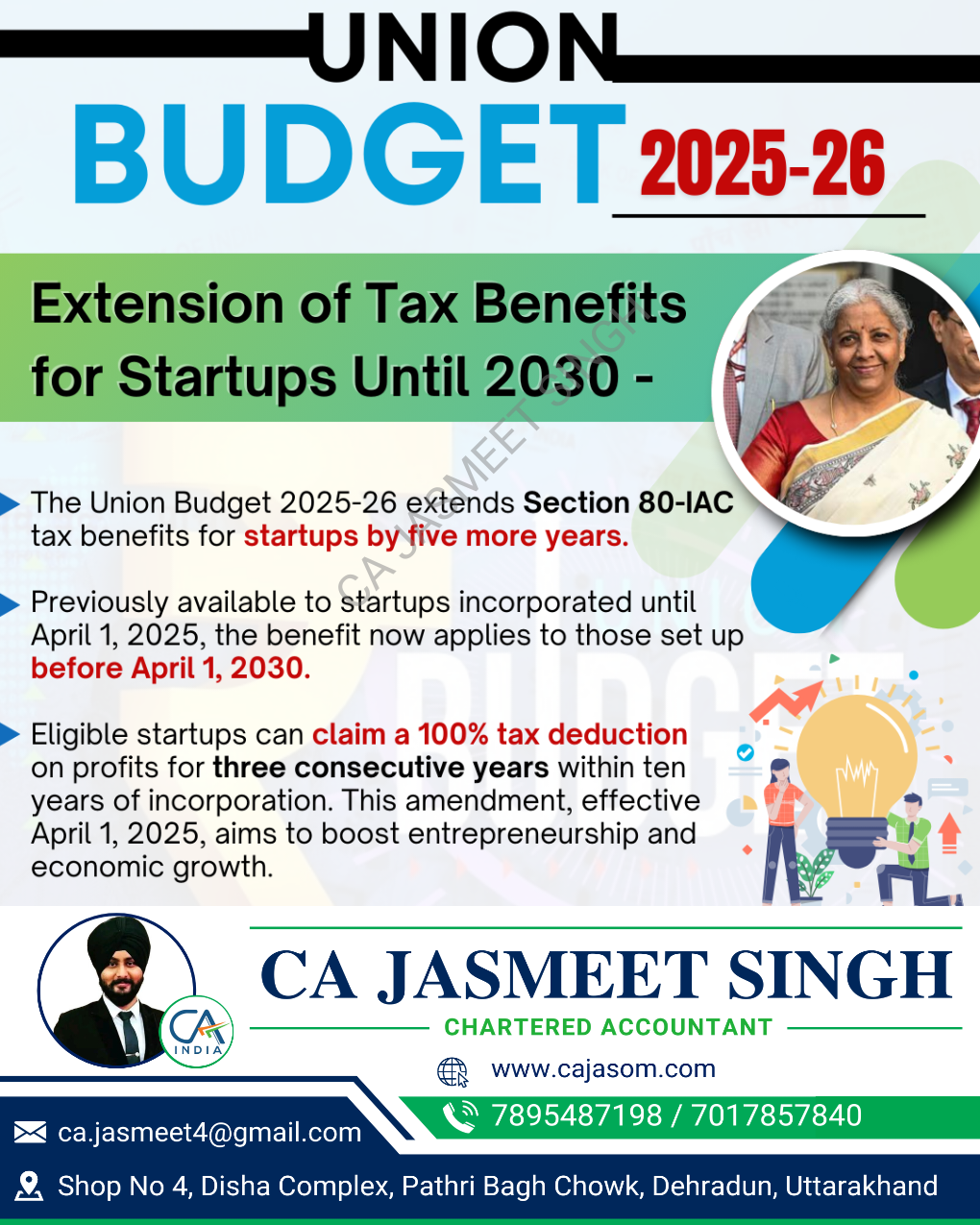

Big Relief for Start-Ups! 🚀 The Finance Act 2025 brings great news for aspiring entrepreneurs! The tax exemption under Section 80-IAC—which allows eligible start-ups to claim a 100% deduction on profits for three consecutive years within their firs

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)