Back

Anonymous

Hey I am on Medial • 1y

The Department for Promotion of Industry and Internal Trade (DPIIT) has requested the government to remove the angel tax on startups ahead of the upcoming Budget. "We had recommended this in the past as well," DPIIT Secretary Rajesh Kumar Singh said. Angel tax is levied when an unlisted company issues shares at a valuation higher than the fair market value.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 7m

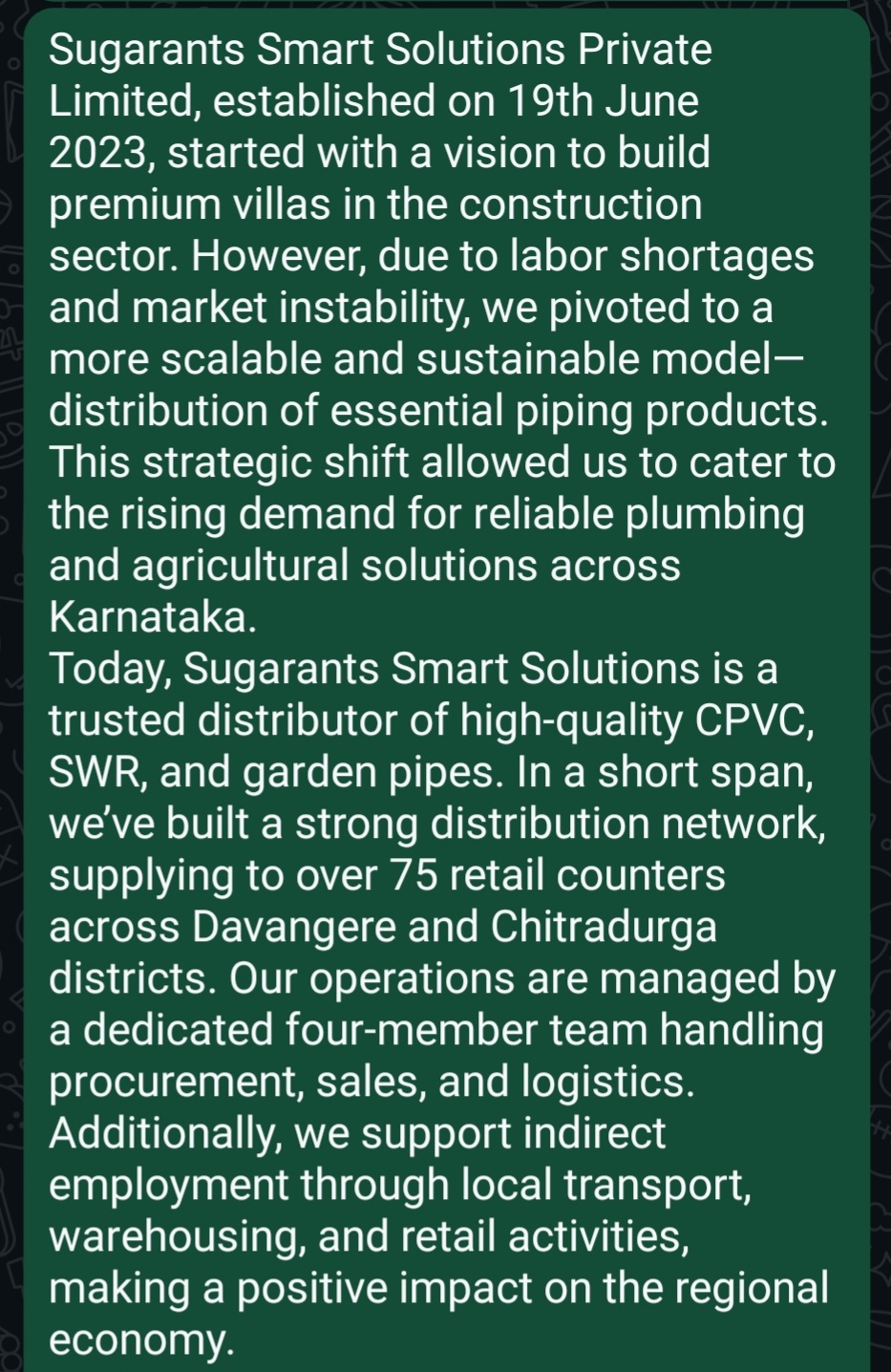

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easie

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Sandip Kaur

Hey I am on Medial • 1y

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See More

Anonymous

Hey I am on Medial • 1y

In an attempt to encourage more investments in the Indian startup ecosystem, Union Finance Minister Nirmala Sitharaman announced that the angel tax will be abolished for all classes of investors. The angel tax, introduced in 2012 to prevent money la

See More

Lalit Mundhra

Hey I am on Medial • 1y

Today's Factoid:- "Vicco Turmeric Nahi Cosmetic, Vicco Turmeric Ayurvedic Cream." If you are a 90s kid it is impossible that you haven't come across this iconic jingle (I am sure most of you read it in the same tune). But, did you know that this jin

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)