Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

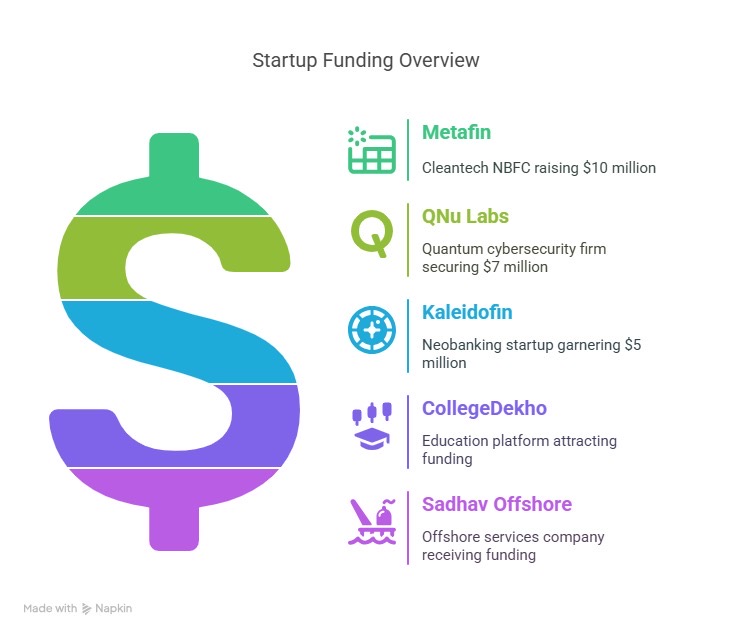

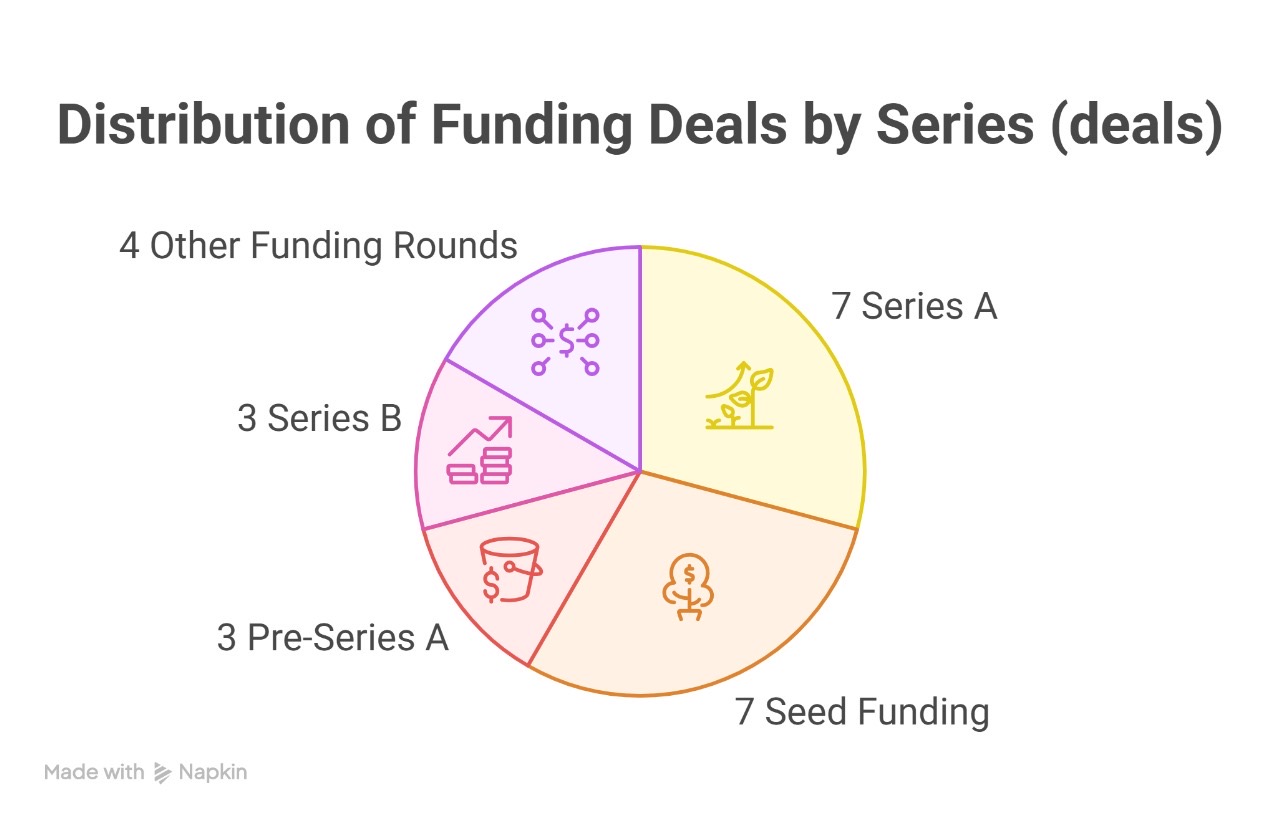

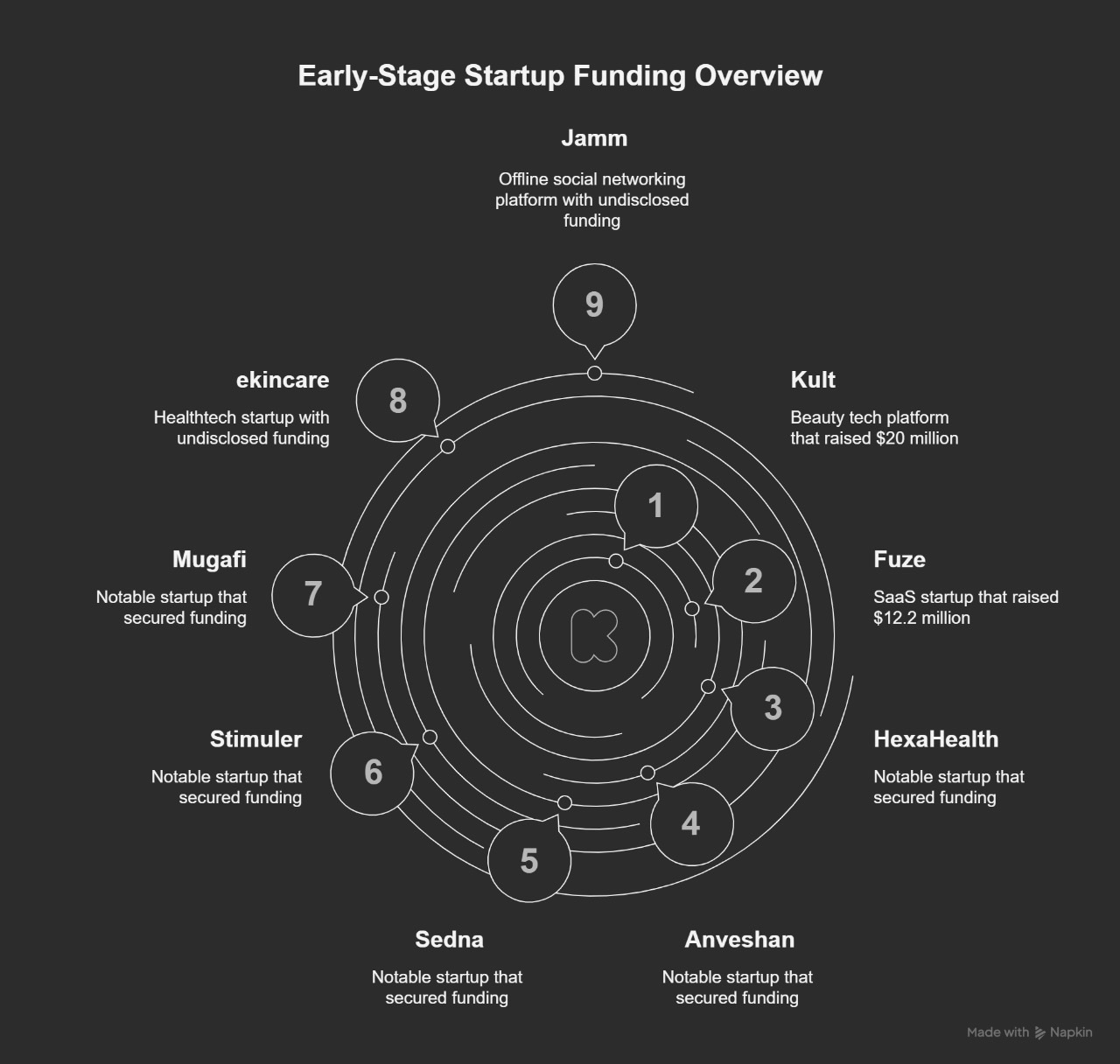

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity

See More

Sourav Mishra

•

Codestam Technologies • 9m

Everyone wants a “clean UI.” Nobody talks about the 17 Slack messages, 3 Loom videos, 2 rounds of “Can we try it like this?” ...and the final “Actually, let’s go back to the first version.” Designers, devs, and clients all want the same thing: clar

See MoreAccount Deleted

Hey I am on Medial • 2y

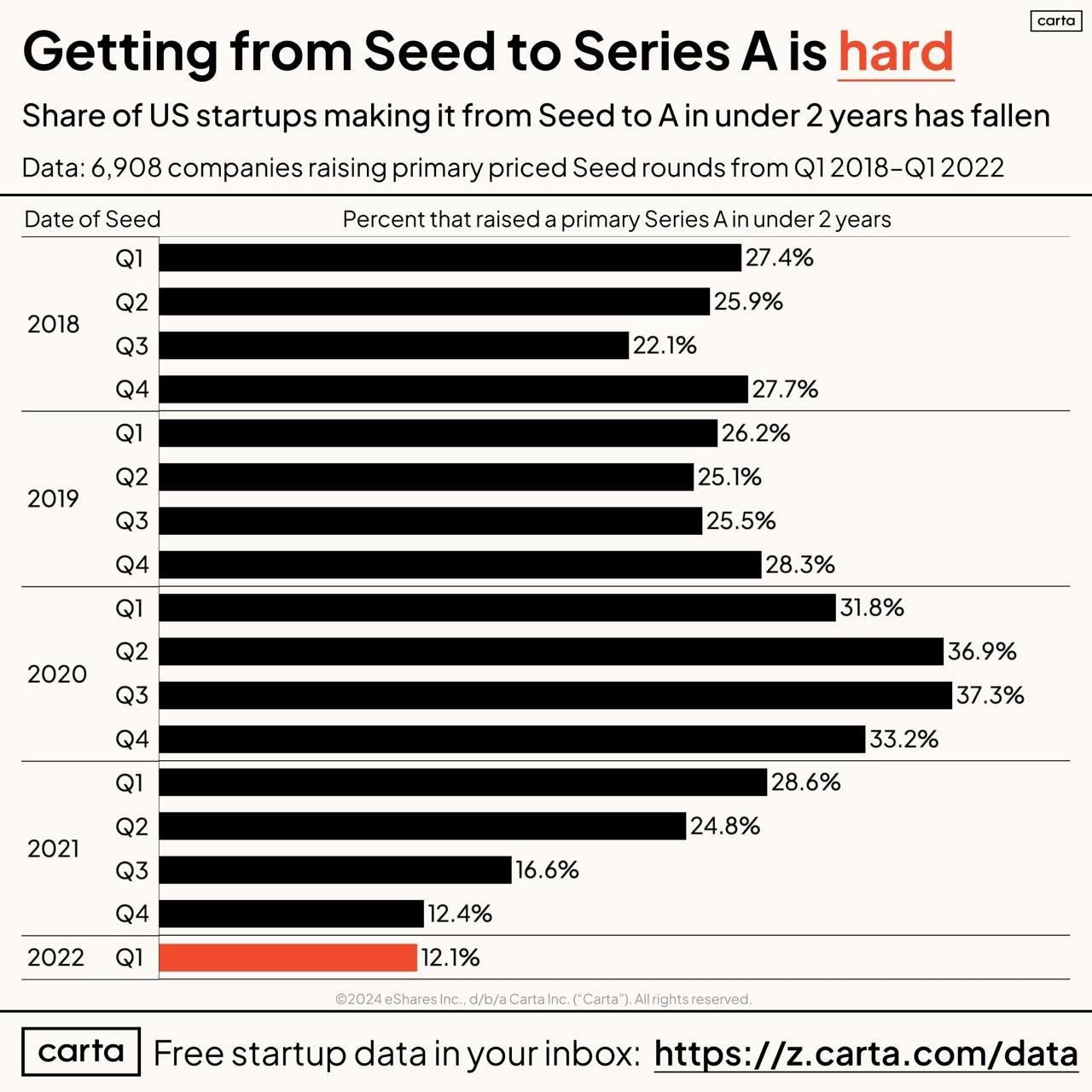

• Today's Topic Is : Stages Of Funding Rounds • Before discussing the funding rounds, let's understand why funding is necessary : • Funding is necessary to start any company or to build MVP or Testing the Products. •Types of Funding Rounds: 1.

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Investment Mandates I. Sector-Agnostic Early-Stage Investments • Focused on providing the first institutional check to startups. • Early signs of traction and revenue are required. • Typical investment size: ₹1-8 crore in exchange for 8-18% equi

See More

Yash Sanodiya

Product Designer, Co... • 3m

When you’re nothing, nobody believes in you. When you become something, a few people start to trust your vision. When you become everything, everyone wants to follow your lead. Talent and hard work matter — but the first chapter is always you, alone

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)