Back

Anonymous 3

Hey I am on Medial • 1y

This just seems like another example of VCs being risk-averse. If the idea and execution are strong, why should team size matter so much? Solo founders bring a focused, nimble approach that could be highly valuable

More like this

Recommendations from Medial

Arcane

Hey, I'm on Medial • 1y

Even though 25% of all startups on Carta have just a solo founder, VCs hesitate to fund them. Having 2 to 3 founders seems to be the sweet spot if you were to raise VC money while building a startup. So, Is there a way to make VC funding easier as

See More

Vivek Joshi

Director & CEO @ Exc... • 6m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Sagar Vadadoriya

Idea hamster 💡 • 1y

Deepseek challenging Nvidia is a reminder that competition is inevitable, regardless of company size. As startups, our priority must always be user-centricity. While we can fix inefficiencies within our business, we cannot prevent others from growin

See MoreGangesh Rameshkumar

Figure it out • 7m

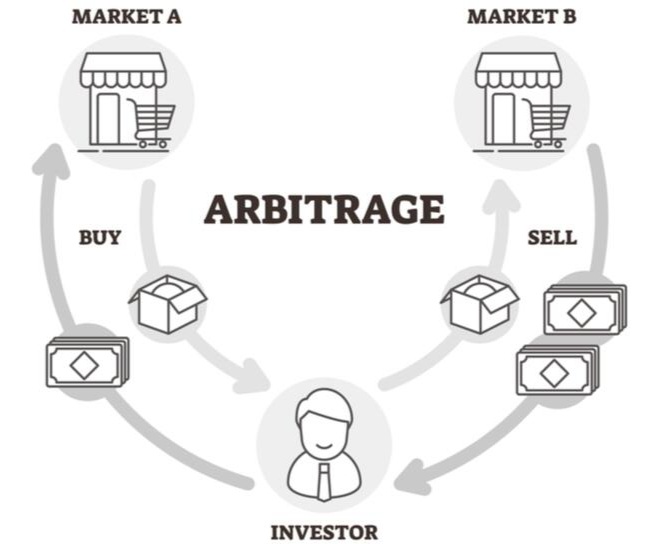

Term of the day: Arbitrage Arbitrage is the exploitation of market inefficiencies where the price of an asset is different in different markets For example, Company X's stock is listed at 20$ on the New York Stock Exchange(NYSE), but $20.05 on th

See More

Rohan Saha

Founder - Burn Inves... • 9m

This is what happens with unlisted shares people often don’t understand the risks involved. They just buy without proper knowledge. Just because a company is trading in the unlisted market doesn’t guarantee it will go for an IPO. When or if a pre-IPO

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Why Private Funding is a Tougher Nut to Crack Than a Bank Loan Often, private funding proves harder to get than a traditional bank loan. Banks are risk-averse and highly regulated, relying on excellent credit, established history, and collateral. Thi

See More

Nimesh Pinnamaneni

Making synthetic DNA... • 10m

🚨 The magic number: ₹800 Cr ⸻ VCs invest in businesses that can be big enough to return their entire fund. To get VCs interested, your startup must at least have the potential to reach ₹800 Cr+ in annual revenue or ₹8,000 Cr+ in market cap (assumi

See MoreSairaj Kadam

Student & Financial ... • 1y

The Harsh Reality of Venture Capital: Recently, I spoke with a founder who had a fantastic business idea, but he was struggling to secure venture capital funding. Got myself thinking: why do some great ideas never get the backing they need? The tr

See MoreDownload the medial app to read full posts, comements and news.