Back

Anonymous 7

Hey I am on Medial • 1y

The same issues that made Barstool problematic for Penn turned out to be the perfect move for Portnoy to regain ownership and control, proving that timing and understanding your value can change everything.

More like this

Recommendations from Medial

Tarun Suthar

CA Inter | CS Execut... • 7m

Imagine you're 20, just started your first startup. You have no funds. But you’ve got big vision.🚀 You can’t pay a fancy salary. So what do you do? 💡 You offer Equity or ESOPs 2%, 5%, maybe even 10% to early team members, designers, techies, m

See More

Mehul Fanawala

•

The Clueless Company • 1y

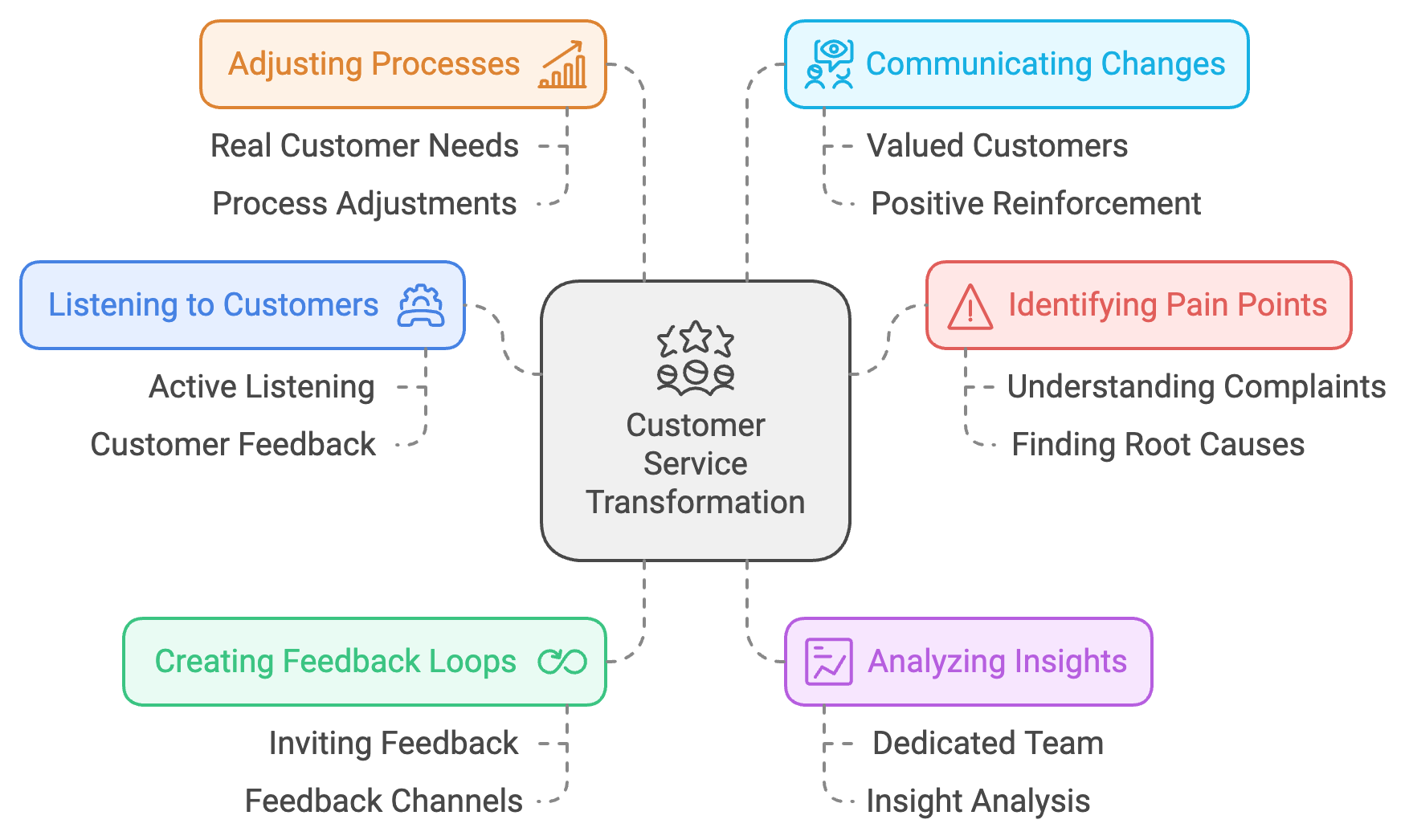

I just heard a story about a company that made a simple change to their customer service process, and it turned their 1-star reviews into 5-star raves overnight. What was the magic sauce? They actually listened. Instead of reacting defensively to

See More

Manoj Rana

Founder & Platform E... • 1m

helping teams regain control, confidence, and clarity as cloud infrastructure and CI/CD systems grow in scale and complexity. I typically work on problems such as: Rising cloud costs with limited visibility — introducing cost attribution, usage bas

See MoreSairaj Kadam

Student & Financial ... • 1y

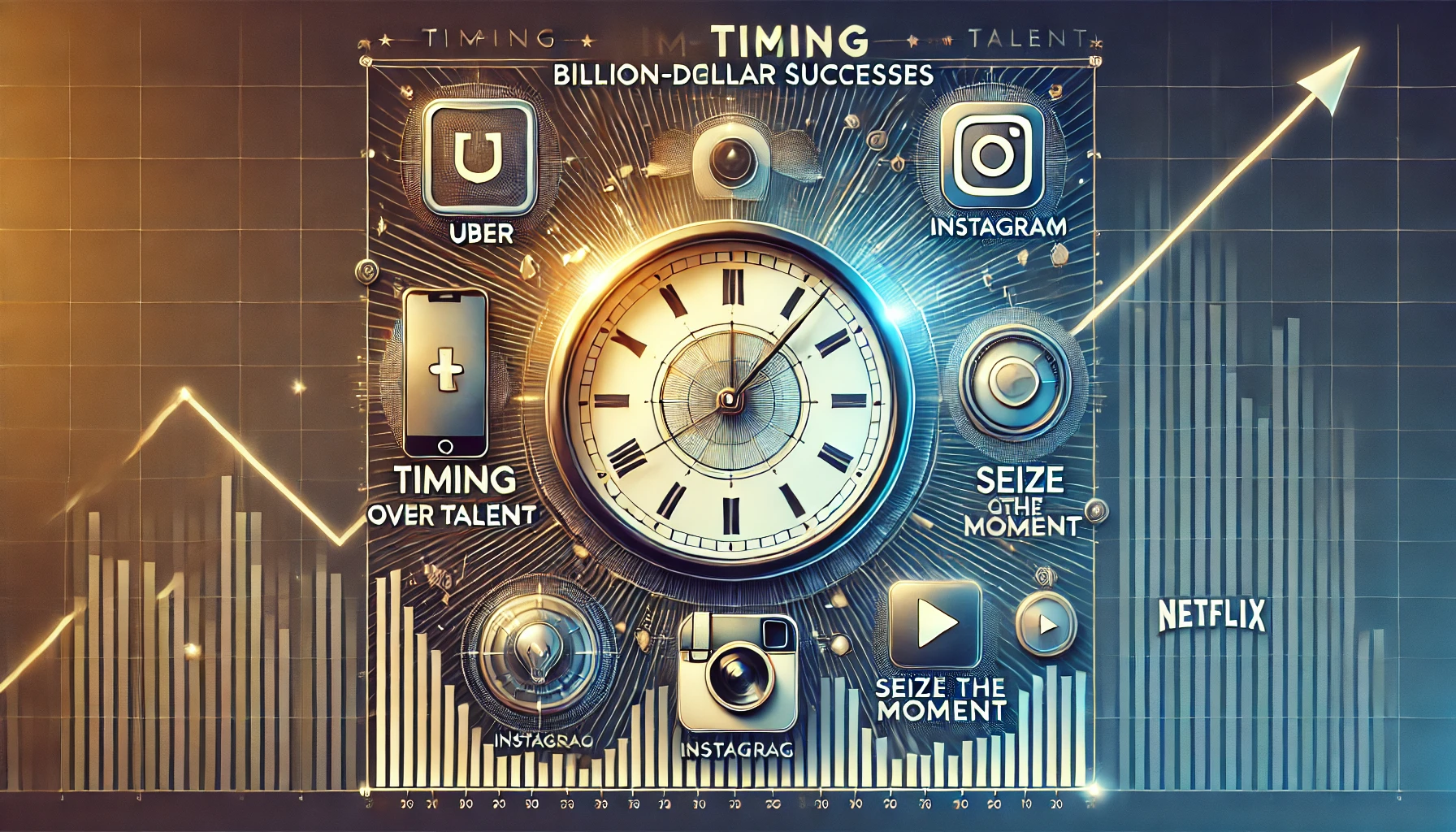

The Billion-Dollar Secret No One Talks About: Timing Over Talent When Uber launched in 2009, it wasn’t the first ride-sharing app. Apps like Sidecar and Taxi Magic already existed. But they didn’t take off. When Instagram came out in 2010, it wasn’

See More

Rajan Paswan

Building for idea gu... • 1y

The Tokyo Metropolitan Government has announced the launch of a government-run dating app aimed at encouraging marriage and addressing Japan's declining birth rate. Set to debut this summer, the app requires users to undergo a thorough registration p

See More

Mehul Fanawala

•

The Clueless Company • 1y

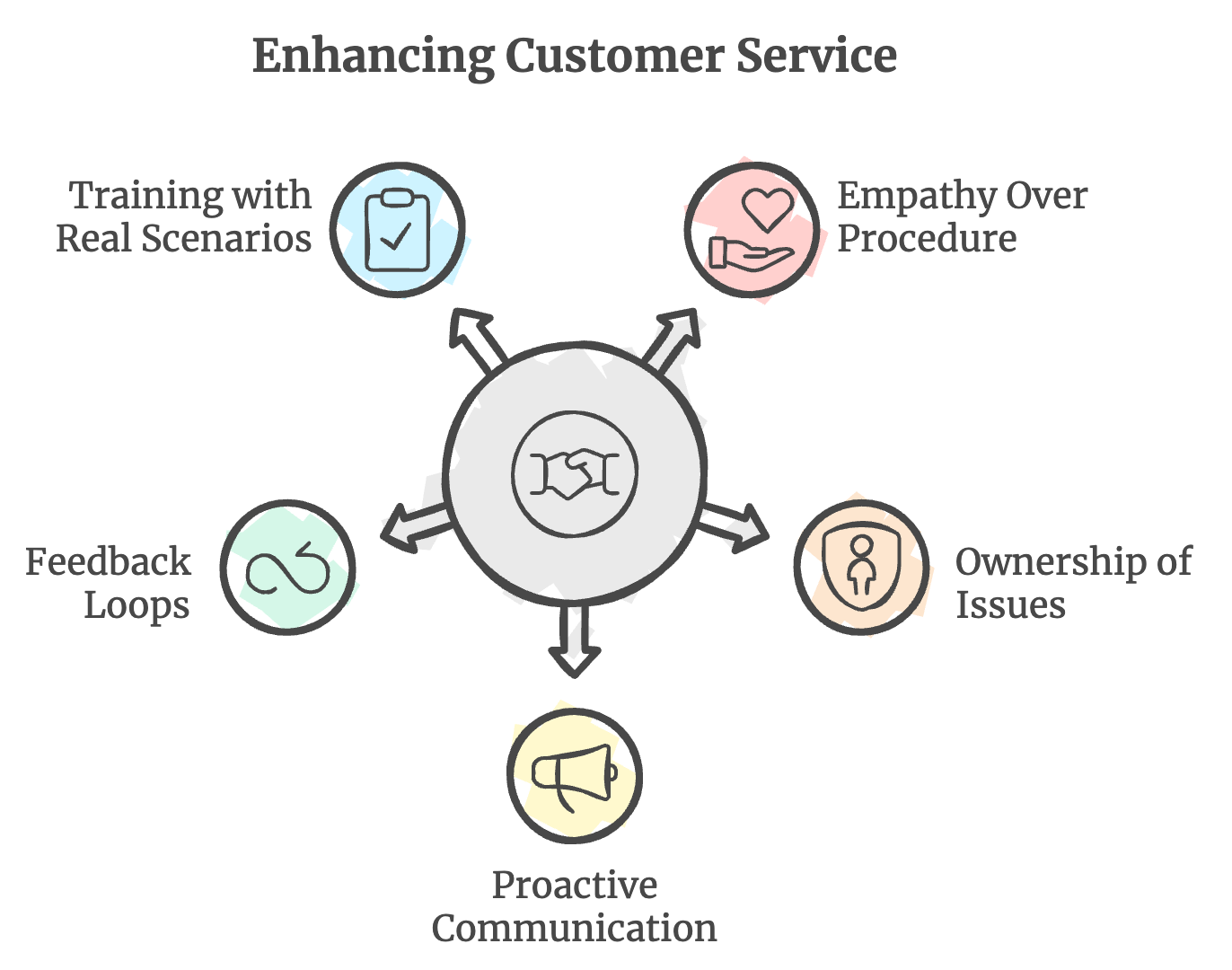

I’ve had numerous conversations about why some companies excel in customer service while others struggle. Let’s explore a few key areas that could be game-changers for you: 1. Empathy Over Procedure ⤷ When talking with customers, it’s important t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)