Back

Rohith R

I help businesses to... • 1y

Most of the small business owners forget (or) don't care to calculate CLV. I recently had a call with my client who seems very frustrated with his marketing performance and sees marketing has money draining machine with no positive effects to company. I asked him 2 questions, what's your ROAS and CLV. He somewhat came with ROAS concept, But he had no clue what's the CLV (Customer lifetime Value) is?... I said, CLV plays a important role from planning your marketing budget to pricing of the product. He was shocked that he is not aware of this important concept. I teache'd him it's importance and how to calculate it. In this post, I will teach you the same and how you can also calculate it for the business. Save this post :) What is Customer Lifetime Value (CLV)? CLV stands for Customer Lifetime Value. It is the total revenue a business can expect to earn from a single customer over the entire time they interact with the business. Imagine you run a coffee shop. If a regular customer buys a ₹50 coffee from you every week and continues to visit for 5 years(Average estimation), the CLV would be: Average purchase value × Purchase frequency × Average customer lifespan ₹50 (per visit) x 52 weeks x 5 years = ₹13,000 This means this one customer will likely bring ₹13,000 in revenue over their "lifetime" as a customer. Easy right?, Ok now why is this important to calculate??, I will give you 3 solid points why you should - Guides Marketing Spending: If a customer has a CLV of ₹13,000, spending ₹2000 to acquire them makes sense, but spending ₹8000 does not. Improves Profitability: By focusing on high-value customers, businesses can prioritize those who bring in more revenue. Example: A subscription service may spend more effort retaining a customer who spends ₹500/month over one who spends ₹100/month. Shapes Retention Strategies: Understanding CLV helps justify investment in customer service and loyalty programs. Example: A restaurant offering free meals after 10 visits keeps high-value customers coming back. Before blaming the marketing as money gamble, Make sure first you done the marketing right ;) (From a marketing employees association😅) Hope this post helped!, Follow for more marketing stuffs!

Replies (5)

More like this

Recommendations from Medial

Kush Katara

I Help Start-up Foun... • 1y

What would be your approximate Customer Lifetime Value (CLV)? You run a mobile app that offers premium subscriptions for ₹500 per month. Last year, you acquired 1,200 new customers, and your marketing spend for customer acquisition was ₹1.2 lakh.

See MoreCentriagal performance marketing agency

24 karat pure meta a... • 2m

The Real Metrics That Grow a Business Most businesses fail because they run ads without tracking three critical metrics: 1️⃣ ROAS (Return on Ad Spend) ROAS tells you how much revenue you generated from every ₹1 spent on ads. For example, if you sp

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

SamCtrlPlusAltMan

•

OpenAI • 10m

Just read an awesome article from ZScale Capital on key metrics for business growth! 🚀📈 If you're building a company, you NEED to be tracking metrics like Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), Daily/Monthly Active Users (

See MoreAnup Thatal

IT enthusiastic | Fu... • 7m

Some glimpse of business full form ? GTM:- go to market LTV:- lifetime value MVP :- Minimum viable product GT:- General Trade SP:- selling price ROI:- return on investment ROAS:- Return on advertising spend DAU:- Daily Active user MAU:- Monthly A

See MoreDevendra Pagar

Founder @ Bunny Bask... • 5m

A first month review for our Startup "Bunny Basket" •Total revenue- Rs 45,754/- •Customer Repeat started on 11th day itself • 75+ website orders within 15 days • Customer Repeat rate for the month 67% • Average order value 576/- • Average selling

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 11m

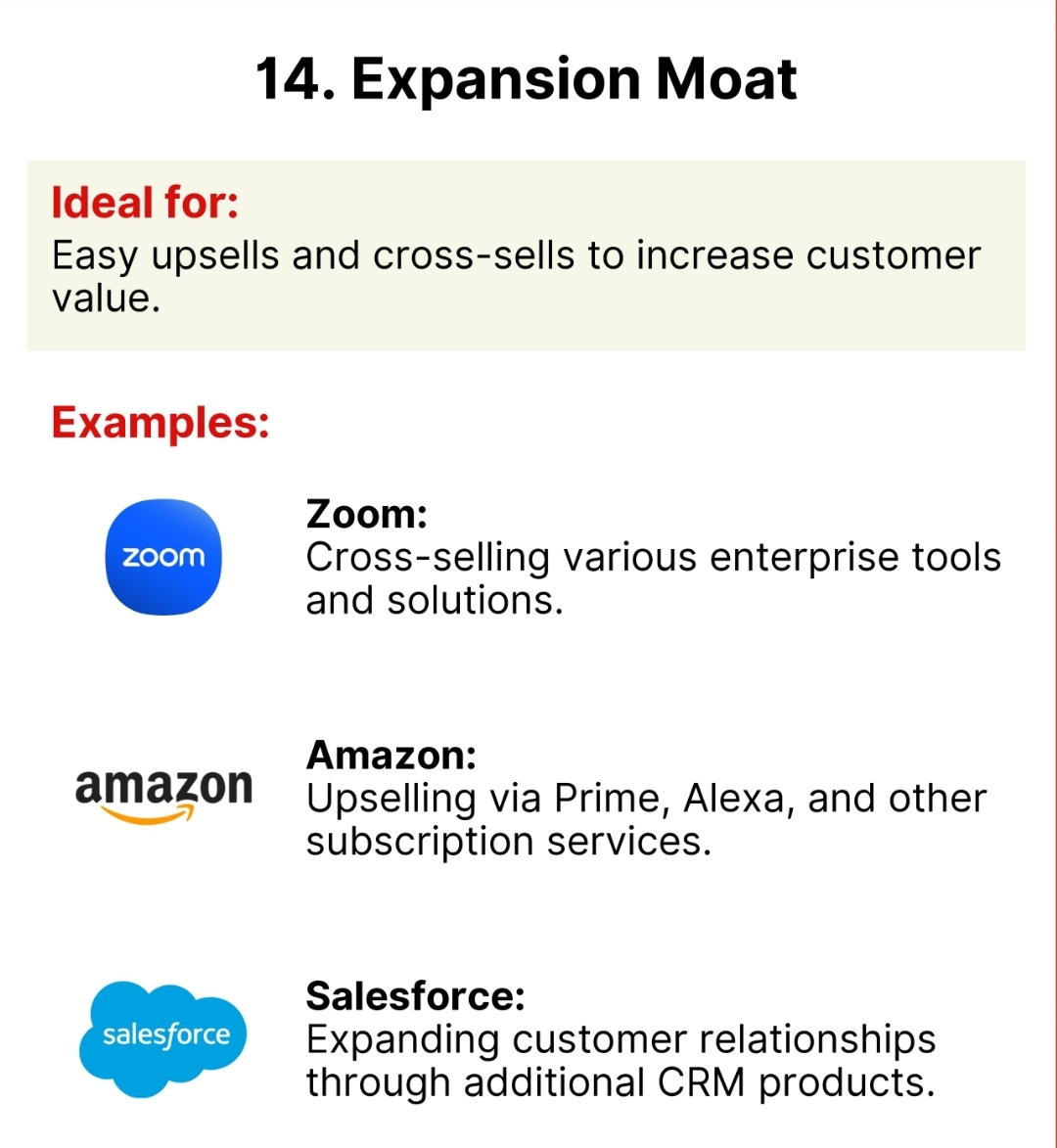

Maximizing Customer Value! 🚀 An Expansion Moat allows companies to upsell and cross-sell seamlessly, increasing customer lifetime value. Zoom offers enterprise solutions, Amazon expands through Prime and Alexa while Salesforce strengthens client rel

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)