Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Here’s the real reason why TITAN didn’t get into lab-grown diamonds, but TRENT did 🙌🙌 This will be long about what played out in the Tata group. So, read on! .. LGDs made for ~3% of engagement rings sold in the US in 2020. That jumped to 6% in 2021. To 10% in 2022. And, 35% in 2023. And it’s estimated to be ~55% already! .. One would think, it would have been a bonanza had someone built a biz in this space early. -> But, so many new players entered the scene, that competition sparked a bloodbath 📛📛 -> The market is witnessing a big wave of consolidation, with many players selling themselves to each other at big discounts After all, the prices have crumbled dramatically. .. And what compounded the trouble was the abundant INDIAN supply! 🙌🙌 -> With Indian LGD production alone surging >12x in the last 4yrs, the supplies in the global market has ballooned -> And our production costs are so low, that the unit economics of players in the US who were making diamonds by themselves were making no sense That sparked trouble. .. And one of the entities which suffered in this mayhem was a company called Clean Origins. Founded in 2017, it was the only LGD seller in the US, to only sell LGDs. Just 2yrs after its foundation, it was growing by >100% every year. This drew the attention of India’s No.1 branded jewellery retailer - Tata Group’s Titan! .. Titan invested $20mn into the company in March 2022. This got it a front-view seat to the world’s largest and highest penetration market for LGDs. But, as Clean Origins crumbled in the above-explained competition, it sold itself to a competitor in June this year. Thus, Titan burnt its hands in the world’s No.1 market for LGDs 📛📛 .. That’s why, there is fear, that what competitive mayhem has erupted in the US, will also erupt in India where the LGD space is still new. Hence the decision to not pursue this space for now, either via Tanishq or CaratLane. Not because it would bring down the brand value of those two flagships, as has been widely assumed by Indian media 📛📛 .. Meanwhile, with TRENT having grown manifold larger and faster than many Tata companies in the last 4yrs, the Noel Tata-led management has earned the clout to pursue its own independent path. -> Thus, with Titan not pursing any opportunity in the LGD space for now, TRENT saw an opening within the Tata group, to launch its private label in the LGD space under Westside -> This is just like how Titan launched Taneira and SKINN when TRENT was the one which held more relevant experience Meanwhile, who knows? Once the market stabilises, we could also see TRENT sell its LGD biz to Titan, like it sold Tata Cliq to Tata Digital. ..

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 3m

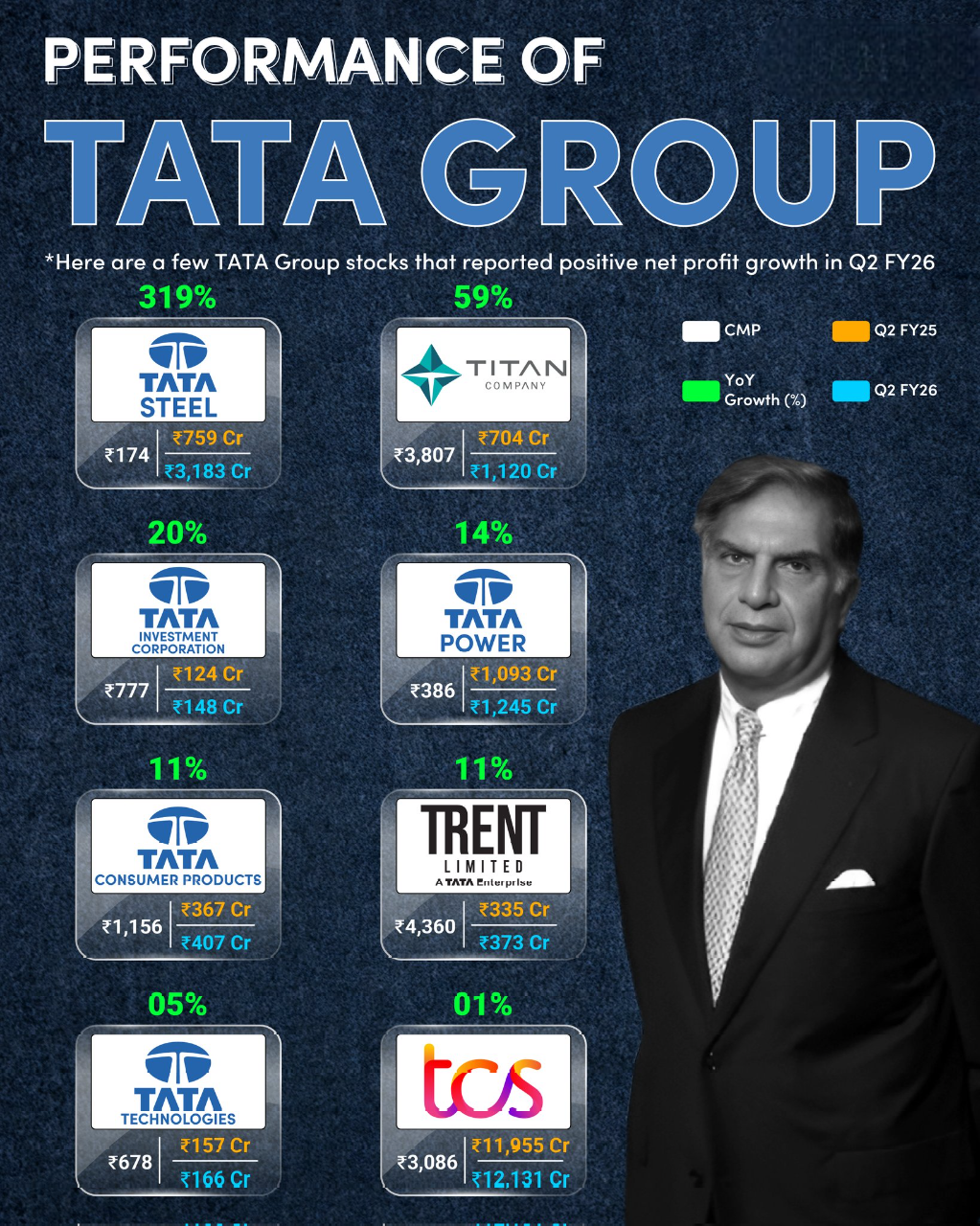

TATA Group Q2 FY26 Performance – Big Winners! 🔥 India’s most trusted conglomerate is delivering strong results again. Here are the TATA companies that recorded positive net profit growth this quarter! 📈 🚀 Tata Steel – 319% Growth 💎 Titan – 59% G

See More

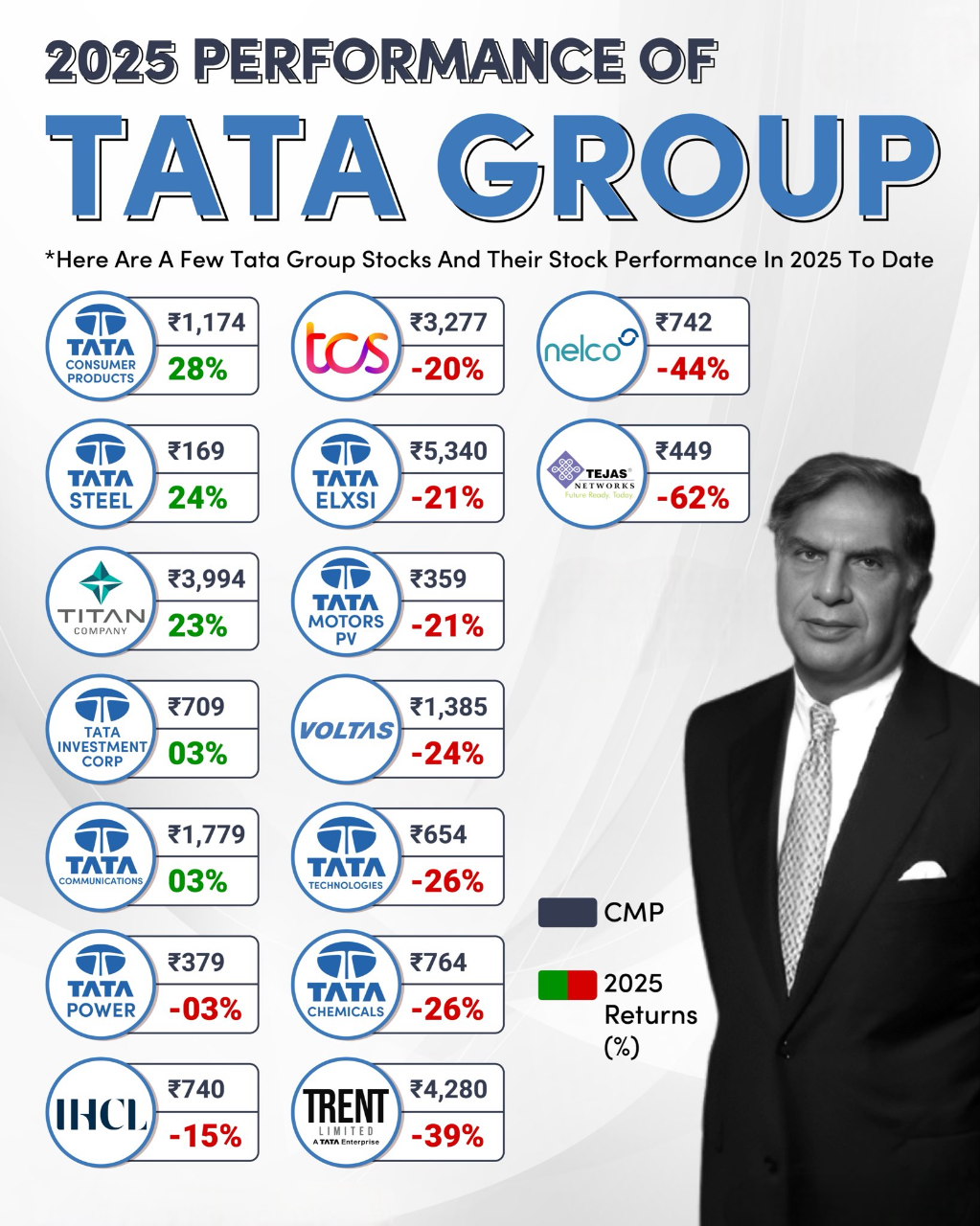

VIJAY PANJWANI

Learning is a key to... • 12d

Q3 FY26 Performance – Tata Group Snapshot Tata Group companies delivered a mixed but interesting set of Q3 results this quarter. 🔹 Strong Profit Growth: • Tata Steel – 824% YoY • Tata Investment Corp – 284% YoY • Titan – 61% YoY • Taj Hotels – 44%

See More

VIJAY PANJWANI

Learning is a key to... • 5m

This Festive Season, don’t just shop… invest! From fashion to jewellery, From FMCG to logistics, From appliances to consumer durables… These stocks are the true backbone of your festive celebrations. 💡 Top picks: 👗 Apparel – Aditya Birla, Tren

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)