Back

LIKHITH

•

Medial • 1y

Strong GDP growth,stimulus pack by govt the central bank cut interest rates to boost borrowing there were new economic policies aimed at revitalizing the capital markets. Plus,the government is increasing investment in infrastructure and technology.

More like this

Recommendations from Medial

Vansh Khandelwal

Full Stack Web Devel... • 11m

Understanding the Recession Snowball Effect A recession is a period of economic decline marked by reduced consumer spending, business slowdowns, and increased unemployment. The Recession Snowball Effect starts when people shop less, leading to lower

See MoreSairaj Kadam

Student & Financial ... • 1y

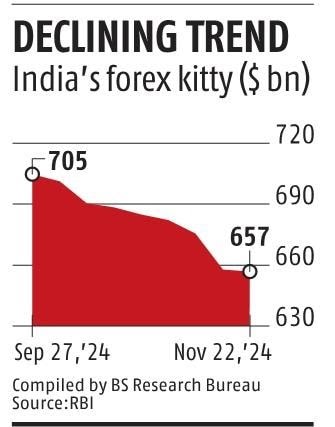

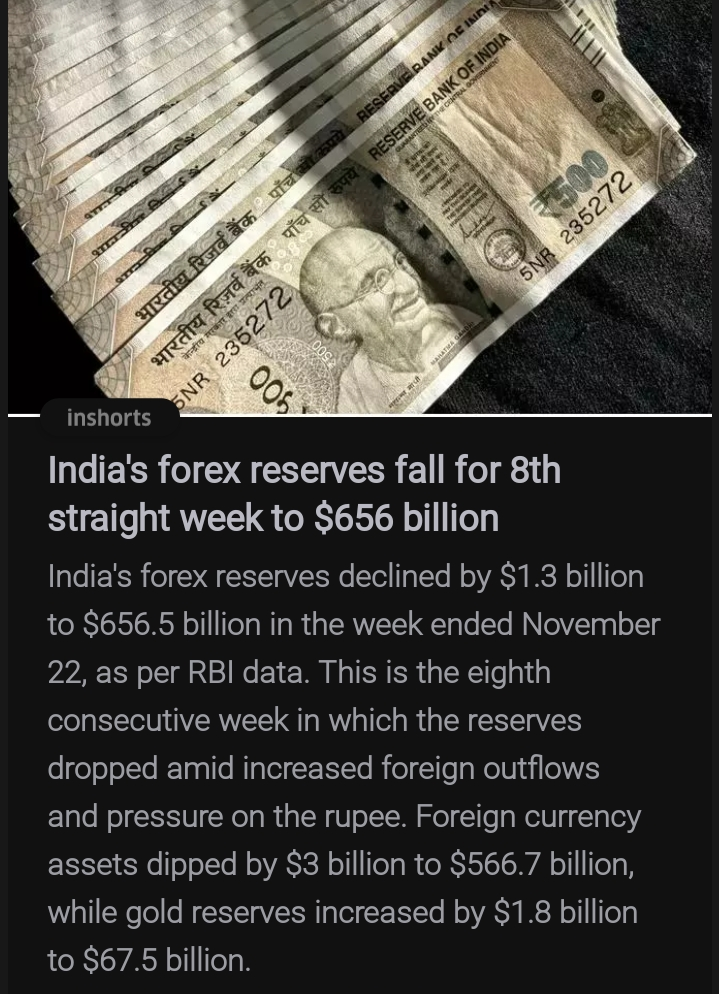

What Happens When Forex Reserves Decline? We should understand it, Because India is going through that. Let’s break it down step by step. Let’s Understand What Forex Reserve Is Forex reserves are a country’s savings in foreign currencies, gol

See More

Tushar Aher Patil

Trying to do better • 9m

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Subham Jain

building damn bejine... • 1y

FII Selling and Buzz is all about investing in China and China Govt announce stimulus plans to revive it's economy Trump is increasing tariff on China products about 60% It's definitely Risky move to invest in China for FII gamble or opportunities

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreAtharva Deshmukh

Daily Learnings... • 1y

PESTLE Framework:- The framework analyzes external factors influencing a business. 1] Political:- Government policies, regulations, stability, tax policies, trade traffic 2] Economic:- Economic growth, inflation, exchange rates, interest rates 3]

See MoreAtharva Deshmukh

Daily Learnings... • 1y

About Rates in the market... To strike a balance in market, the RBI has to consider all economic factors and carefully set the key rates. Any imbalance in these rates can lead to economic chaos: 1)Repo Rate:-The rate at which RBI lends money to oth

See More

Anonymous

Hey I am on Medial • 1y

Hi, A platform to review the work done by the central & state govt through different policies (like what was the target and how much work has been done so far) in very simplistic way so that everyone can understand the content. Motto is to change the

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)