Back

Anonymous 1

Hey I am on Medial • 1y

Charge a small fee or percentage on each bill split. This is a straightforward way to generate revenue, especially if the platform becomes popular and the volume of transactions grows.

More like this

Recommendations from Medial

Gyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

Swamy Gadila

Founder of Friday AI • 6m

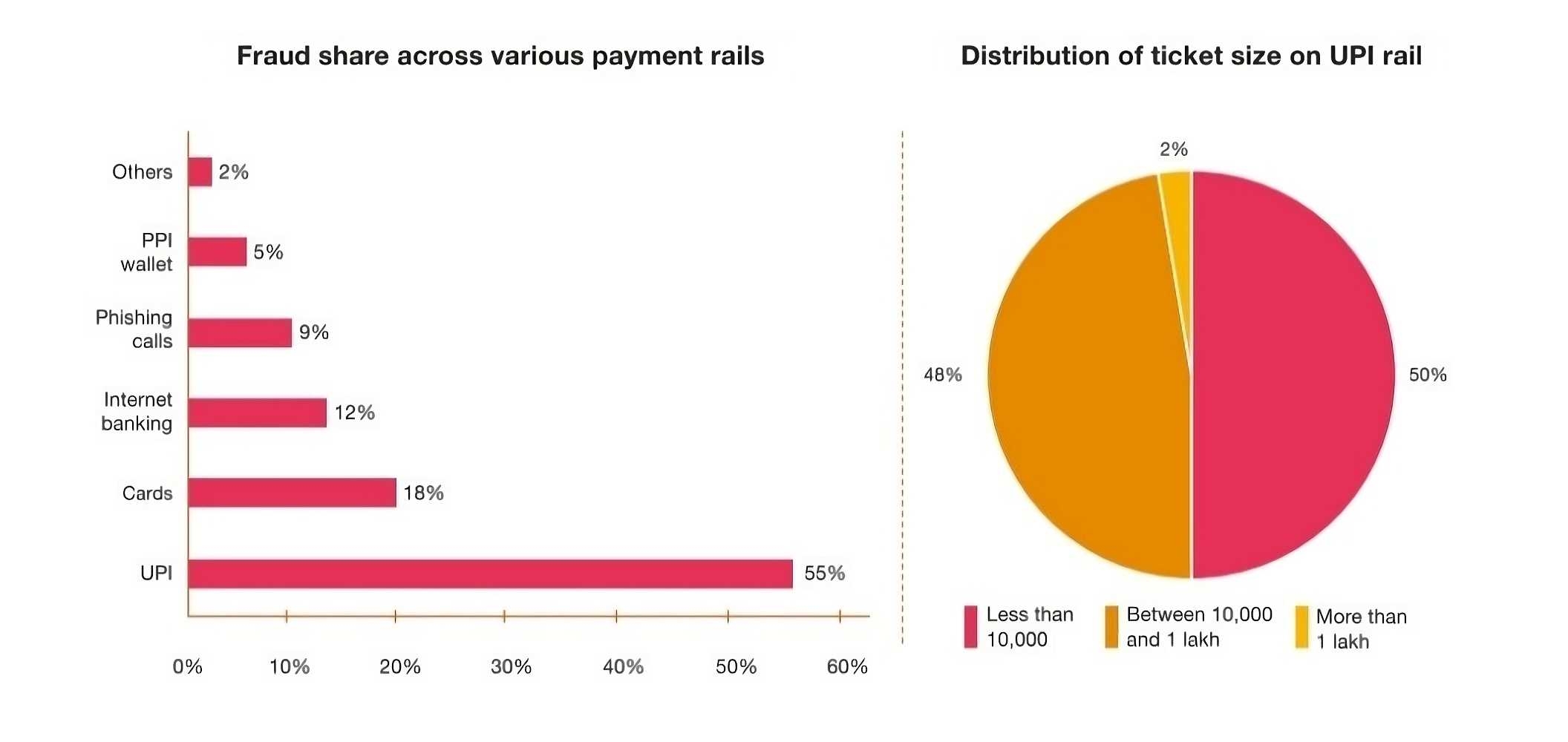

🚀 Should India Start Charging Fees for High-Value UPI Transactions? UPI is a world-class digital payments system — fast, free, and inclusive. But there's a hidden cost: 💸 Infra cost of ₹0.10–₹0.30 per transaction 🏦 Over ₹1,000 crore/month just t

See Moreaaquib mahfooz

Being innovative • 1y

i have idea of creating an online platform that connects lenders directly with borrowers is similar to peer-to-peer lending (P2P lending). P2P lending has become popular in recent years as an alternative to traditional banking and NBFC loans. To mak

See MoreAccount Deleted

Hey I am on Medial • 12m

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

PRATHAM

Experimenting On lea... • 3m

Flipkart has executed a major strategic move by rolling out a zero-commission model for all products priced below ₹1k, significantly widening the scope from the previous Rs500 cap. They have also lowered return fees by Rs35. By eliminating commissio

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)