Back

More like this

Recommendations from Medial

Kimiko

Startups | AI | info... • 9m

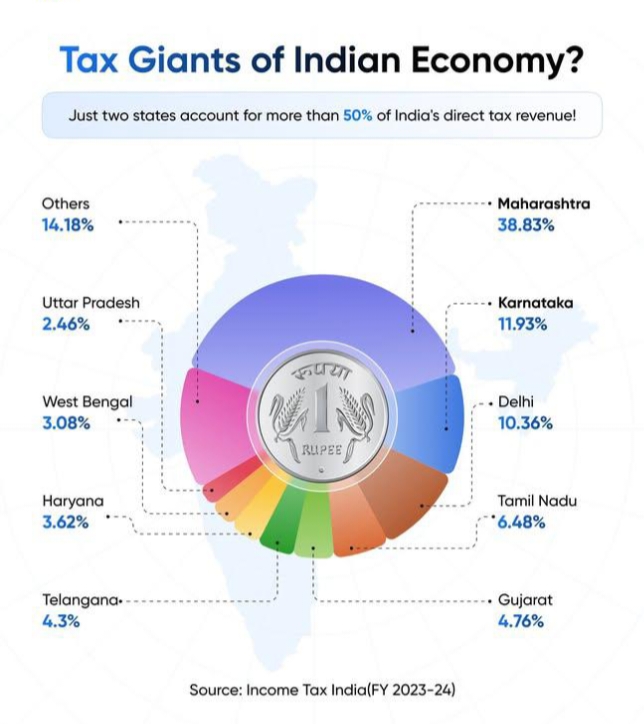

Over half of India’s direct tax revenue — from individuals, corporates, and businesses and more— comes from just two states. This revenue is the backbone funding our infrastructure, healthcare, and education. Comment below and tell us: which state do

See More

Reply

1

9

HigherLevelGames

Learning | Earning • 1y

If you're trying to build an Agency some day, these are the terms that you should keep in mind: 💵OPERATION 1. Revenue 2. CashFlow 3. Net Operating income. 4. Return On Investment 5. Break Even Point 6. Gross Profit 7. Net Profit 📈MARKETING 1. B

See More2 Replies

5

5

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)