Back

Ravi Singh

Information is Every... • 1y

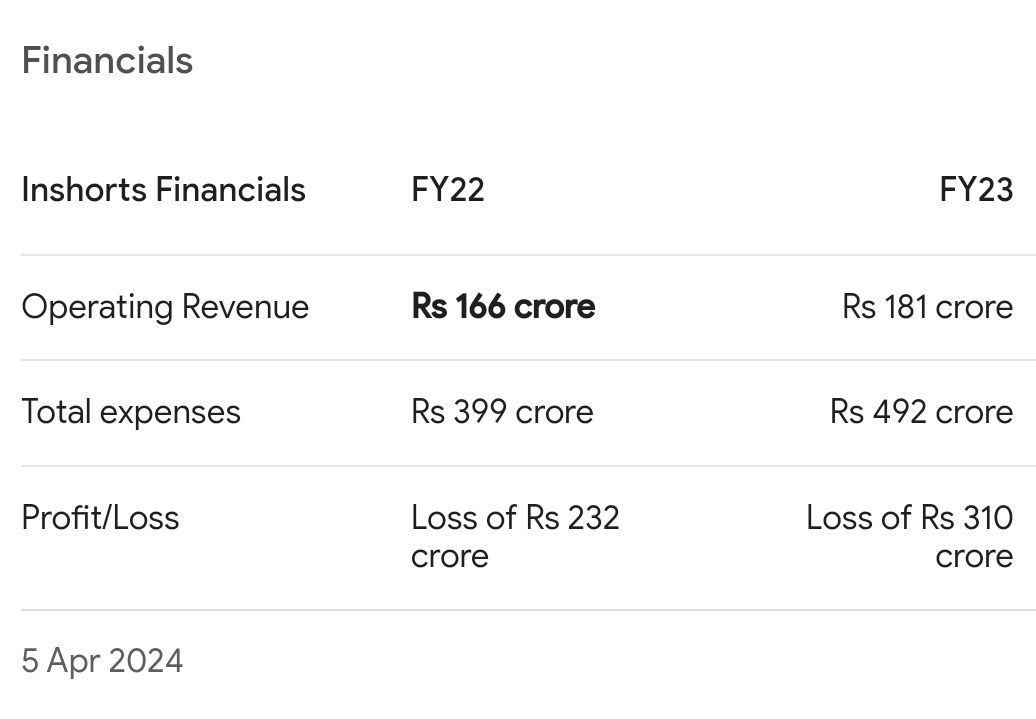

I don't think company would like to pay 30% tax.... Financials may give a different picture ... Go into finer details,.. How much founders are withdrawing... And other details...

Replies (1)

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MoreRohan Saha

Founder - Burn Inves... • 11m

This morning, I shared a post about the 30% tax notice on crypto, highlighting that individuals are being asked to pay 30% tax on their total turnover. After discussing the issue with several people, I discovered that some Binance users have received

See Morefinancialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)