Back

Vishvas Yadav

Founder HR Calcy • 1y

Hi, Please do not accept the offer from new or revised salary unless you validate with HR Calcy in hand salary calculator. This will even indicate that what will be your take home salary after income tax deduction, help you for a better decision.

Replies (4)

More like this

Recommendations from Medial

Vishvas Yadav

Founder HR Calcy • 1y

Hi, I'm operating a site (in fact multiple sites) called HR Calcy which is very specific to human resources calculator and calculation updates and tutorials. I have a good plan for the same and have been working on it for a year. Now this site has go

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

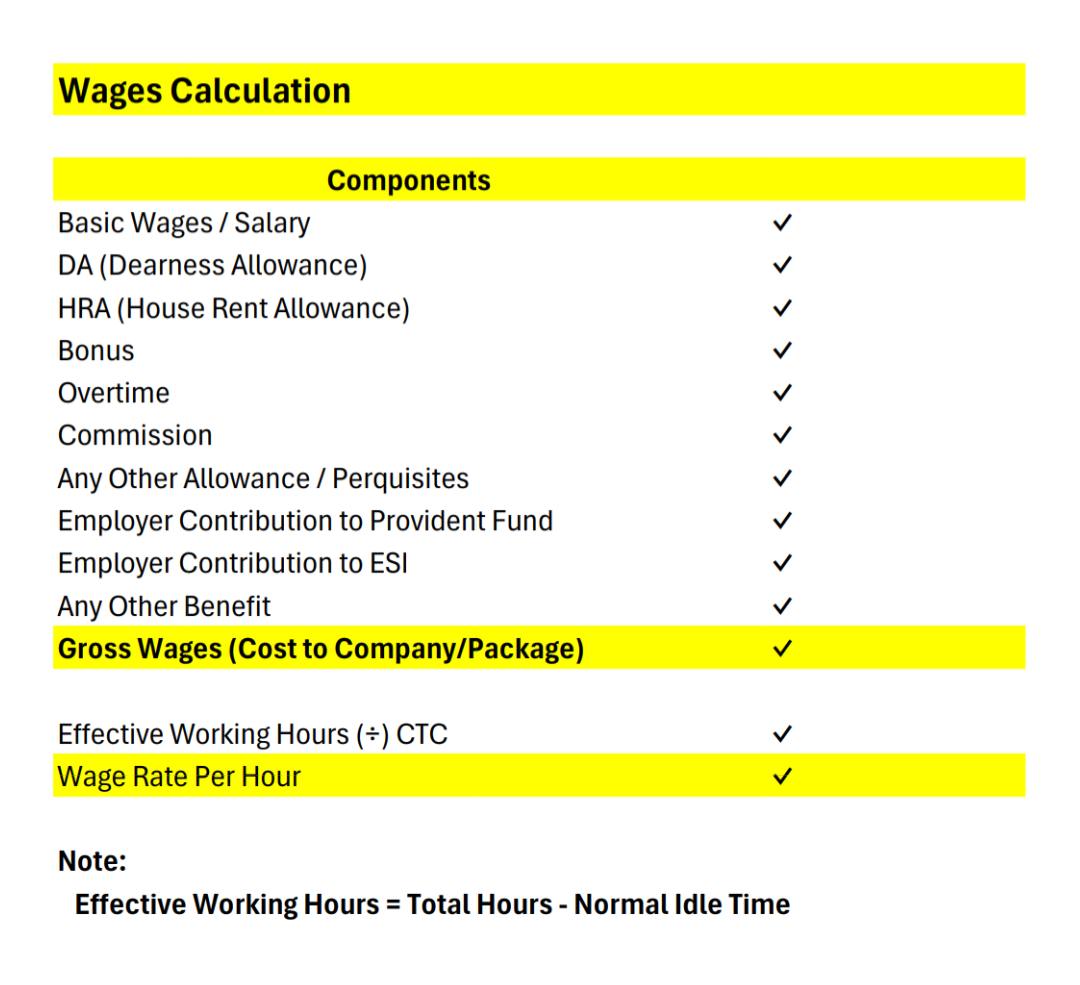

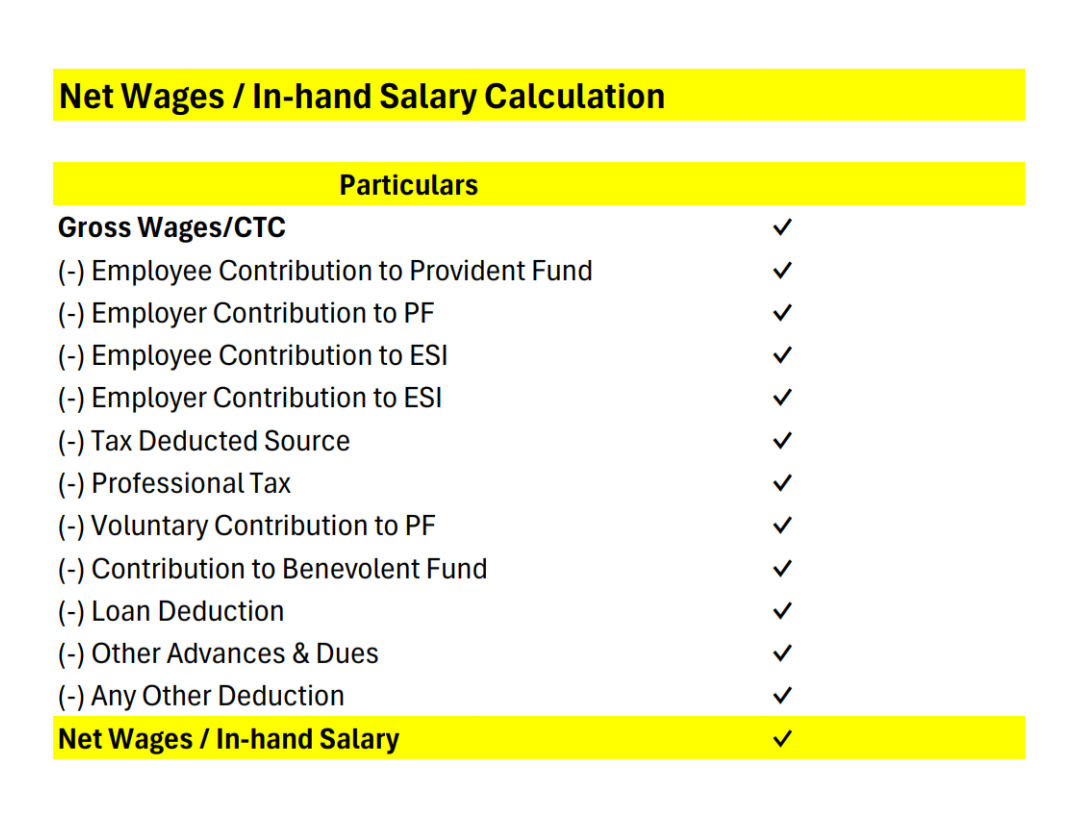

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

CA Abhishek Singhal

Har Har MAHADEV • 9m

If you're an employee, you've got an in-hand salary hike today! This is because of Nirmala Sitharaman's tax cut for the new regime. April 2025 is the first month you see it in action. Your company would've cut lower TDS in accordance with the new sl

See MoreCA Kakul Gupta

Chartered Accountant... • 6m

Bhai, mera HRA kaise niklega? HR ne bola taxable hai, but kaise pata chale? This question my salaried friend asked me over coffee. Aur phir shuru hua calculator–Excel–notepad ka marathon… but the answer could have come in just 2 minutes, if the righ

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)