Back

Poovendhiran P

Vice President at NA... • 1y

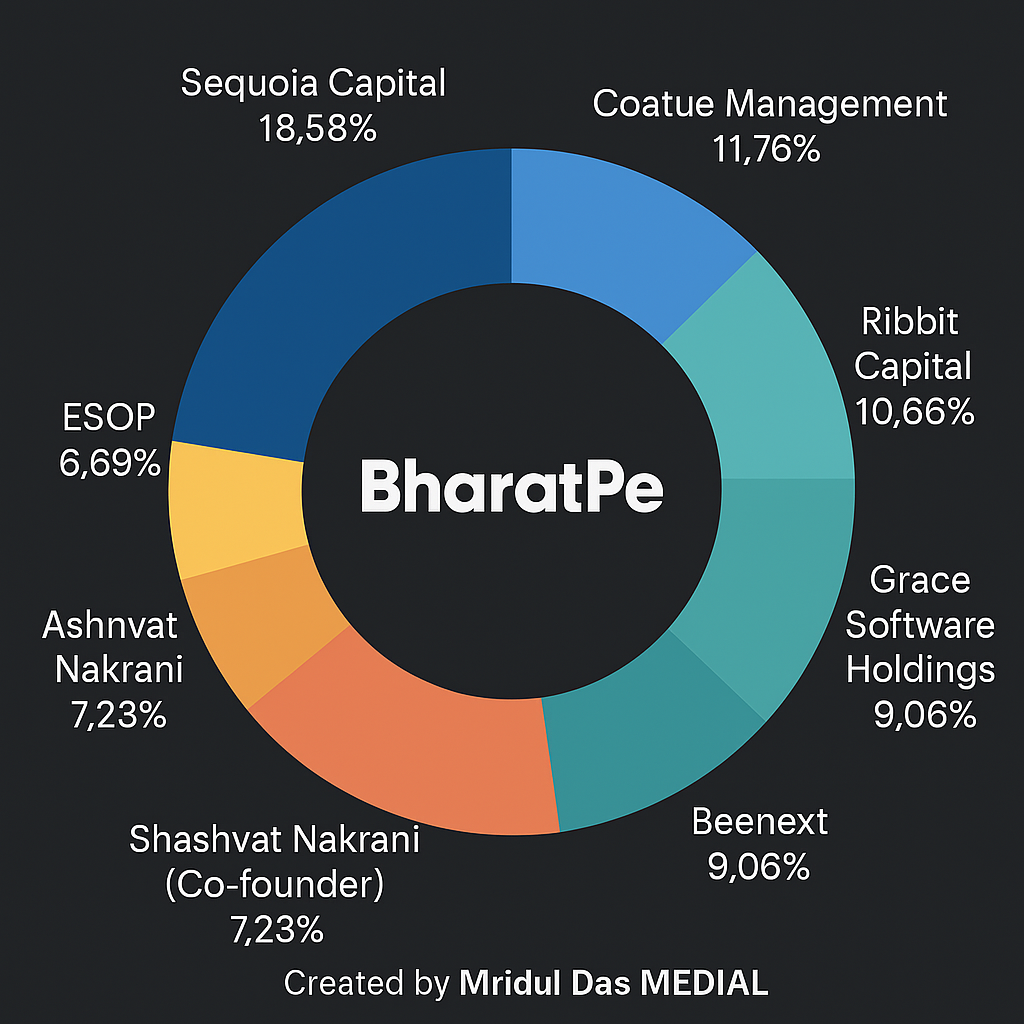

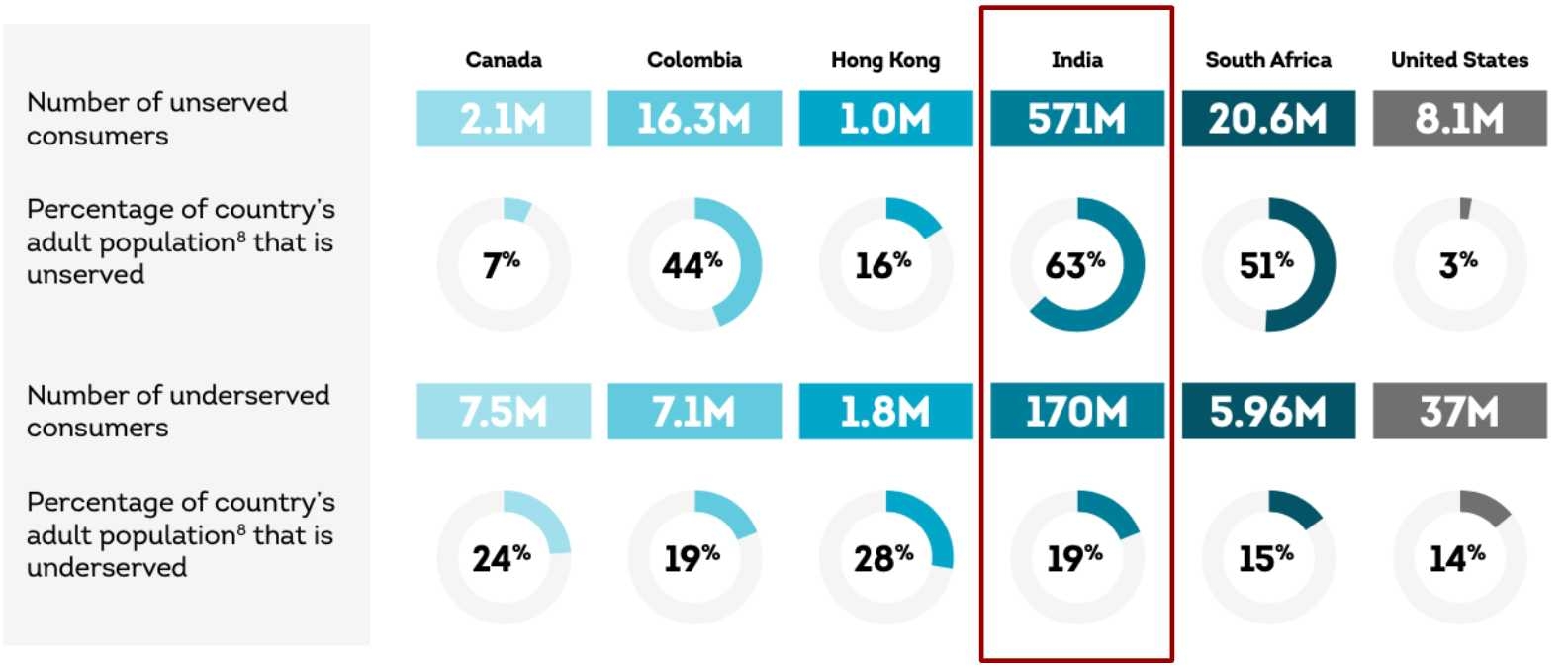

Loans are a way to become profitable for the startup’s in an otherwise bleeding environment. Lending is highly profitable business. That’s why all Fintech companies are focusing on lending. It’s also risky and heavily regulated that’s why Paytm is in trouble.

More like this

Recommendations from Medial

Neophile Nexus

Trying new things ,.... • 8m

Would you rather build: a boring, profitable business OR a risky but sexy startup? Let’s say you could either: Build a logistics or waste management company making $250k/year profit in 4 years OR Build an AI startup that might be a $100M exit…

See MoreSanthosh Gandhi

Decoding Venture Cap... • 11m

If you’ve ever wondered why VCs invest in risky startups instead of safe businesses, it’s because of something called the power law. And trust me, if you understand this, you’ll see why most VCs don’t care if 90% of their startups fail! Think about

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Why Private Funding is a Tougher Nut to Crack Than a Bank Loan Often, private funding proves harder to get than a traditional bank loan. Banks are risk-averse and highly regulated, relying on excellent credit, established history, and collateral. Thi

See More

Poosarla Sai Karthik

Tech guy with a busi... • 3m

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banki

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)