Back

Arcane

Hey, I'm on Medial • 1y

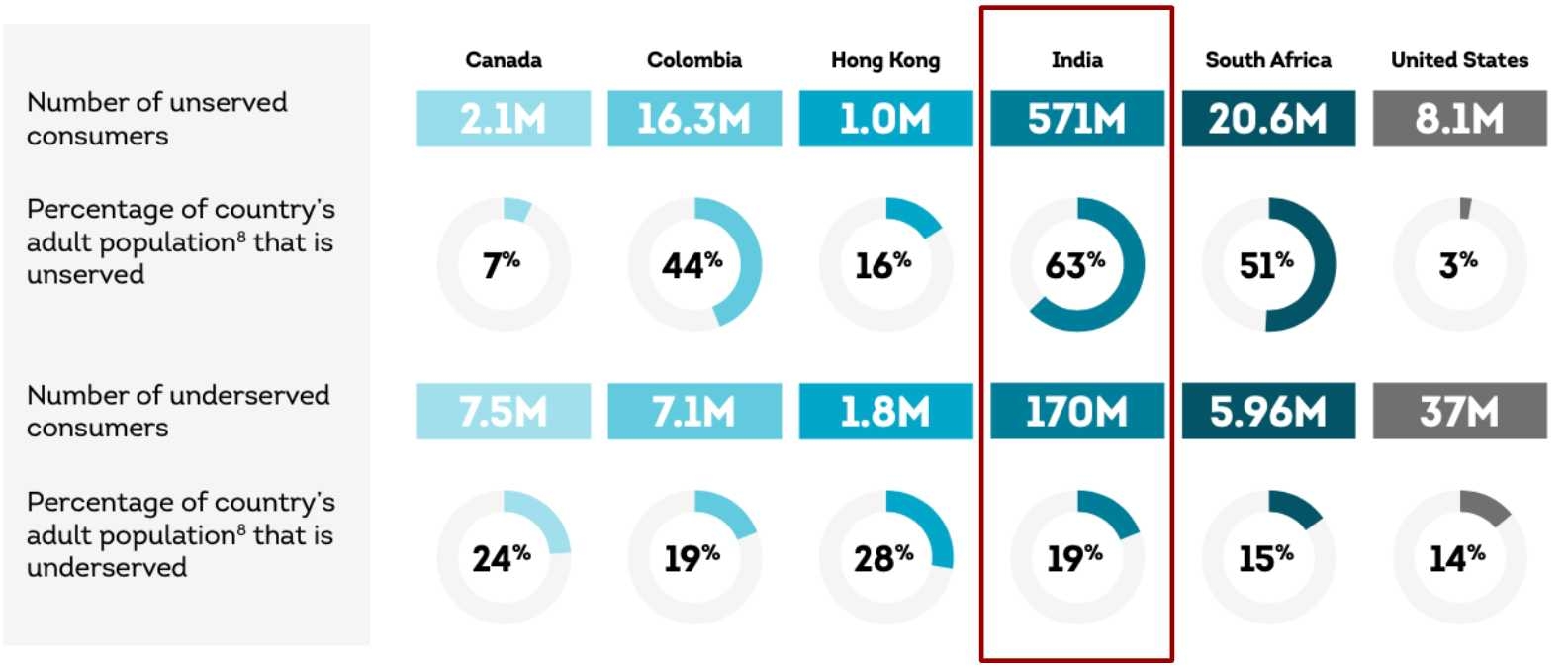

ONE INTERESTING OBSERVATION SERIES DAY #7 Retail lending in India is heavily concentrated in Metro and Tier-1 cities due to limited reach in other areas. This opens up a significant market opportunity for digital lenders. With 65% of the population living in semi-urban and rural areas but accounting for only 40% of outstanding loans, there's a clear credit supply gap waiting to be filled. Also, 63% of India's adults remain UNSERVED and 19% UNDERSERVED in this category, representing a vast segment of the population without adequate financial access. Expanding financial services to these regions is essential for balanced economic growth. Increasing access to credit can boost consumer spending, which in turn stimulates business growth and job creation, significantly impacting the country's GDP.

Replies (11)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Fintech in Bangalore: Trends and Opportunities * Trends: Mobile payments, digital lending, insurtech, blockchain, wealth management, regulatory sandbox. * Opportunities: Financial inclusion, increased access to credit, personalized fina

See Moreadvaidh prasad

CEO & Co-founder of ... • 1y

"Seeking Solutions: Addressing Credit Challenges in the HORECA Industry 🍽️ Facing sudden customer vanishings and navigating the unorganized sector has posed significant credit challenges for our HORECA business. How can we strategize and resolve cr

See MoreHarsh lambhate

We are just human • 1y

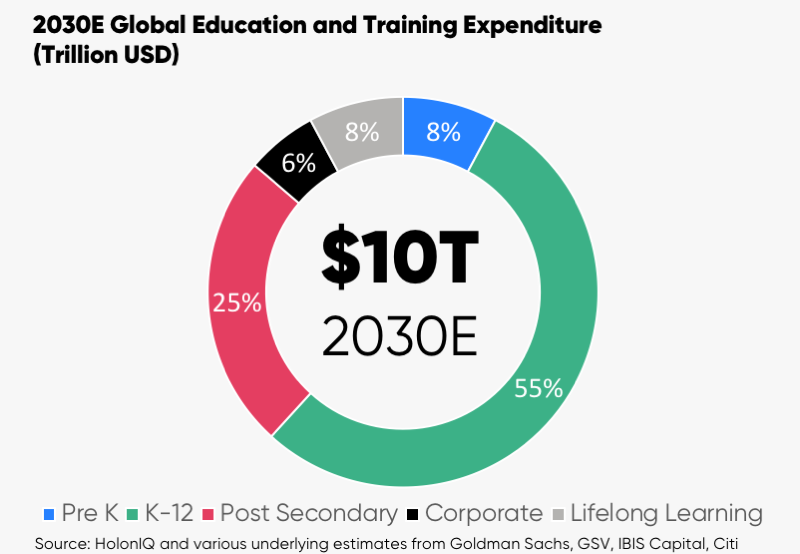

The global education market is expected to reach $10 trillion by 2030, up from $6 trillion in 2022. This growth is due to a number of factors, including: Population growth Developing markets are seeing population growth, which will drive expansion. T

See More

gray man

I'm just a normal gu... • 9m

Flipkart, the ecommerce powerhouse backed by Walmart, is said to be strategically scaling back the expansion of its rapid delivery service, Flipkart Minutes. This adjustment reportedly focuses its reach on the six to eight largest metropolitan areas

See More

CA Sumit Chandwani

The New way of Compl... • 11m

🚀 The Role of Financial Strategy in Business Growth Managing a business involves countless decisions—budgeting, fundraising, compliance, and financial planning. One common challenge I’ve observed is that many startups and SMEs struggle with financi

See Morerohit kumawat

Software Engineer • 6m

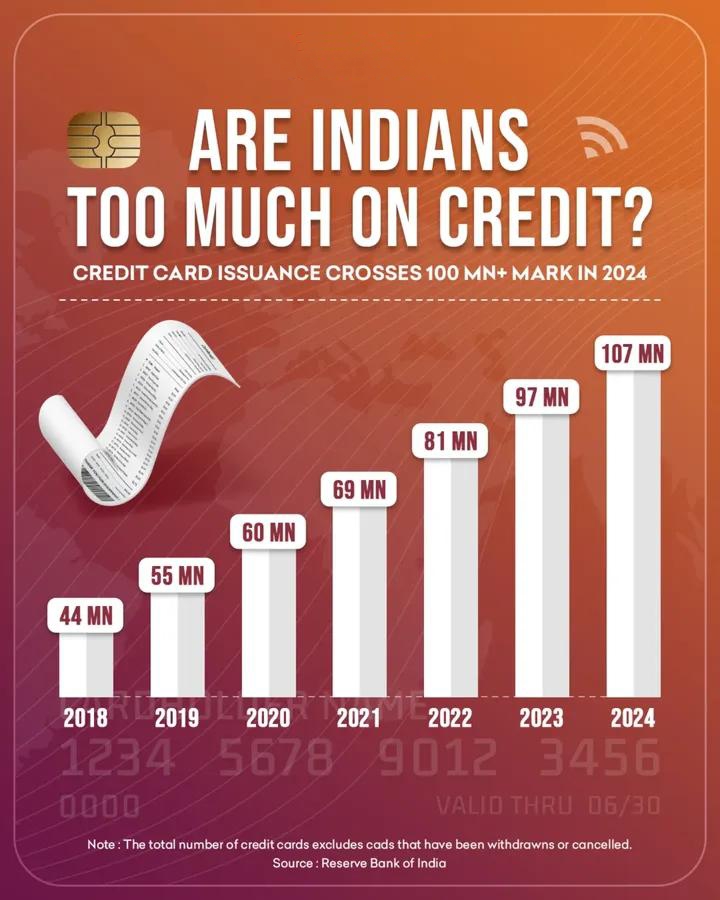

About Fintech Startup in India. India’s economy is growing, and so is its digital population. As of 2024, India has over 800 million internet users and nearly 1.2 billion mobile connections. Ignoring the need for digital-first financial solutions wo

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)