Back

Havish Gupta

Figuring Out • 1y

If you are saying this because of the tax slab. You are Wrong. Tax for income above 15 lakh is taxes at 30% but the income tax is charged on per slab basis. That means, even if one is earning a crore. The first 3 lakhs won't be taxed, next 3 lakhs at 5% and so on.

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

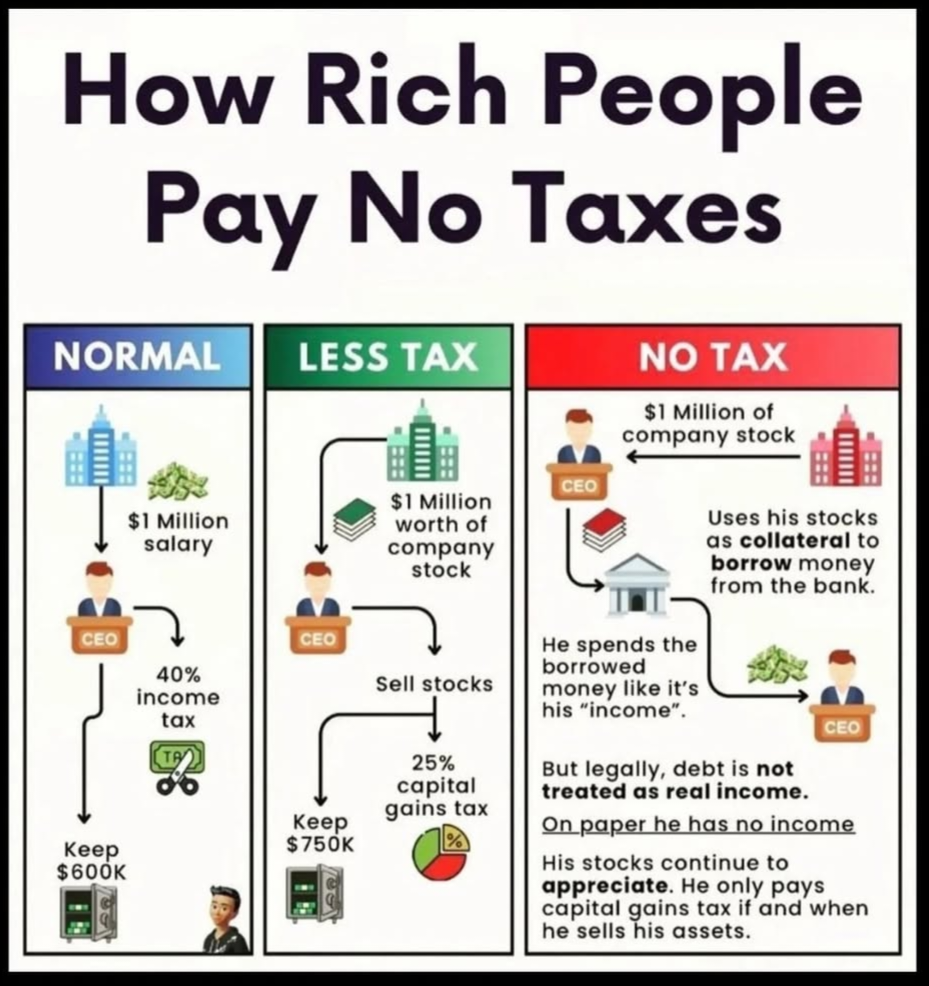

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)