Back

Shabrez

Dev at Myntra • 1y

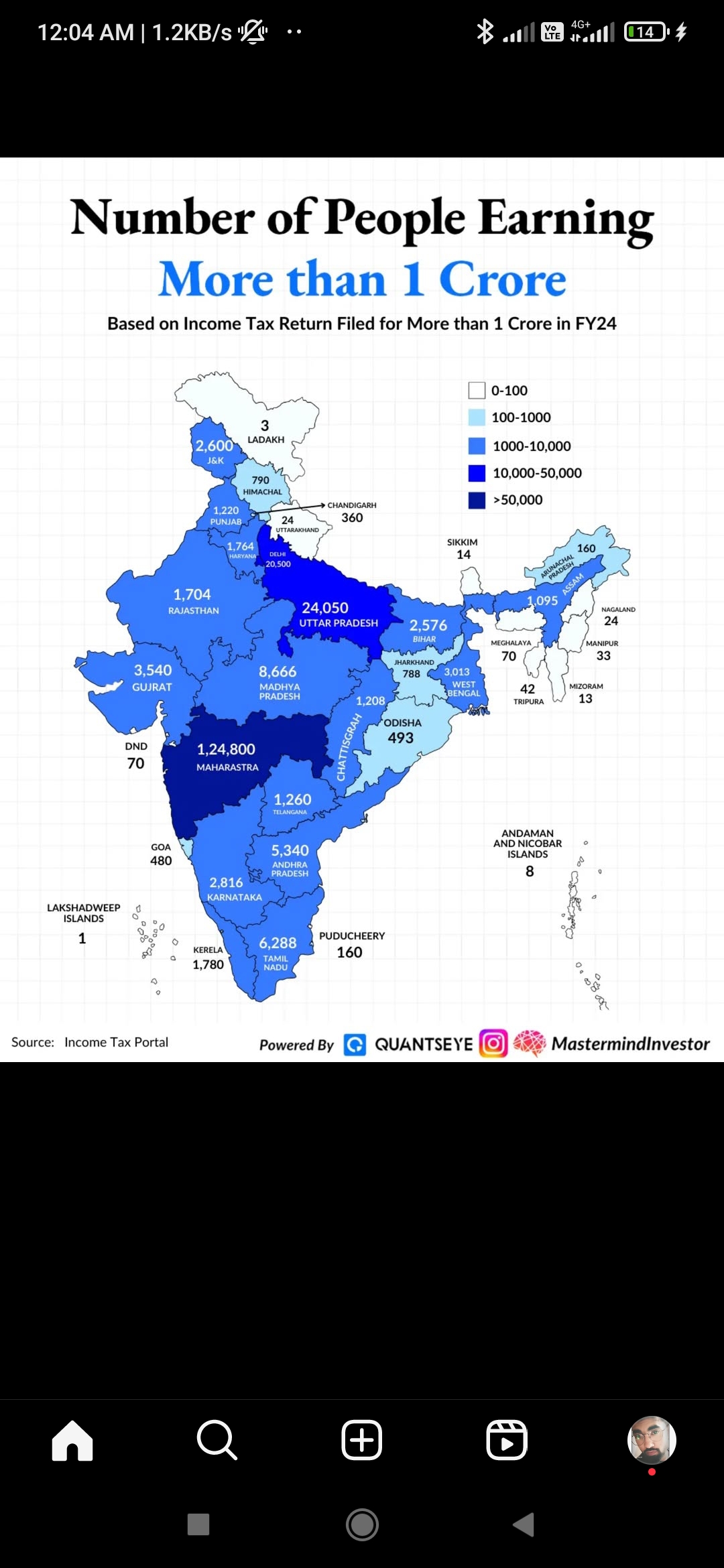

I doesn't understand, Y none of the economist raise the question on this. There is huge financial fraud rules are in the department. Think slightly, if ur paying tax on ur income as u earn and ur the Indian which is good. Now I got the salary cutting the tax, should I pay GST for film, food at restaurant, goods that I buy? Every where I go its totally a taxed environment and that to non - refundable.

Replies (1)

More like this

Recommendations from Medial

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 11m

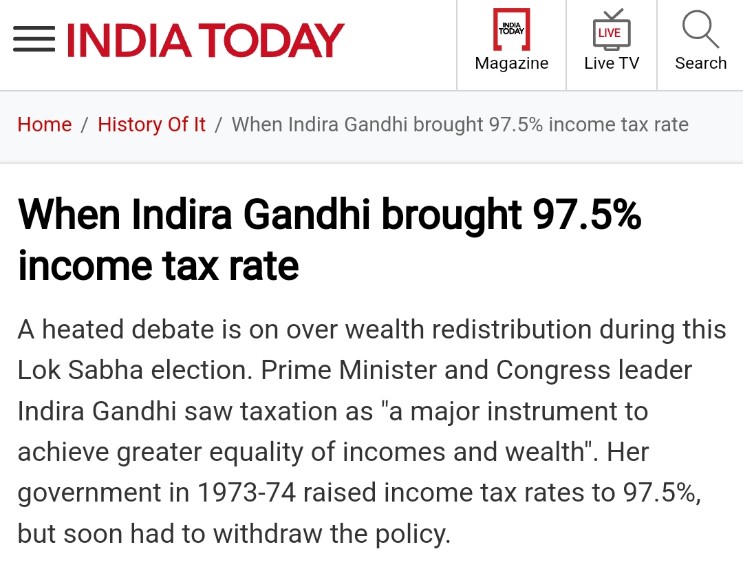

Of course the value of money has changed but it's a great comparison. It does not show Congress taxed the rich btw. Nobody was paying 97.5% tax. They were just paying bribes to Congress to keep money black. That's how they destroyed our economy.

B Yashwanth

Customer success ent... • 11m

Just invest 10 sec in below 👇 calculator to calculate your tax as per new regime 2025 Tax Calculator comparison as per budget 2025! https://tax.pythontrader.in/ Calculate ur tax as per new proposed slab rates .. just enter your income in this ..

See MoreCA Jasmeet Singh

In God We Trust, The... • 8m

🚨 Breaking Tax News: The TCS Chronicles – April 2025 Edition 🚨 Brace yourselves, tax enthusiasts! The Finance Ministry has rolled out a new TCS (Tax Collection at Source) rule that's turning heads and emptying wallets. Effective April 22, 2025, ce

See More

Download the medial app to read full posts, comements and news.