Back

CA Dipika Pathak

Partner at D P S A &... • 1y

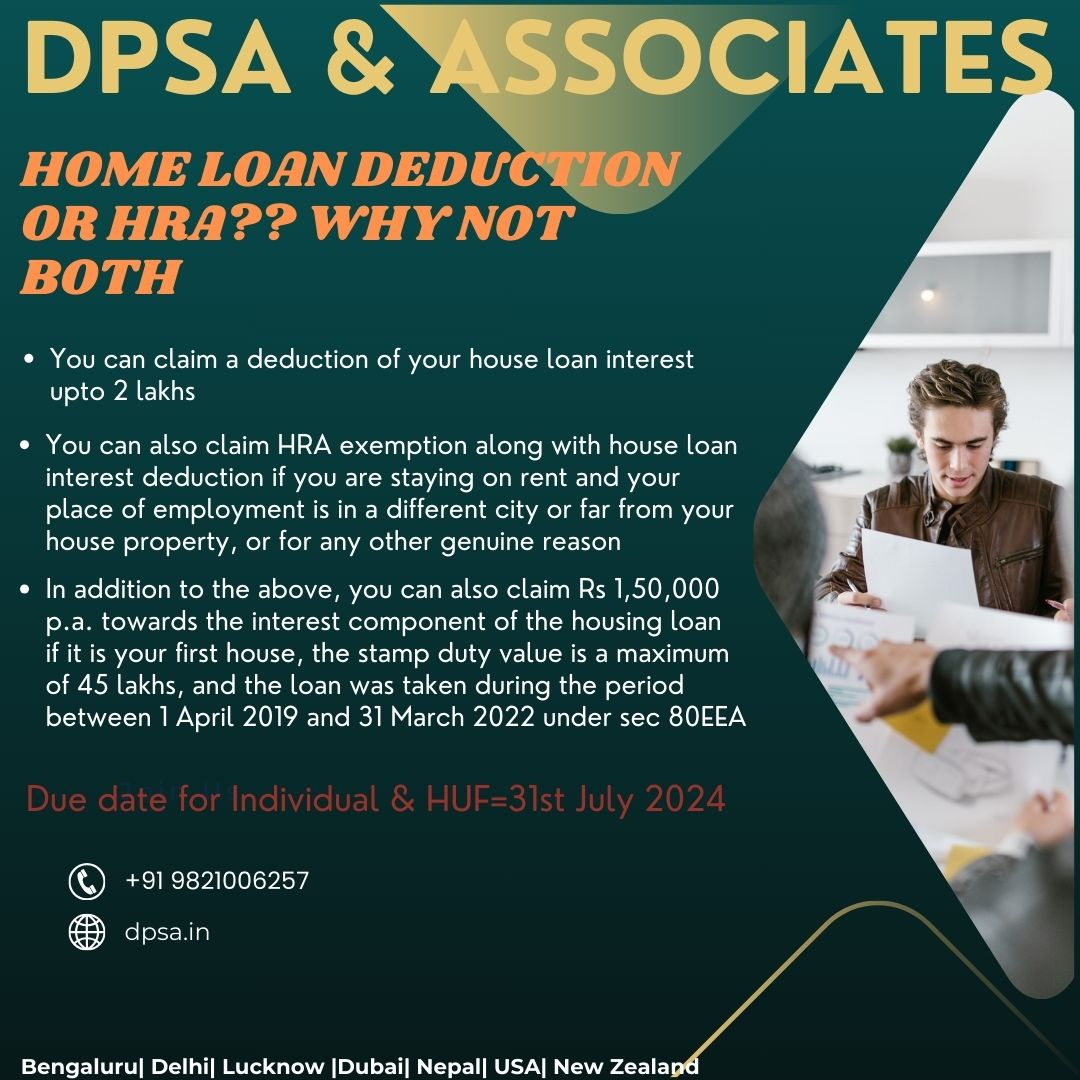

Home loan deduction or HRA......Why not both??

More like this

Recommendations from Medial

theresa jeevan

Your Curly Haird mal... • 1y

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

Kaamar Thakur

Real estate and fina... • 5m

Who has -1 CIBIL means they never took a loan but today they need a loan, then all people can contact us but only for employees or business owners from 1lacs to 5lacs.Those who do not need it, please do not waste your time.Everyone has a need, but no

See More

Darshan jain

All types of financi... • 1y

🚨 hiring for field work sales person at your nearby area ( work from home or field work available) I have my own financial firm 'kuwad associates', We provide financial services like saving account 🏦 credit card 💳 demat account 📈 personal loan

See MorePushpender Verma

Looking for VC fundi... • 1y

Hi, I am looking for Inverter for starting a Finance Company which will do secured lending to SOHO/Small Shopkeeper/Daily wage earner. Location - Lucknow loan Amount - Upto 5 Lac Rate of Interest - 24% - 30% Type - Home Loan / Loan Against Property

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)