Back

Sayan Bagchi

Management | Fronten... • 10m

This is the best time to get Home loans you'll save a lot of interest due to repo rate deduction throughout the next few years. Take my advice buy a property or you'll regret in the future

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreAkshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

AVOID this mistake WHILE taking deduction of interest (saving +fixed deposit)in your ITR🔴🔴🔴🔴🔴 Since ITR Season is around, highlighting common confusion ➡️For Individual & HUF - We can take a max deduction of 10,000 on interest from a savings a

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

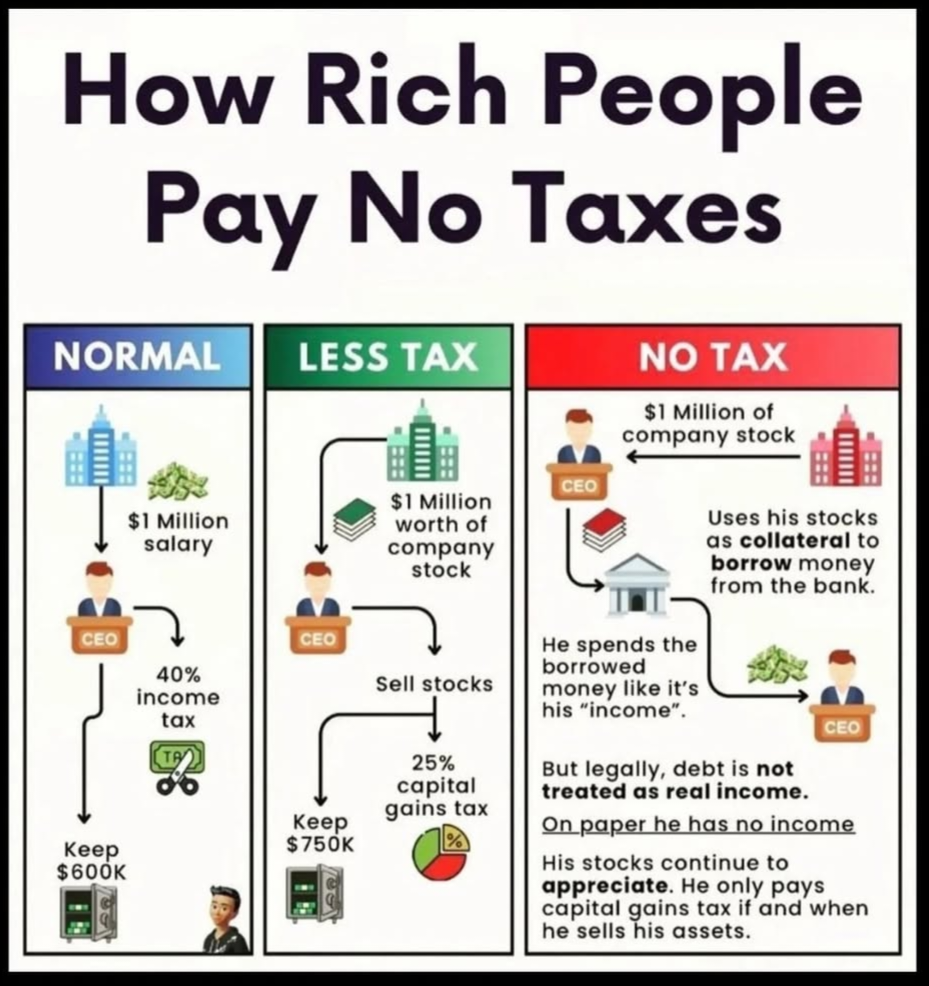

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)