Back

Anonymous 3

Hey I am on Medial • 1y

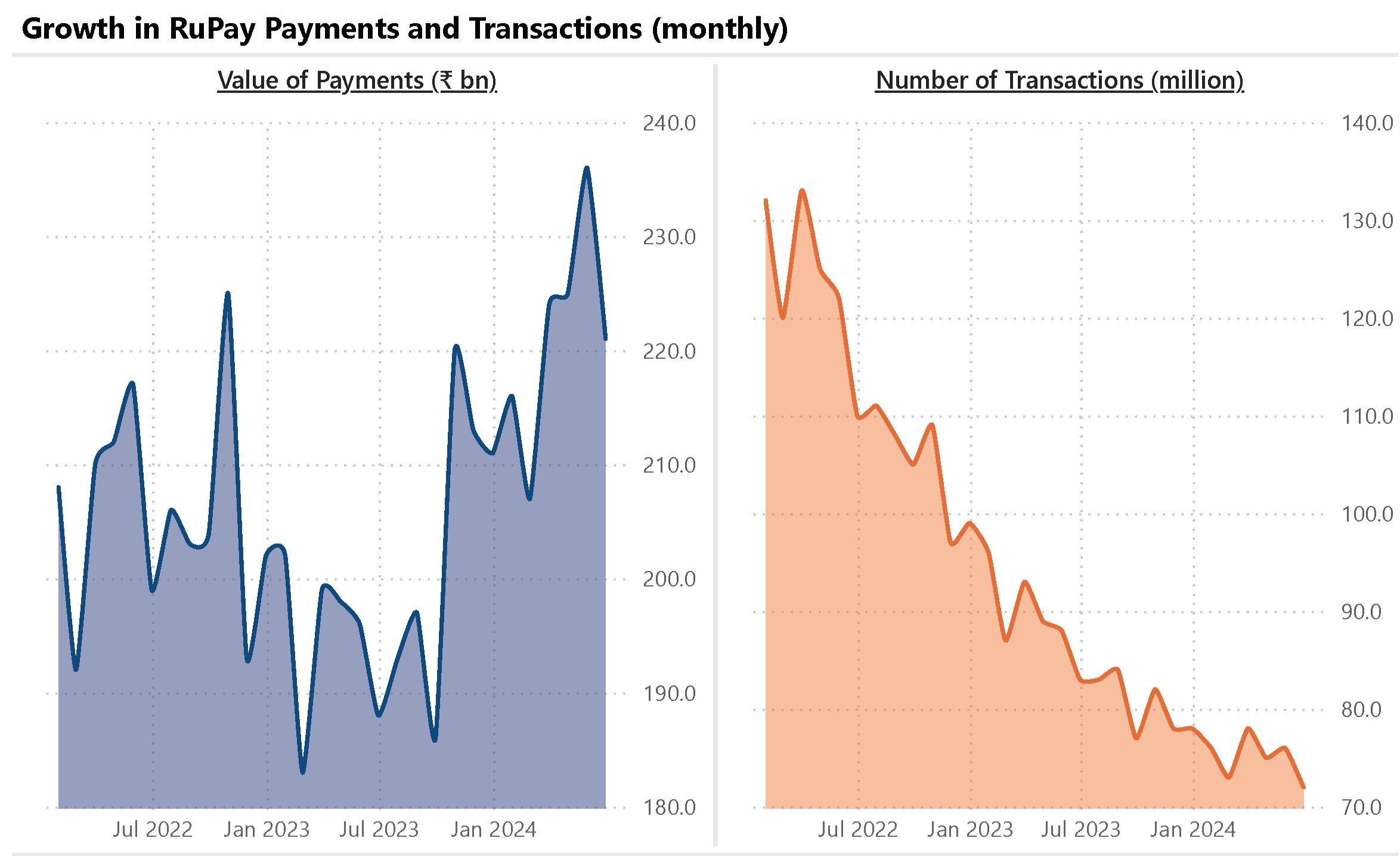

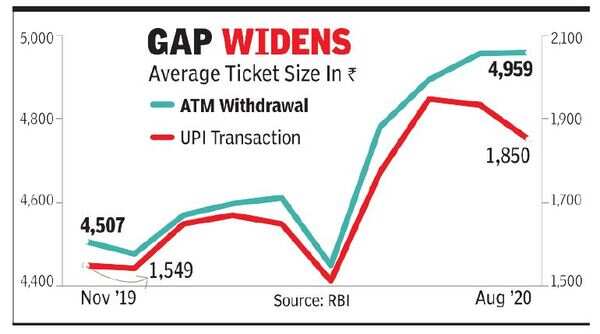

This could indicate a shift towards higher-value transactions on RuPay. Perhaps more people are using it for big-ticket purchases or B2B transactions, while smaller everyday transactions are moving to UPI or other platforms.

Replies (1)

More like this

Recommendations from Medial

Mr khan

Smart. Sustainable. ... • 1y

UPI Statistics for December 2024: Total Transactions: December 2024 mein, UPI ne over 10 billion transactions process kiye, jo pehle ke months ke comparison mein kaafi zyada tha. Transaction Value: UPI transactions ki total value ₹15 lakh crore (app

See MorePoosarla Sai Karthik

Tech guy with a busi... • 7m

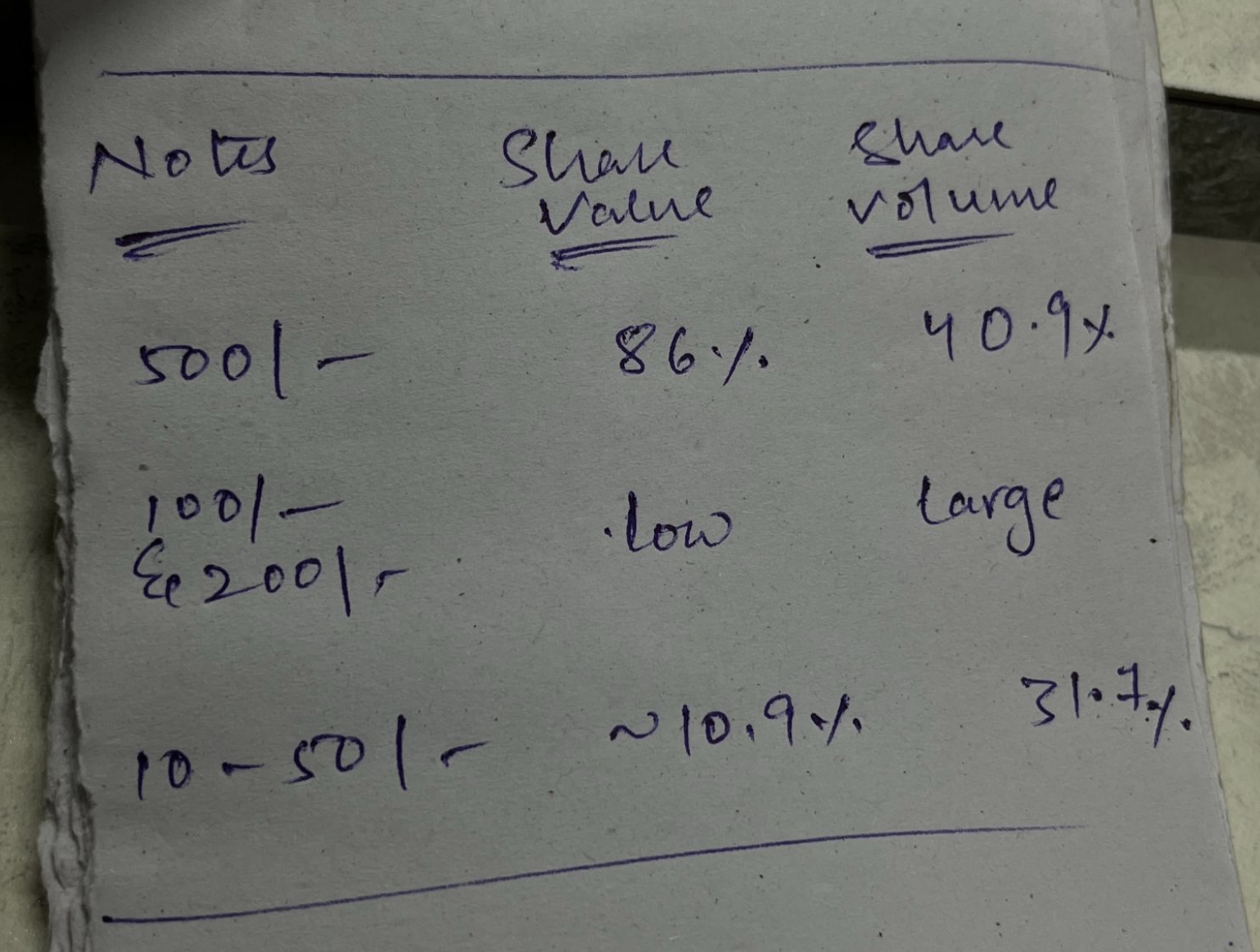

As of 2025, ₹500 notes dominate India’s cash system, making up 86 percent of the total value and 40.9 percent of all notes by volume. But while they’re everywhere, they’re not always practical. For everyday use, smaller denominations like ₹100 and ₹2

See More

Kamalesh B

Building India's Ec... • 8m

🛒 Amazon Introduces Marketplace Fee for Buyers in India Amazon India has quietly rolled out a marketplace fee on select buyer transactions starting June 2025. This nominal fee (₹2 to ₹10 approx.) is added during checkout, primarily on low-ticket it

See More

Poosarla Sai Karthik

Tech guy with a busi... • 7m

UPI on Credit? PhonePe’s Boldest Bet Yet In partnership with HDFC Bank and NPCI, the card is powered by Rupay and allows UPI payments through credit. NPCI had enabled this back in 2022, but PhonePe had to wait almost ten months to get RBI approval.

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

Navi’s 10x jump in UPI is no big deal 🙏🙏 Many social media posts have already declared Sachin Bansal-led Navi the next big thing in UPI. Why? It stormed from 3mn UPI transactions in March to 30mn in May. But, to be honest, that’s pretty naive. H

See More

Arcane

Hey, I'm on Medial • 10m

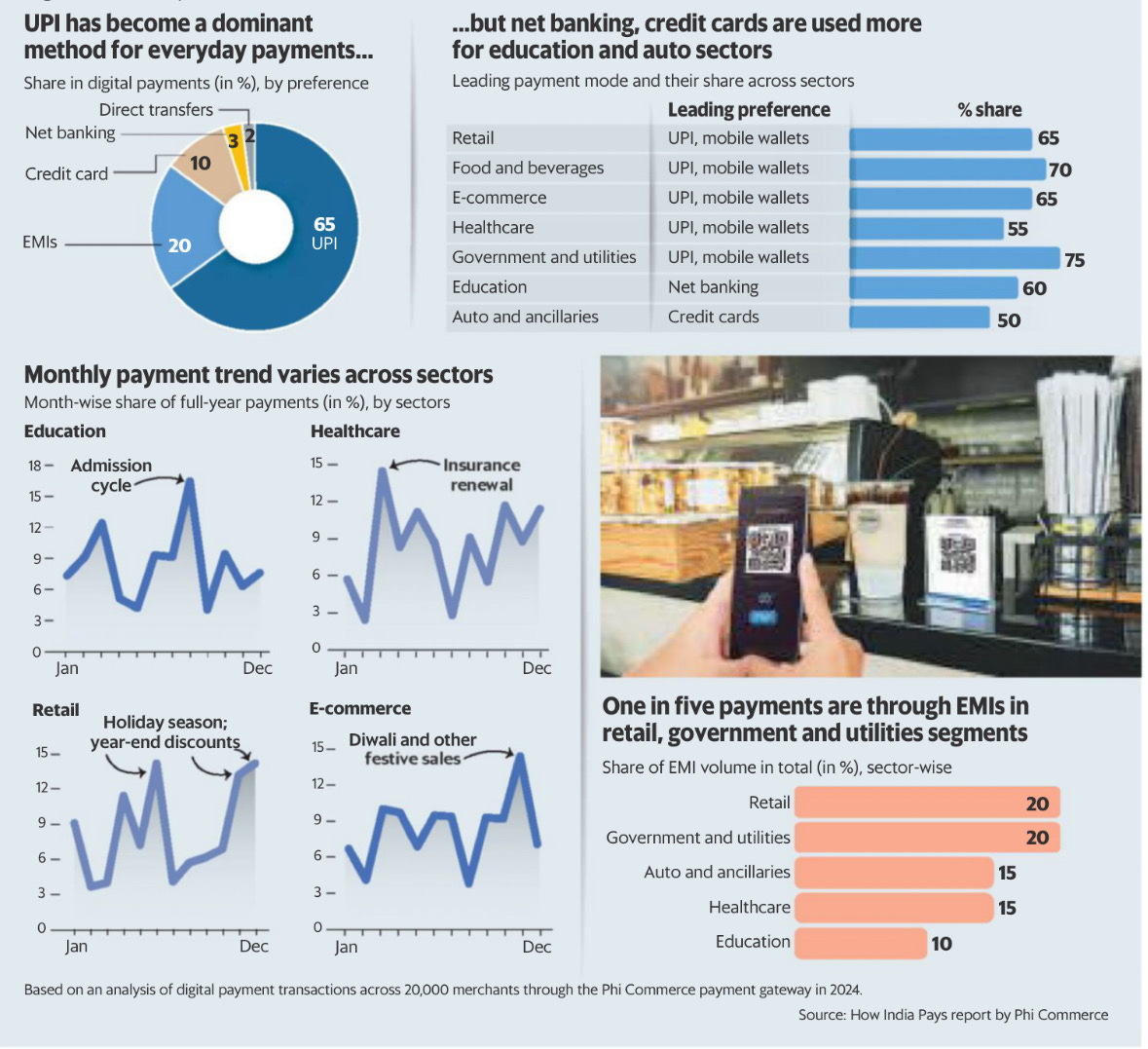

A QUICK SNAPSHOT OF HOW INDIA PAYS Let's start with UPI 1/ UPI dominates everyday transactions because it requires almost zero mental effort and well, it's free (for now). Would be interesting to see how this changes once charges are introduced. 2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)