Back

Anonymous 1

Hey I am on Medial • 1y

Debt, if I’m sure about the return

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

I recently posted about debt financing and got some interesting responses. I want to dig a bit deeper into this topic. For those new to startups or even those with some experience, how do you feel about using debt financing? Robert Kiyosaki, from "R

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

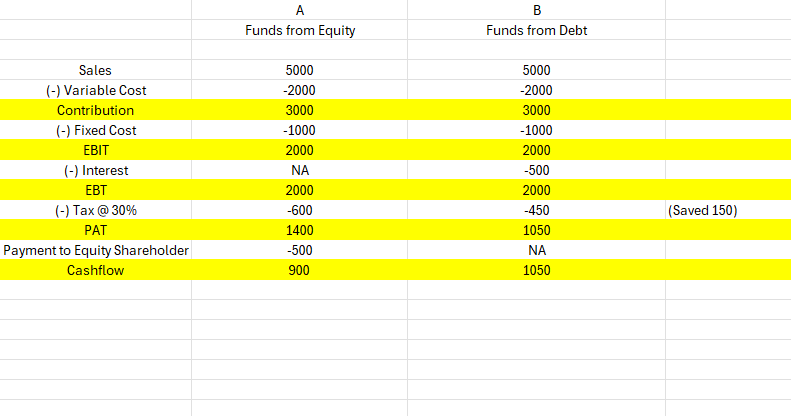

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Anonymous

Hey I am on Medial • 1y

What is the severity of return-to-origin, return, and refund abuse for e-commerce sellers? I’m specifically referring to the core challenges these issues present, including the financial impact, operational inefficiencies, and customer trust concerns

See MoreKarunya Sivakumar

Founder cum CEO of a... • 1y

I’m not sure if I should be posting this here but I need inputs… Any suggestions to improve my logo? I want to keep this as simple as possible and how do I make sure it blends well with different backgrounds? (I’m not satisfied with the colour combi

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)