Back

Anirudh Gupta

CA Aspirant|Content ... • 1y

True A friend of mine who is a CA faces difficulty in accessing income tax website.

Replies (1)

More like this

Recommendations from Medial

Sai Vishnu

Income Tax & GST Con... • 11m

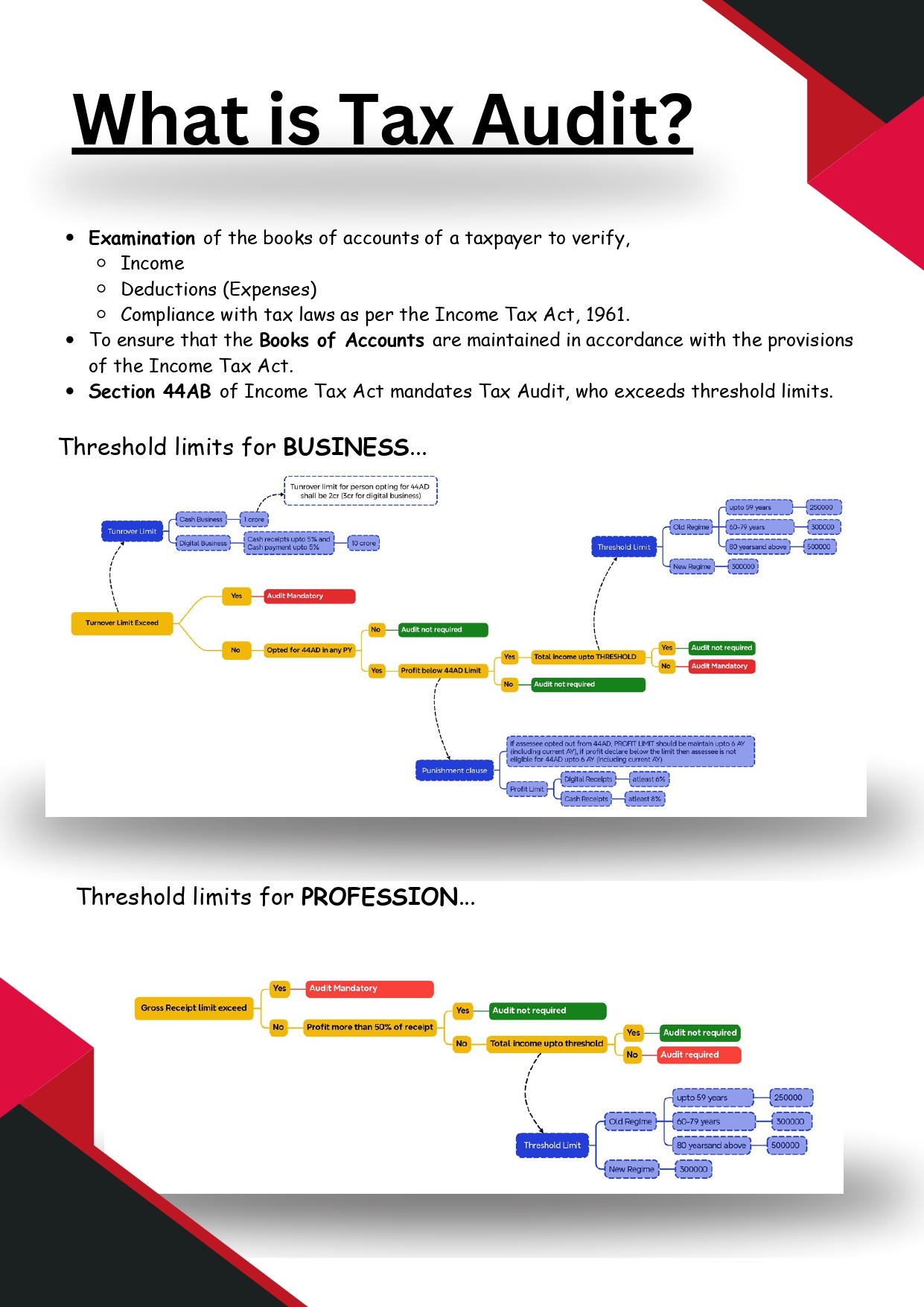

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreCA Jasmeet Singh

In God We Trust, The... • 10m

Tax season got you sweating? 😅 Here’s your survival kit: ✅ Organize receipts monthly (use apps like Expensify!). ✅ Track deductible expenses (yes, that home office counts!). ✅ Hire a CA who speaks ‘tax’ fluently—😎 DM me for a FREE tax checklist to

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)