Back

Anonymous 1

Hey I am on Medial • 1y

A here. Pvt Ltd companies need to file annual financial statements, tax returns, and depending on your turnover, you may need a statutory audit

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

Hello everyone, I am planning to start a Pvt Ltd along with my brother. So I need guidance regarding business registration. I have found that vakilsearch is good for registration but what about the audits and other filings . Do I really need a CA af

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

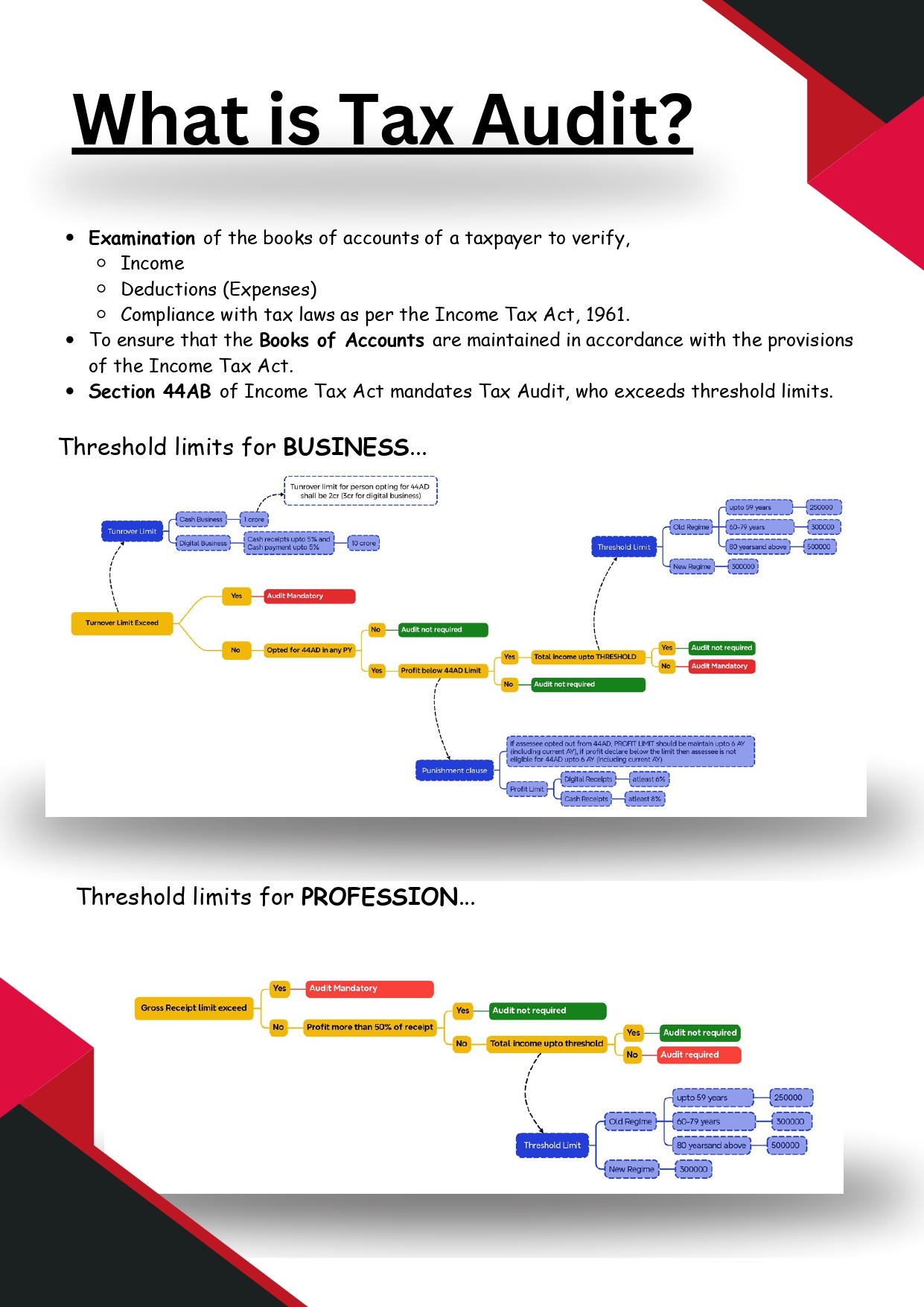

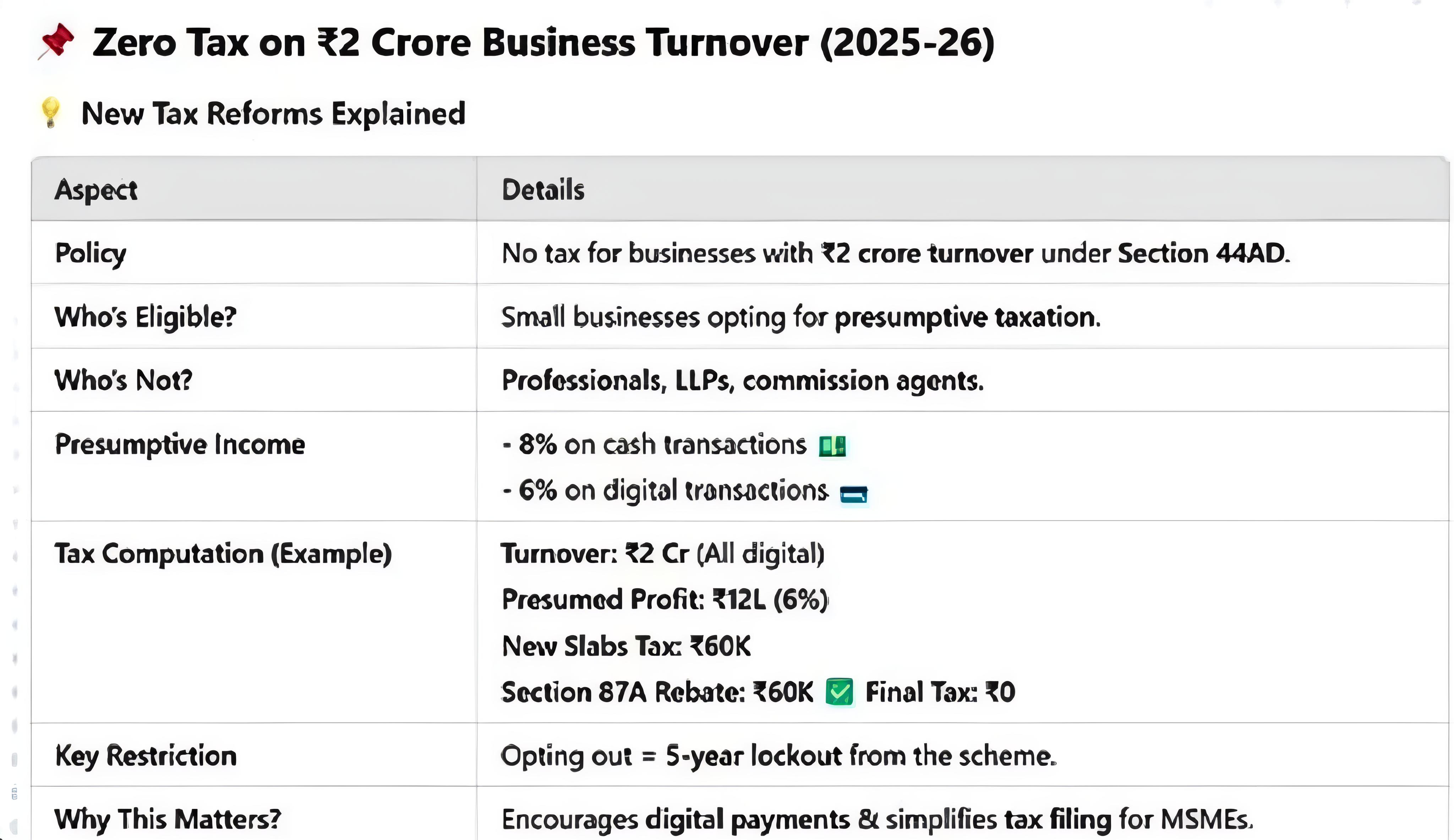

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Sai Vishnu

Income Tax & GST Con... • 11m

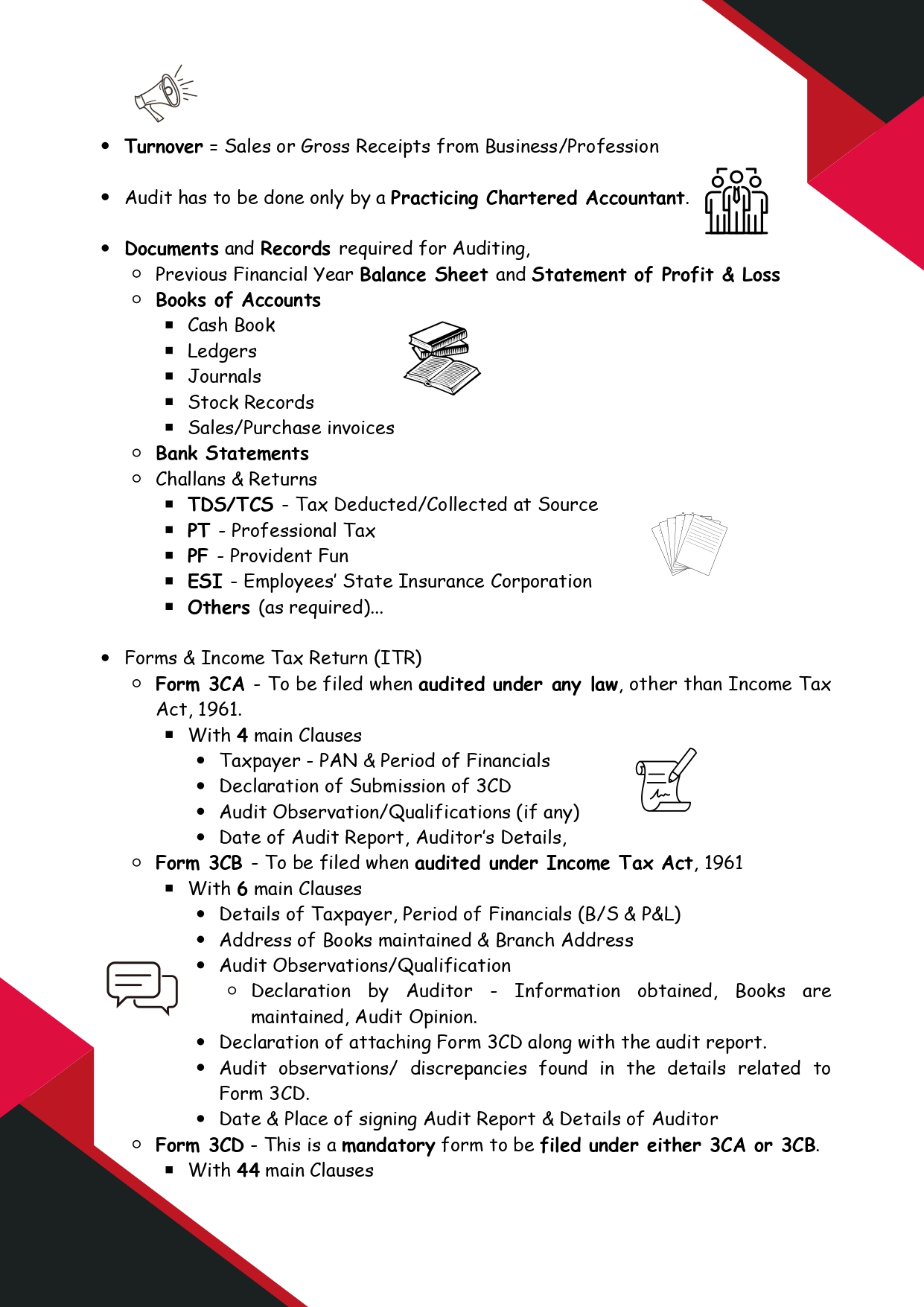

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

calculus

Your Bottom Line Our... • 8m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)