Back

Anonymous 3

Hey I am on Medial • 1y

If you’re also looking to save on taxes, consider ELSS funds like Axis Long Term Equity Fund. They have a lock-in period of 3 years and offer tax benefits under Section 80C.

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

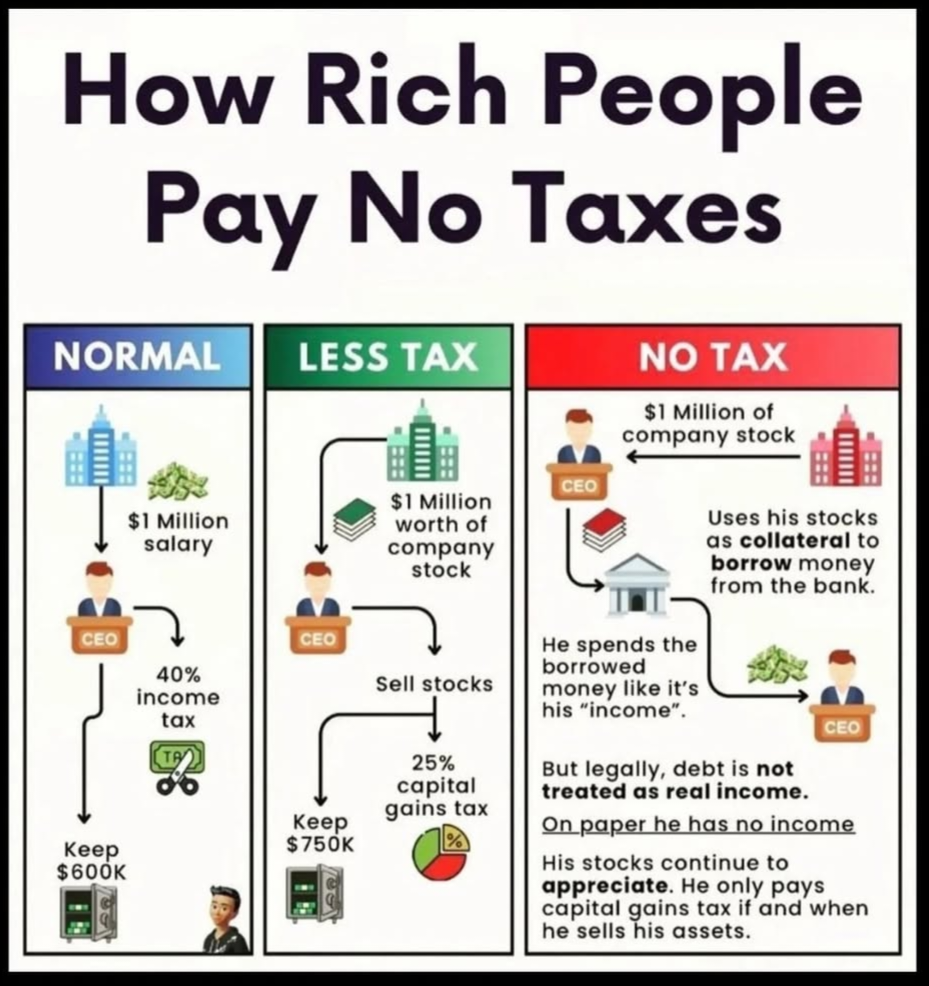

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

theresa jeevan

Your Curly Haird mal... • 1y

🚨 Tax Saving Alert: Only 2 Months Left! 🚨 Hi there! 👋 Here’s a quick guide to help you maximize your savings: 🔹 80C - Save up to ₹1.5L PPF, ELSS (higher returns), NSC, LIC, Tax-Saving FDs (5 yrs). 🔹 80D - Health is Wealth Save ₹25K (self/fami

See More

theresa jeevan

Your Curly Haird mal... • 1y

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

CA Kakul Gupta

Chartered Accountant... • 1y

The Central Board of Direct Taxes (CBDT) has specified that no tax deduction at source (TDS) under Section 194Q of the Income Tax Act, 1961, will be required for purchases made from units of International Financial Services Centres (IFSC), provided b

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)