Back

Sairaj Kadam

Student & Financial ... • 1y

I've been thinking about your business strategy and wanted to share some thoughts with you. It seems like you've built a strong presence with your existing platform and customer base, which is fantastic. Now, when it comes to obtaining a GST number, it could be a smart move, especially if you're generating significant revenue and want to streamline your tax compliance processes. Having a GST number can add legitimacy to your business and allow you to claim input tax credits, which can ultimately benefit your bottom line. Plus, it may be necessary for certain transactions or partnerships down the line. As for selling on other platforms like Amazon, while it may seem like a tempting option, focusing on growing your own platform first could yield better results. By investing in your brand and engaging with your existing audience, you can build a loyal customer base that's more likely to support your business in the long run. If you need more detailed insights or assistance Reach out!

Replies (1)

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 11m

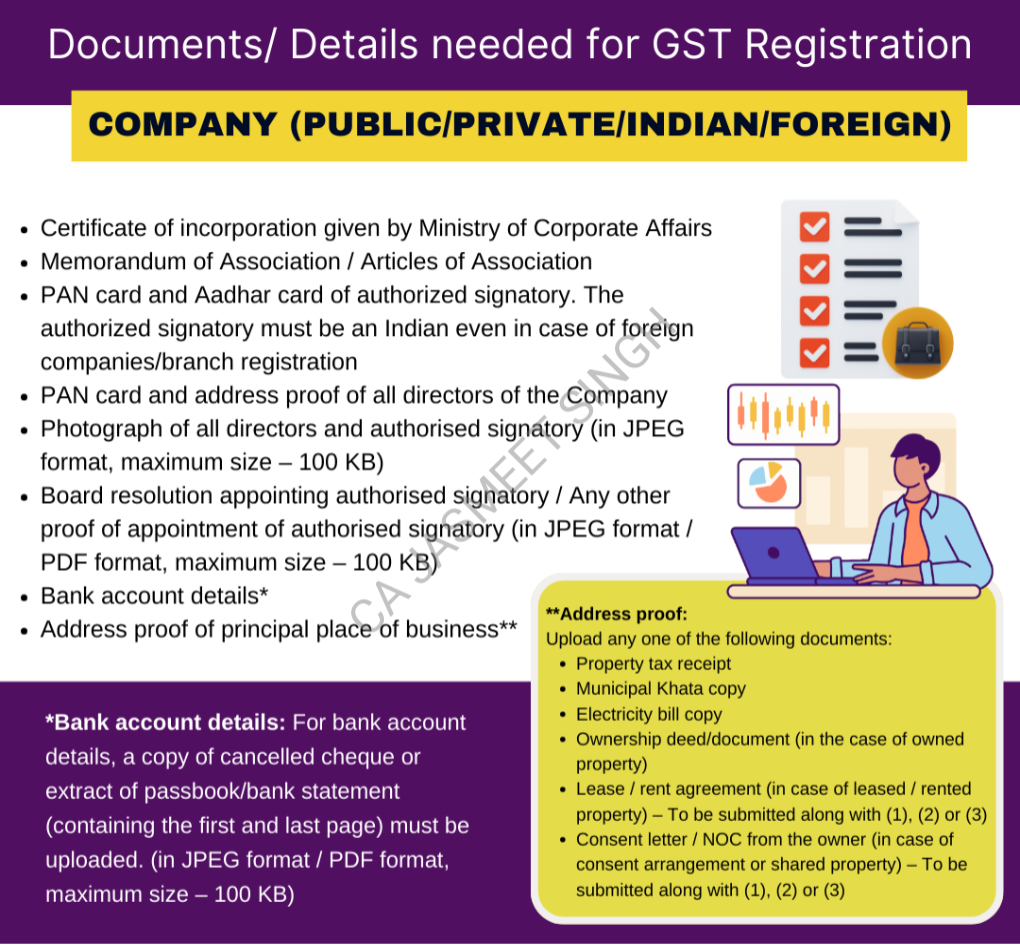

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Sandip Kaur

Hey I am on Medial • 1y

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 10m

How Parachute Outsmarted India’s Tax System & Saved Crores🤯🌝 Ever noticed that Parachute Coconut Oil never says "hair oil" on its bottle? Instead, it’s labeled as “100% Pure Edible Coconut Oil.” This isn’t just a branding choice—it’s a smart tax-s

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MorePremsukh kumawat

Hey I am on Medial • 6m

Proudly sharing Bizrelievo's upcoming launch on July 27th! Your Partner for Seamless Business & Tax Compliance. What is Bizrelievo? It's your dedicated partner for comprehensive business incorporation, meticulous ongoing compliance, and expert in

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)