Back

Anonymous 6

Hey I am on Medial • 1y

One of the biggest reasons for this is that capital gains tax in India is close to 42%. During secondaries founders get half their money so a place like singapore makes more sense. During IPO everyone will definitely flip back.

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

40% Indian unicorns aren’t actually Indian Razorpay is planning a ‘Bharat Wapsi' from US that could cost them around $300 in taxes. Today, I wanted to explain the process, Infamously called a "reverse flip". - PhonePe and Zepto might have to pay ov

See MoreVCGuy

Believe me, it’s not... • 1y

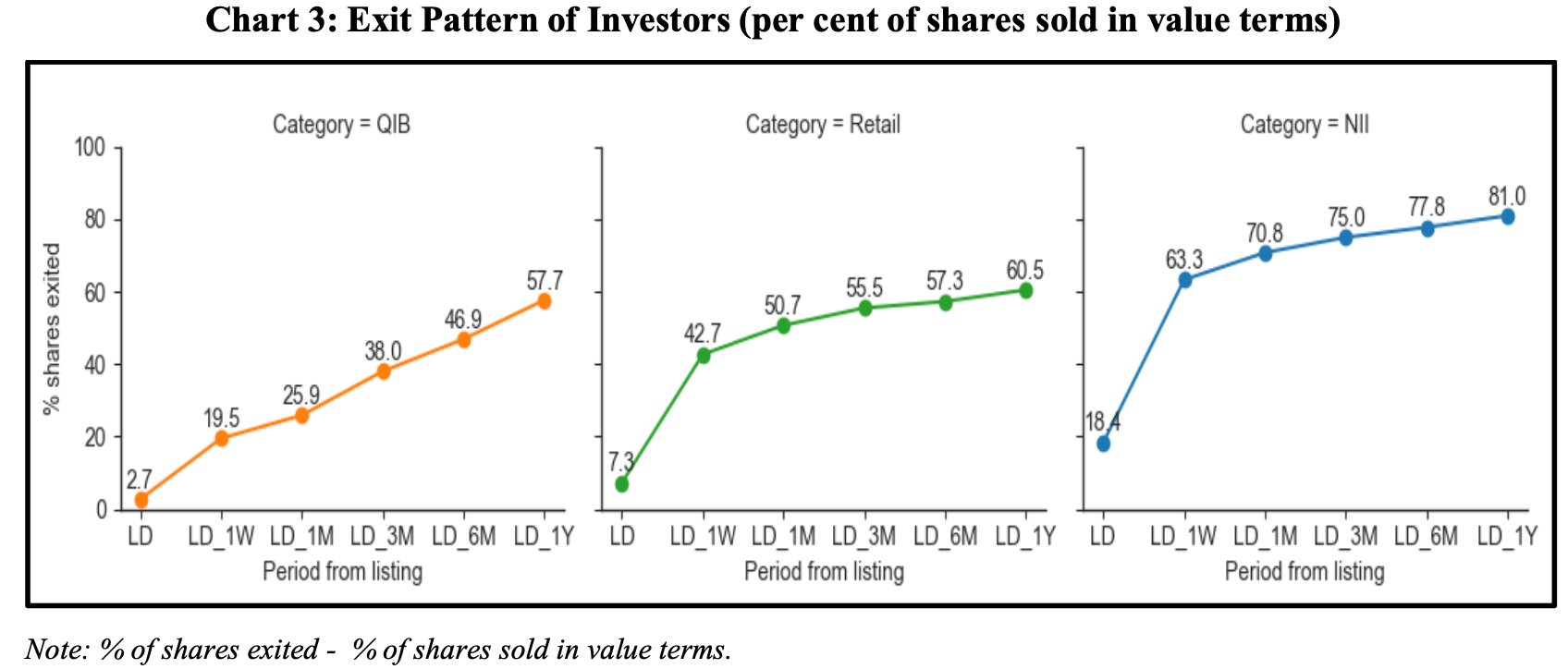

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

VCGuy

Believe me, it’s not... • 1y

Indian startups are Reverse Flipping. Many startups incorporate in countries like Singapore, Mauritius, the US (primarily for SaaS), or the Cayman Islands for several reasons: - Ease of doing business - Tax incentives - Better funding opportunities

See MoreLinkrcap Studio

A digital news platf... • 1m

Shares of online brokerage platform Groww remain under pressure for the second straight trading session after the finance minister Nirmala Sitharaman proposed hiking securities transacation tax (STT) on F&O derivatives during her ninth Budget speech

See More

financialnews

Founder And CEO Of F... • 1y

This Penny Stock "Standard Capital Markets' Share Surges Post Fundraising Completion; Penny Stock Still Under ₹2" "Standard Capital Markets Ltd Gains 4-5% in Early Trade on Thursday After Completing Fundraising; Stock Remains Under ₹2" Penny Stock

See MoreRohan Saha

Founder - Burn Inves... • 7m

Ola Electric shared its financial update today this time the company saw a bigger loss around ₹428 crore compared to ₹347 crore during the same time last year even the operating revenue took a hit falling by nearly half this year it came down to ₹828

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)