Back

Arcane

Hey, I'm on Medial • 1y

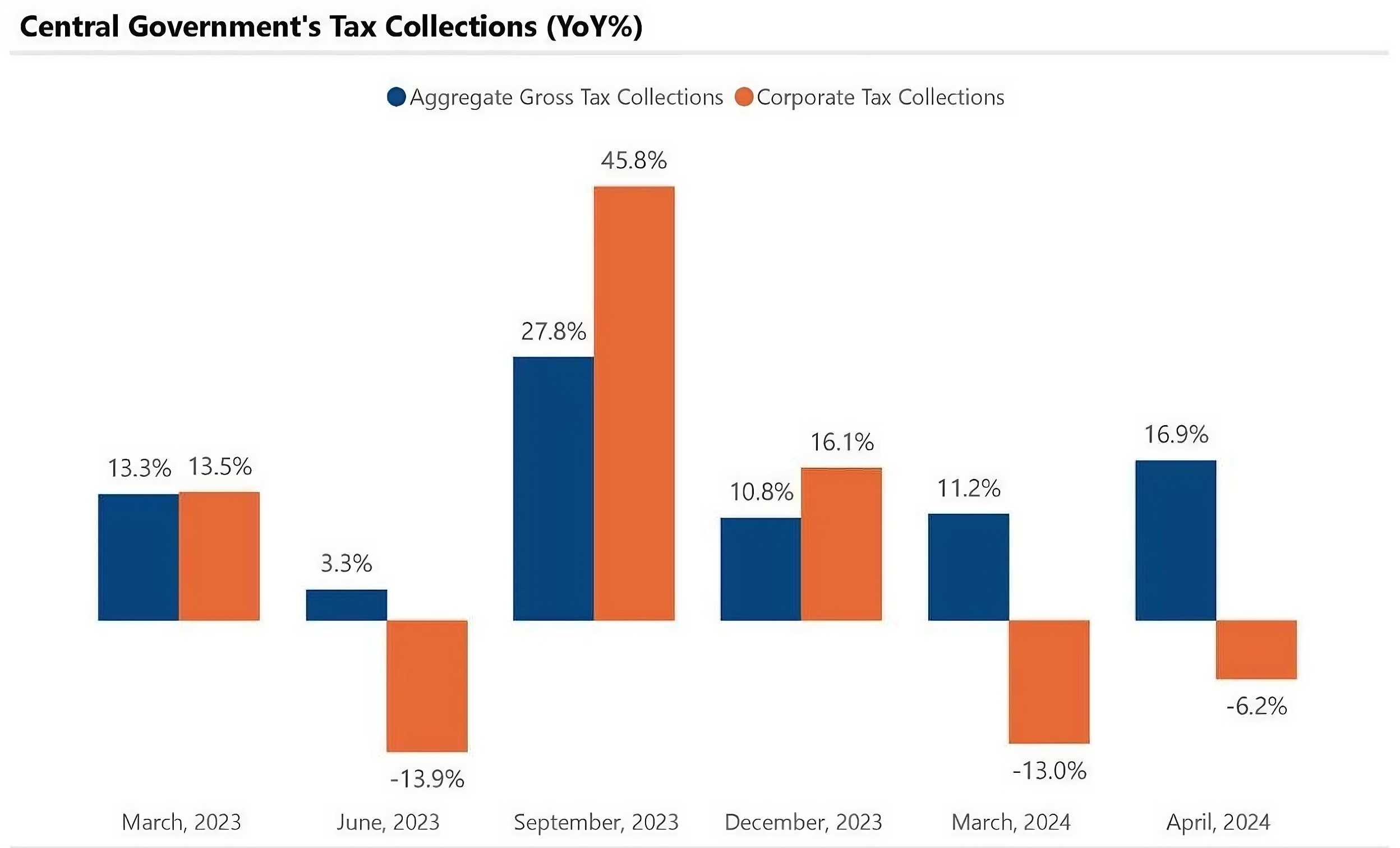

ONE INTERESTING OBSERVATION SERIES DAY #4 Good news and bad news on the Indian tax collection front. Personal income tax is surging, with a near 20% increase over the past three months, suggesting that individual spending might be on the rise, indicating a positive consumer sentiment. But here's the concerning flip side: corporate tax collections are experiencing a double-digit decline over the same period. March is a crucial month for businesses in India, as it's when they adjust their advance tax payments for the full year. This year, however, those payments saw almost a worrying 15% YoY drop. This could be a red flag for corporate profitability, which often acts as a leading indicator for economic growth, especially when it comes to future investments. This trend needs close monitoring to see if it is just a temporary blip or more of a systemic concern.

Replies (3)

More like this

Recommendations from Medial

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreAakash kashyap

Building JalSeva and... • 1y

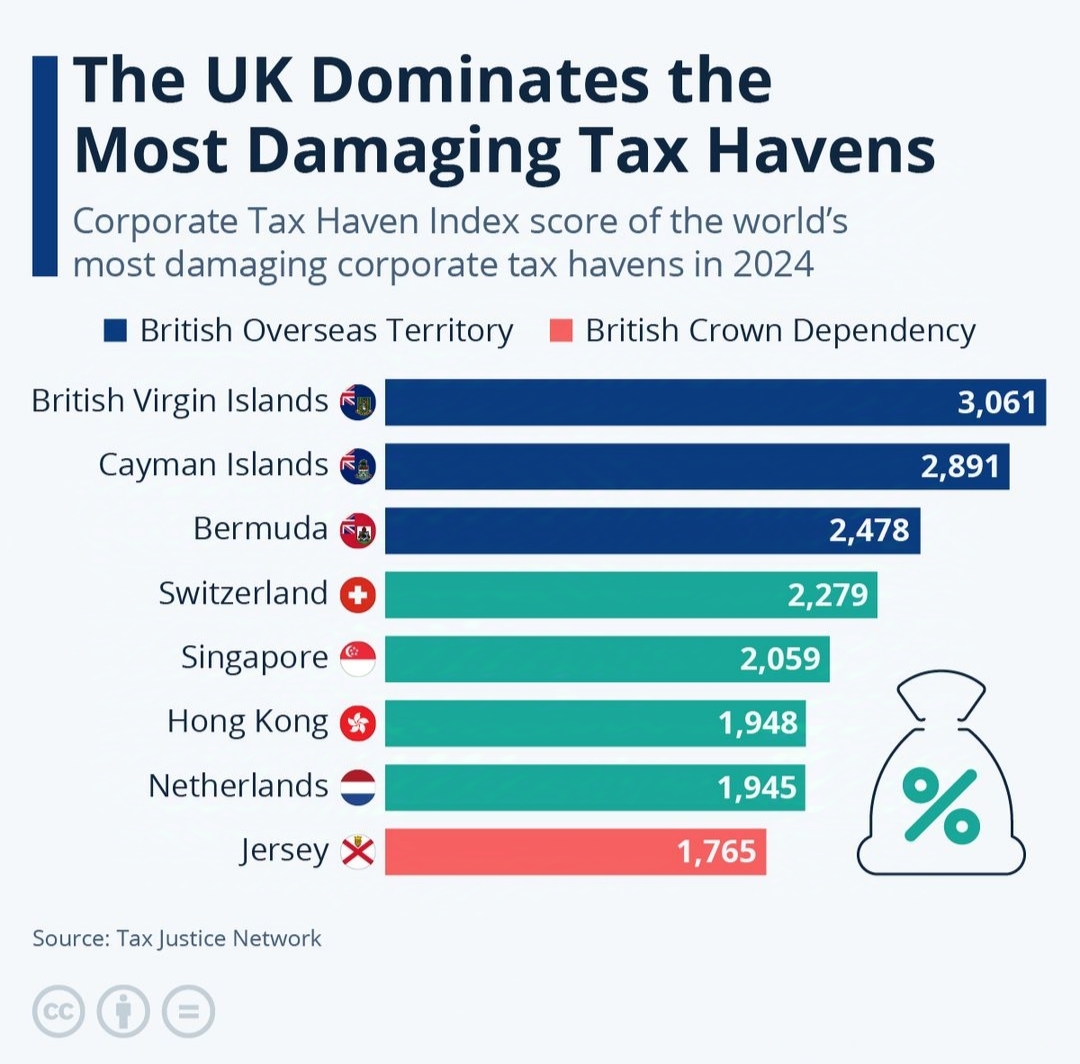

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)