Back

Anonymous

Hey I am on Medial • 1y

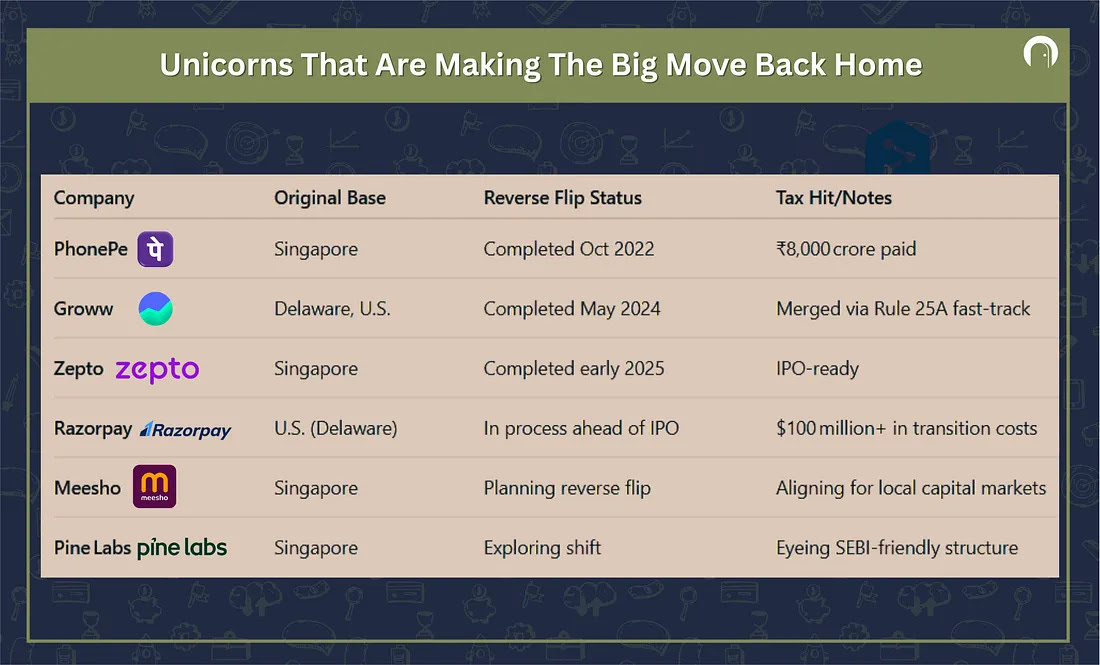

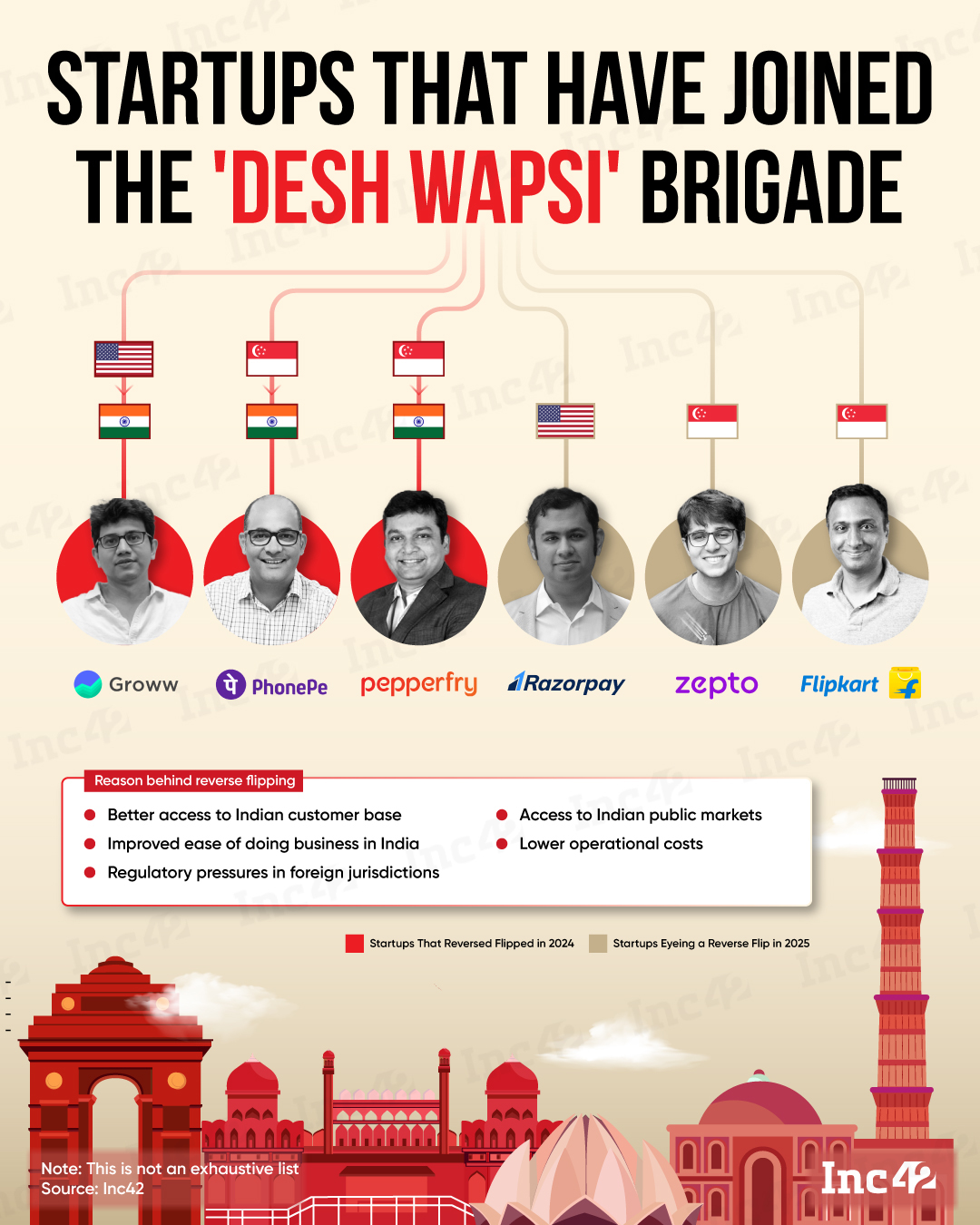

40% Indian unicorns aren’t actually Indian Razorpay is planning a ‘Bharat Wapsi' from US that could cost them around $300 in taxes. Today, I wanted to explain the process, Infamously called a "reverse flip". - PhonePe and Zepto might have to pay over $1 BILLION in taxes for their reverse flip. - Groww is still figuring out the best structure. The comeback path involves carefully executing a "share swap" strategy. In simple terms: Shareholders in Razorpay’s US entity would receive proportional shares in the Indian Entity. Then the US Entity would wind down operations. While this might seem strategic to IPO, Razorpay could face a huge tax bill. Even though the concept of unicorns moving back to India to IPO is exciting, it comes with complex challenges of tax and laws. Curious why this is done in the first place?

Replies (19)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreWomenCare

Santan social networ... • 9m

Is there a way around Stripe Payments, since the software I am using only supports Stripe and two other payment gateways and all of them require an American(US) business entity. Being an Indian business entity, how should I use Stripe being in Indi

See MoreVCGuy

Believe me, it’s not... • 1y

Indian startups are Reverse Flipping. Many startups incorporate in countries like Singapore, Mauritius, the US (primarily for SaaS), or the Cayman Islands for several reasons: - Ease of doing business - Tax incentives - Better funding opportunities

See MoreSamCtrlPlusAltMan

•

OpenAI • 8m

After years of chasing capital abroad, billion-dollar tech giants are shifting their HQs back to India. Once drawn overseas by easier fundraising and U.S. IPO dreams, over 70 fastest-growing Indian tech companies are making a U-turn, closing offshore

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 8m

📉 From 66 to 4: What's happening with Y Combinator and Indian Startups? 🇮🇳 Y Combinator's backing of Indian startups significantly dropped in 2024, and it's a fascinating shift! Here's why: * "Reverse Flipping" Costs: YC's requirement for a U

See More

Aakash kashyap

Building JalSeva and... • 1y

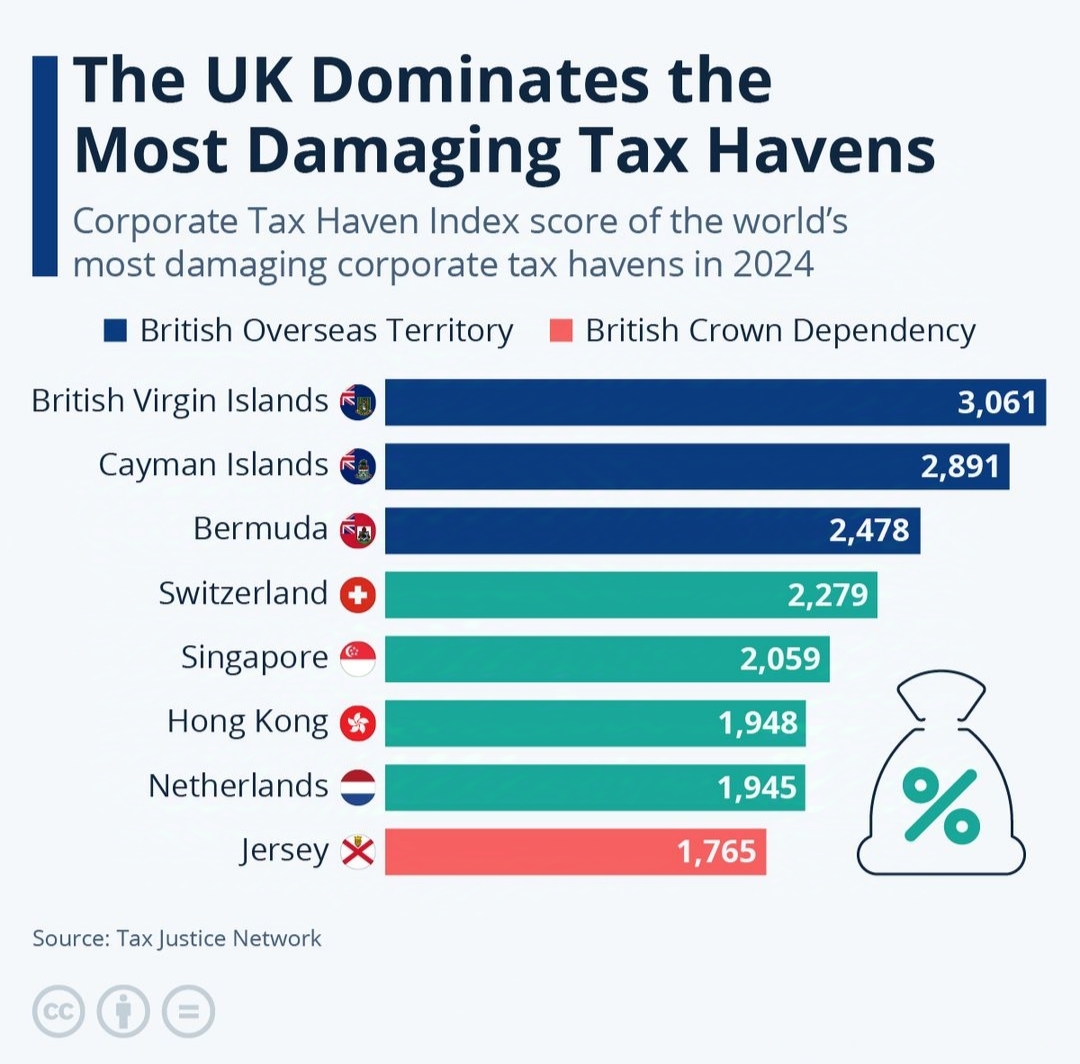

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)