Back

Arcane

Hey, I'm on Medial • 1y

Tax collections for the Govt can be much higher if they are through GST as we don't think of it while paying, while that's not the case with Income Tax. I wonder what type of Taxation system would work the best in India ?!

Replies (1)

More like this

Recommendations from Medial

Prem Siddhapura

Unicorn is coming so... • 1y

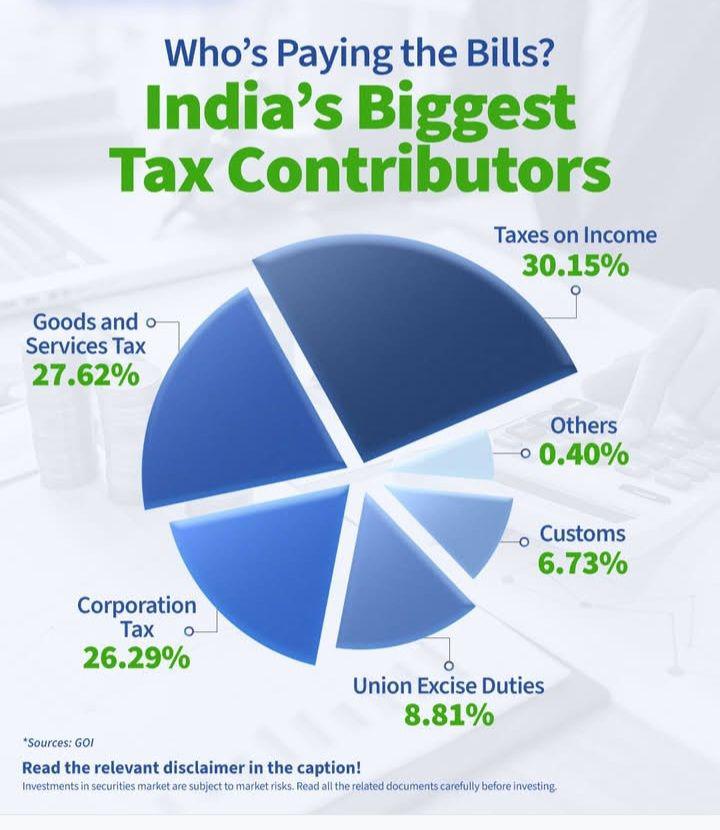

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreVamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

Ashutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreRishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)