Back

More like this

Recommendations from Medial

Aakash kashyap

Building JalSeva and... • 1y

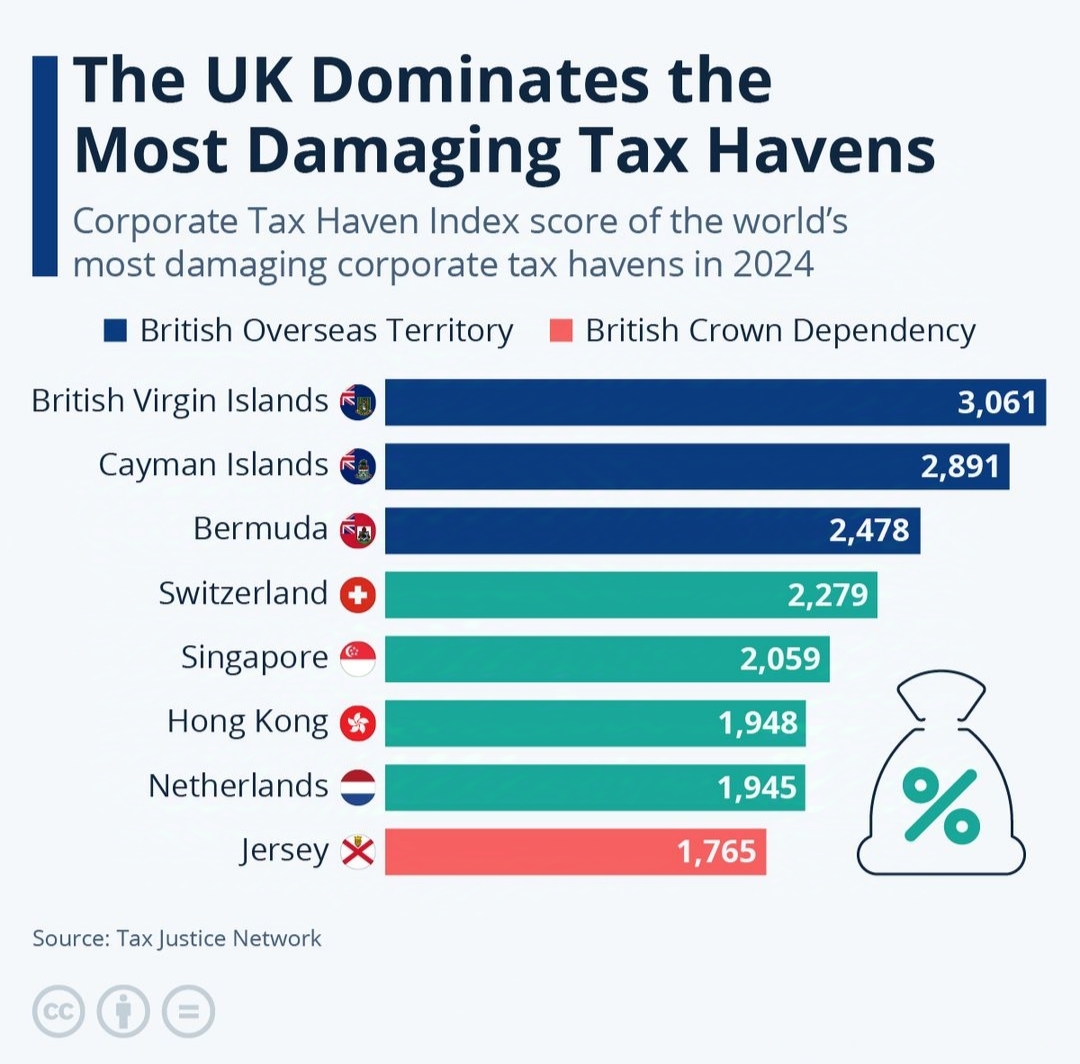

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8.

See MoreVCGuy

Believe me, it’s not... • 1y

Indian startups are Reverse Flipping. Many startups incorporate in countries like Singapore, Mauritius, the US (primarily for SaaS), or the Cayman Islands for several reasons: - Ease of doing business - Tax incentives - Better funding opportunities

See MoreChetanya Jain

Be passionate, live ... • 1y

What do u say? Do we require better connectivity, a better economy and a better employment rate? Actually in a nation where still people are unemployed, is it possible to employ students who can work part time and can fulfil their day to day expens

See MorePriyesh Pansari

Business and Managem... • 1y

I’m thrilled to share an exciting initiative to simplify India’s complex tax system through AI-powered automation. Our platform aims to process bank statements, classify transactions, and generate tax-ready reports while ensuring compliance with regu

See MoreAtharva Deshmukh

Daily Learnings... • 1y

PESTLE Framework:- The framework analyzes external factors influencing a business. 1] Political:- Government policies, regulations, stability, tax policies, trade traffic 2] Economic:- Economic growth, inflation, exchange rates, interest rates 3]

See MoreVamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)