Back

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

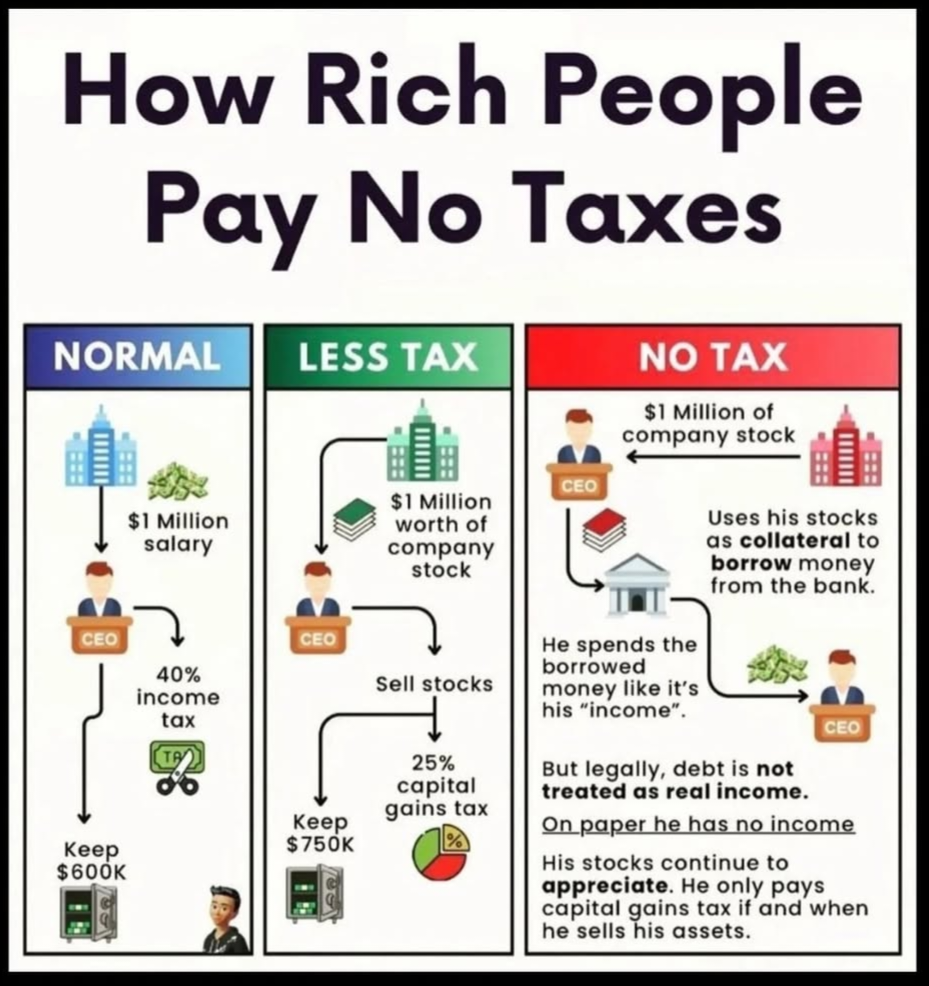

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Vivek Joshi

Director & CEO @ Exc... • 4m

One of the country’s big debt fund is looking for real estate debt deals. We at Excess Edge Experts Consulting Would appreciate if you could kindly share our reference to your network. Would appreciate if you could share your decks and business pl

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

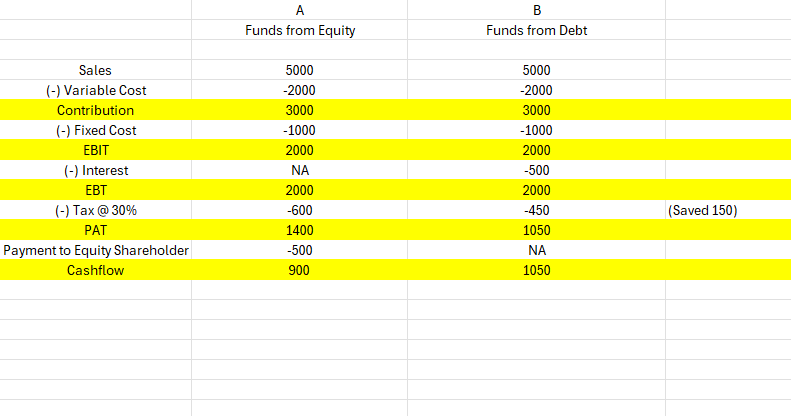

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Anonymous

Hey I am on Medial • 1y

How important is a problem statement? If you can deliver a better product than the competition ,if it's quicker delivery or cheaper prices. Will it be a issue if there is not a huge problem? For example in the fashion industry if delivery speed is n

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)