Back

Harsh Tiwari

Hey I am on Medial • 1y

Giving the loans at higher rates to ensure our money back and return the money at the closure of the loan which was taken above our minimum rates so that the effective rates for them will be same as of the loan at lower rates. So effective rate will be same as other people, rate charged will depend on customer profile, and if loans don't become bad then customer will get extra money charged at the end.

Replies (2)

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreAkshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreVikas Acharya

Building Reviv | Ent... • 11m

Yenmo Raises ₹9.2 Crore to Expand Instant Loan Services Yenmo, a Bengaluru-based startup, has raised ₹9.2 crore in funding, led by Y Combinator with support from Pioneer Fund, Zaka VC, and other investors. What Does Yenmo Do? Yenmo offers instant lo

See More

Harsh Tiwari

Hey I am on Medial • 1y

I have a business plan which will definitely change the whole home loan, loan company sector in India for the people who are paying more interest on thier loans just because they have low income or low cibil score. While people earning more who don

See MoreAtharva Deshmukh

Daily Learnings... • 1y

About Rates in the market... To strike a balance in market, the RBI has to consider all economic factors and carefully set the key rates. Any imbalance in these rates can lead to economic chaos: 1)Repo Rate:-The rate at which RBI lends money to oth

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

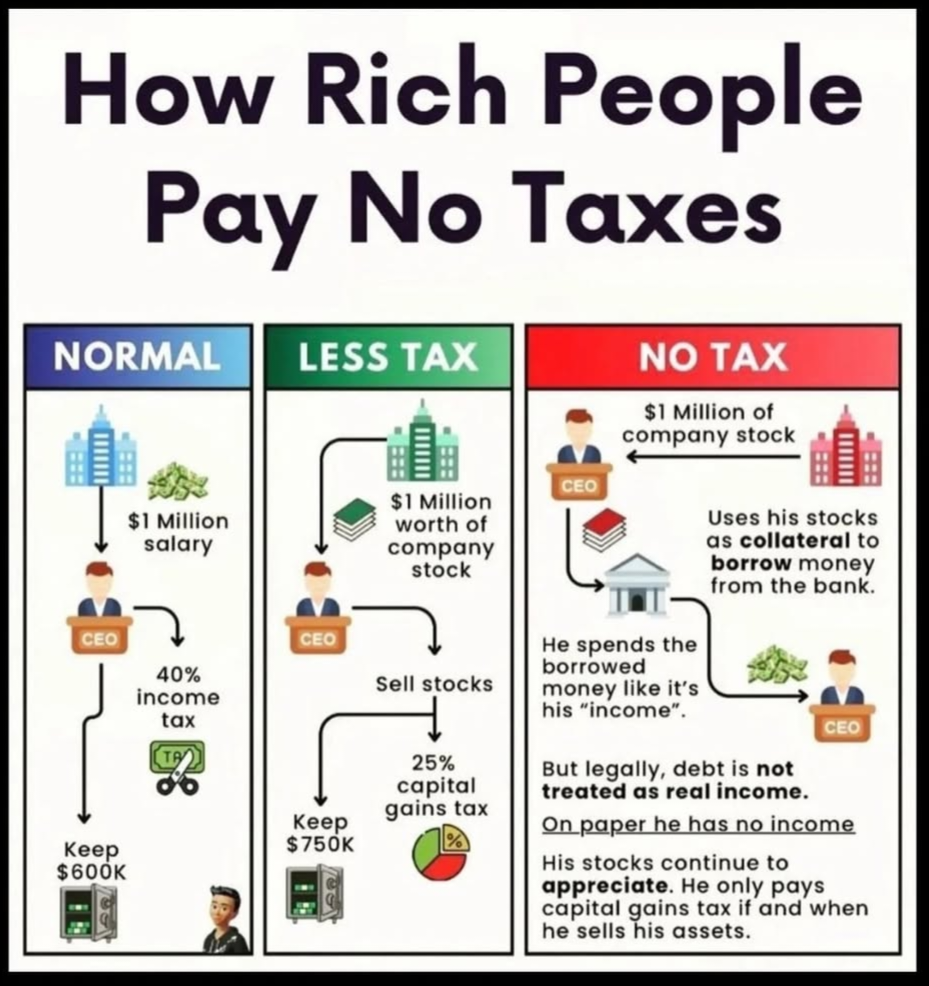

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

aaquib mahfooz

Being innovative • 1y

i have idea of creating an online platform that connects lenders directly with borrowers is similar to peer-to-peer lending (P2P lending). P2P lending has become popular in recent years as an alternative to traditional banking and NBFC loans. To mak

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)