Back

Vikas Acharya

•

Medial • 1y

Word to Know: Burn Rate - How fast a startup spends money. Lower rates = longer runway.

More like this

Recommendations from Medial

Santhosh Gandhi

Decoding Venture Cap... • 11m

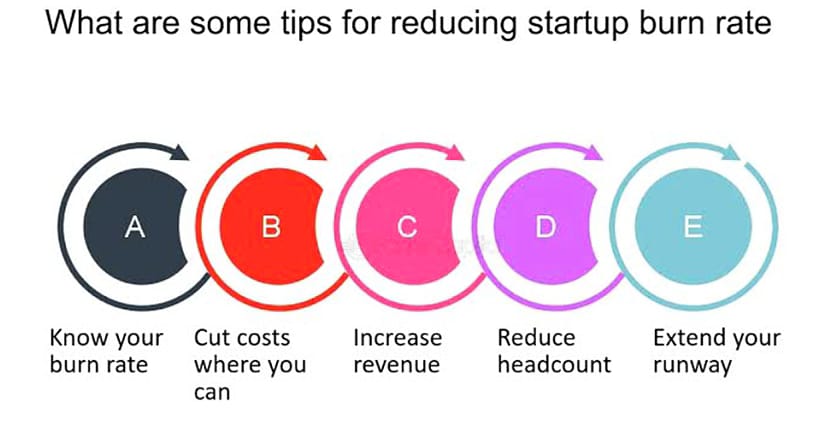

Startups don’t die because they have bad ideas. Most die because they run out of money. And that’s exactly why understanding Burn Rate and Runway is crucial. Burn Rate is the amount of money a startup spends every month to operate salaries, rent, ma

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreSwapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreVedant Tiwari

Founder of VedspaceA... • 1y

Guysss... How to calculate the burn rate? like a initial startup... who's in initial stages... And a investor asking how much you need??? as our last post, a lot of you suggested some of the great ideas.... thanks for that... one of them was, burn

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

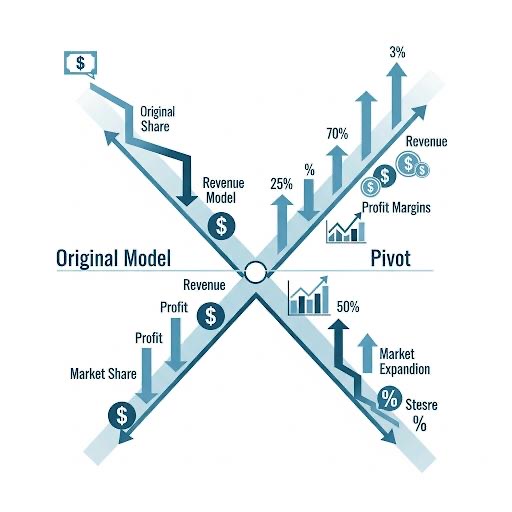

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)