Back

Amil Naushad

18 | Startups | Fina... • 1y

Interesting! What are you planning to do to solve this? To give out home loans to people who've low CIBIL score at lower rates of interest? Won't that be a little too risky? The loan recovery rates will be lower which is not good for any lending platform I believe.

Replies (1)

More like this

Recommendations from Medial

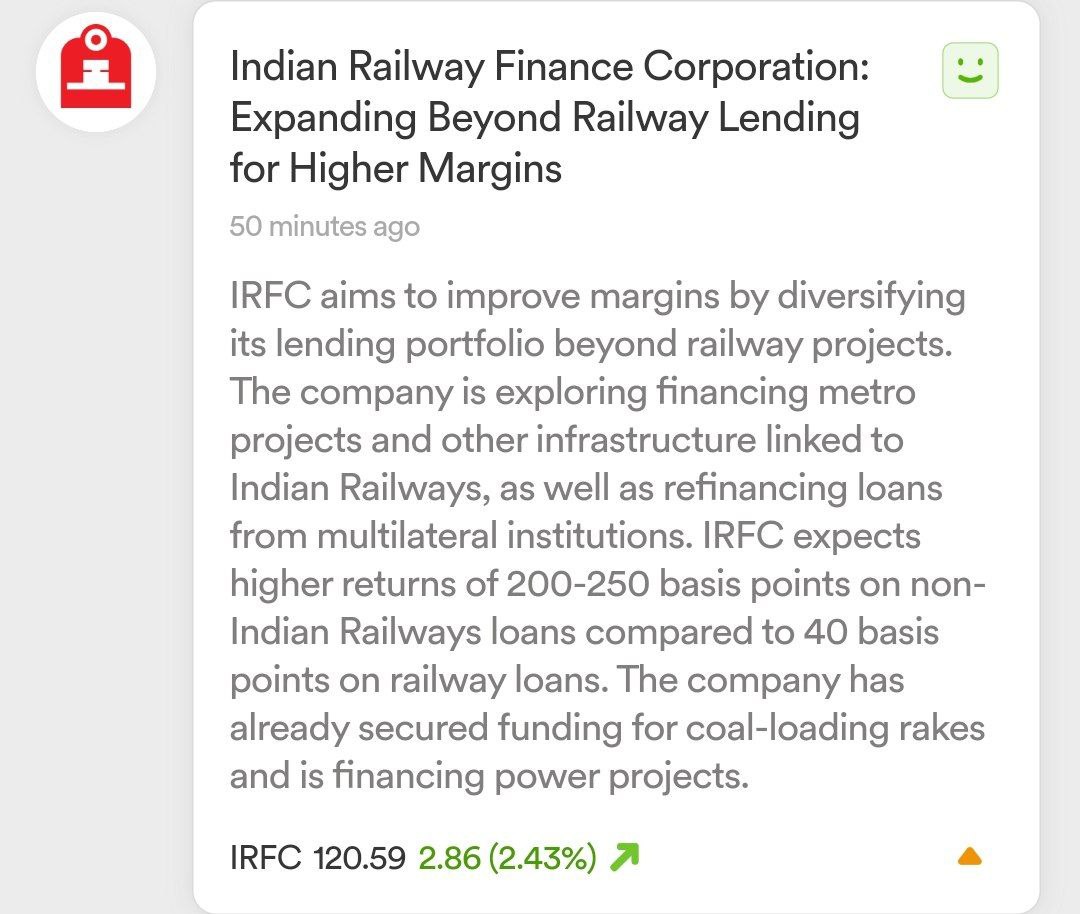

Vikram Kumar

Founder at Stockware • 1y

Navi Finserv Ordered to Cease Loan Disbursement by RBI 🚨 In a recent development, Navi Finserv, the NBFC arm of Sachin Bansal’s Navi Technologies, has been ordered by the Reserve Bank of India to cease and desist from sanctioning and disbursing loa

See MoreSARASHI ASSOCIATION

Hey I am on Medial • 12m

Sarashi Association Need help for startup and grow.....My aim is to provide loans to common poor business people at very low interest rates, and much lower than normal banks and finance company like half interest loans, small medical expenses loans

See MorePraveen Kumar

Start now or Regret ... • 1y

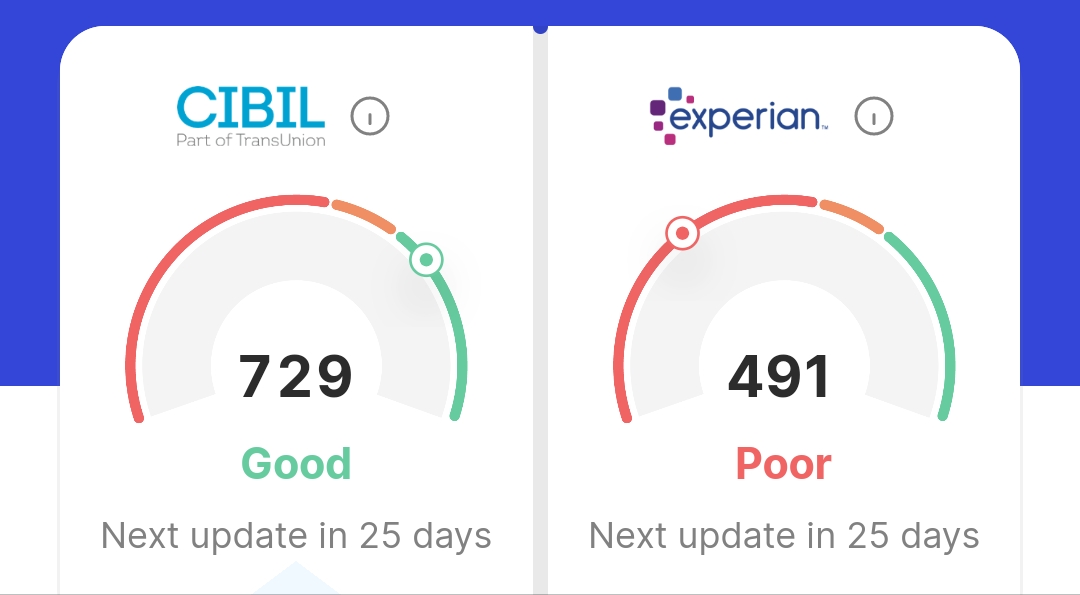

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

Harsh Tiwari

Hey I am on Medial • 1y

I have a business plan which will definitely change the whole home loan, loan company sector in India for the people who are paying more interest on thier loans just because they have low income or low cibil score. While people earning more who don

See MoreDownload the medial app to read full posts, comements and news.