Back

Rohan Saha

Founder - Burn Inves... • 11m

IRFC is looking to enter non-railway lending. If this happens, it could create issues for other infrastructure lenders because IRFC typically has a lower borrowing cost, which allows them to distribute loans at a lower interest rate.

More like this

Recommendations from Medial

aaquib mahfooz

Being innovative • 1y

i have idea of creating an online platform that connects lenders directly with borrowers is similar to peer-to-peer lending (P2P lending). P2P lending has become popular in recent years as an alternative to traditional banking and NBFC loans. To mak

See MoreADITYA

Aditya Kumar Jha | P... • 1y

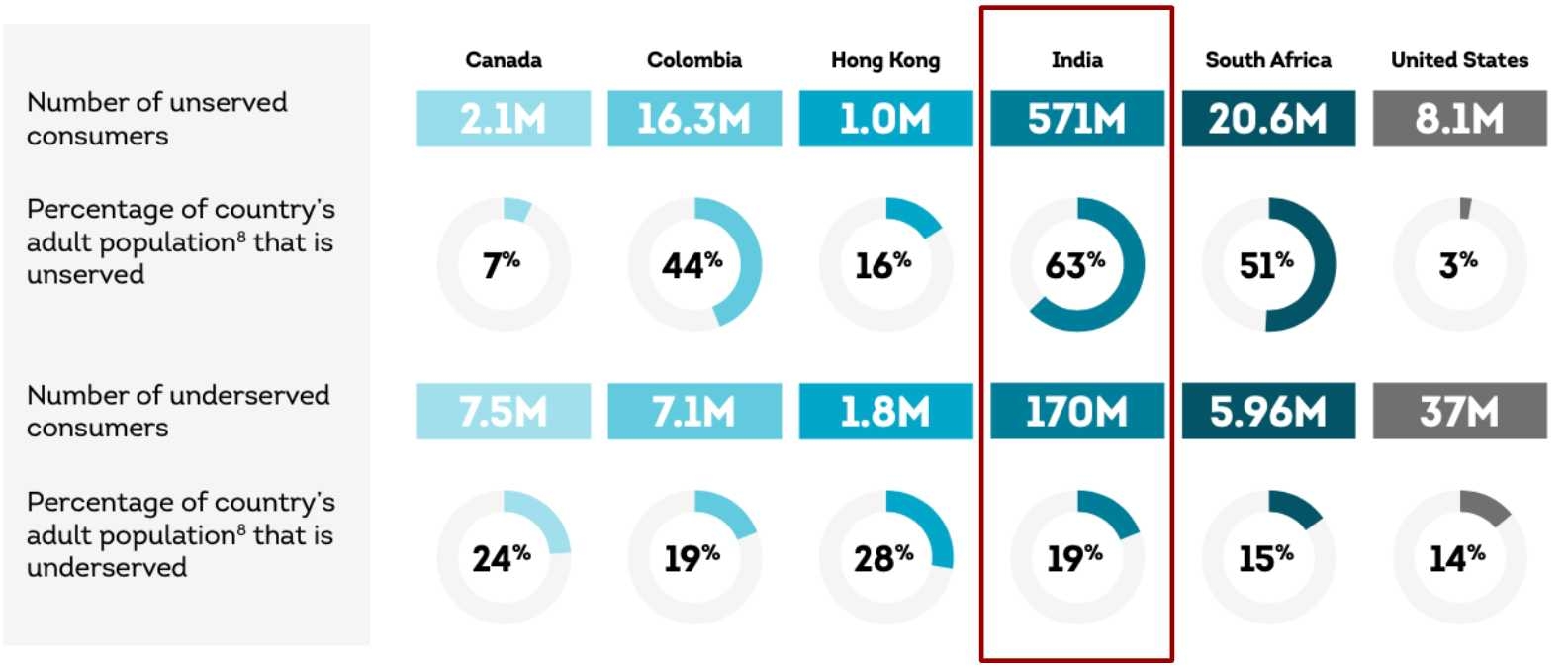

Concept. A lending platform that connects undeserved borrowers with lenders , offering personalized pathways to improve their creditworthness and access affordable loans . Please give me insights on this if you find any demerit discuss with if anyb

See MoreGyananjaya Behera

Helping an Idea to S... • 1y

Volt Money Partners PhonePe To Offer Loans Against MFs - Partnership Announcement: Volt Money has partnered with PhonePe to offer loans against mutual funds through the PhonePe app, with loan sizes ranging from INR 25,000 to INR 5 Cr. - Integration

See More

Kishore Arepalli

Co-founder at AlphaW... • 1y

Hi everyone! I’m exploring an idea for a digital platform that connects individual lenders with finance seekers in India- a solution that could help many people access funds more easily while providing earning opportunities for lenders. The goal is

See MoreRohan Saha

Founder - Burn Inves... • 7m

KreditBee made a profit of ₹473 crore this quarter which is 66% more than before, So far they have given out loans worth ₹25,000 crore. The company is growing fast and wants to expand even more. They are also regularly raising money from private len

See MoreKarnivesh

Simplifying finance.... • 1m

A realization that changed my perspective: monetary tightening doesn't impact businesses uniformly. The same rate hike helps some while hurting others. 🔸When prices surge, central banks lift borrowing costs to slow spending. Lenders benefit from im

See More

Download the medial app to read full posts, comements and news.