Back

Karnivesh

Simplifying finance.... • 21d

When I first heard the term negative working capital, it sounded like a problem. Then I saw how some businesses actually use it. In these models, customers pay first. Products move quickly. Suppliers are paid later. Cash enters the system before expenses leave it, making daily operations surprisingly comfortable. You see this in retail, FMCG, and even auto companies. Payments are collected instantly, inventory turns fast, and supplier terms do the heavy lifting. The business isn’t chasing cash. Cash is already there. But it only works when driven by strong operations. Fast turnover, trusted brands, and healthy supplier relationships. When negative working capital comes from delayed payments or slowing sales, it’s a warning sign. Understanding this difference changed how I read balance sheets. Sometimes, what looks negative on paper is actually a quiet strength. 👉 Refer to the attached link for a deeper breakdown and examples.

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 28d

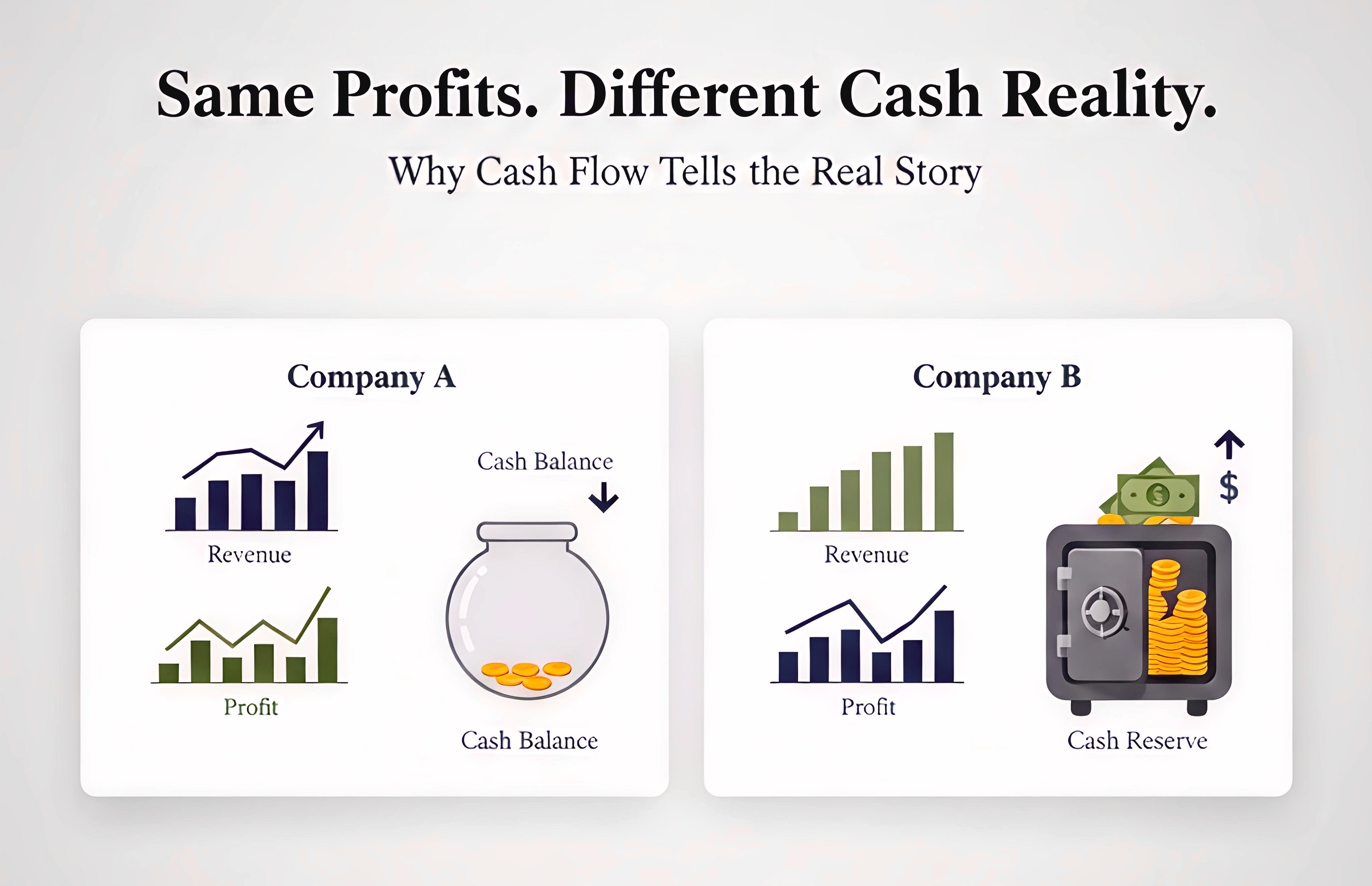

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly an

See More

Karnivesh

Simplifying finance.... • 1m

Growth looks good on dashboards. But I’ve learned that not all growth actually creates value. Some companies grow organically, improving products, deepening customer trust, strengthening margins. It’s slower, but resilient. Others grow fast throug

See MoreAccount Deleted

Hey I am on Medial • 8m

ARR vs MRR vs Cash Flow It’s easy to feel like things are going well when your ARR looks strong. Or when MRR keeps ticking up. But if your bank account is saying otherwise, something's off. Breakdown: 1) ARR shows the big picture. Great for invest

See MoreKarnivesh

Simplifying finance.... • 25d

Not all capital spending creates growth. Some of it simply keeps a business from slipping backwards. This became clear to me after a conversation where a company proudly announced a large CapEx plan. It sounded impressive, until the question came up

See MoreVansh Khandelwal

Full Stack Web Devel... • 26d

OfBusiness streamlines B2B raw‑material procurement by linking manufacturers, suppliers and SMEs on a single tech platform that centralizes orders, shipment tracking and financing. It addresses payment delays, cash‑flow gaps and limited market access

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)