Back

Karnivesh

Simplifying finance.... • 22d

Not all capital spending creates growth. Some of it simply keeps a business from slipping backwards. This became clear to me after a conversation where a company proudly announced a large CapEx plan. It sounded impressive, until the question came up: how much of this is maintenance and how much is actually growth? Maintenance CapEx is the cost of staying in place. Machines need replacement, systems need upgrades, plants need repairs. Growth CapEx is different. It’s a choice to expand capacity or enter new markets. Once I started separating the two, business quality looked very different. Mature companies often spend to maintain steady cash flows. Growing companies invest heavily but may not generate free cash flow for years. Now, when I look at CapEx, I focus less on the number and more on its purpose. That distinction quietly changes how you judge cash flows and long-term value. 👉 Read more in the attached link for a deeper breakdown.

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 26d

A finance leader once said something that changed how I look at businesses. “We were profitable on paper, but cash was always tight.” That’s when the cash conversion cycle started making sense to me. A company may sell today, wait weeks or months

See MoreMahesh Reddy

Semi qualified CMA (... • 11m

Hey founder👋 Ever wondered how startups figure out their worth? Let me break down the Discounted Cash Flow (DCF) method—it’s easy! What’s DCF? It calculates a business’s current value by predicting its future cash flows and adjusting for risk usin

See MoreAtharva Deshmukh

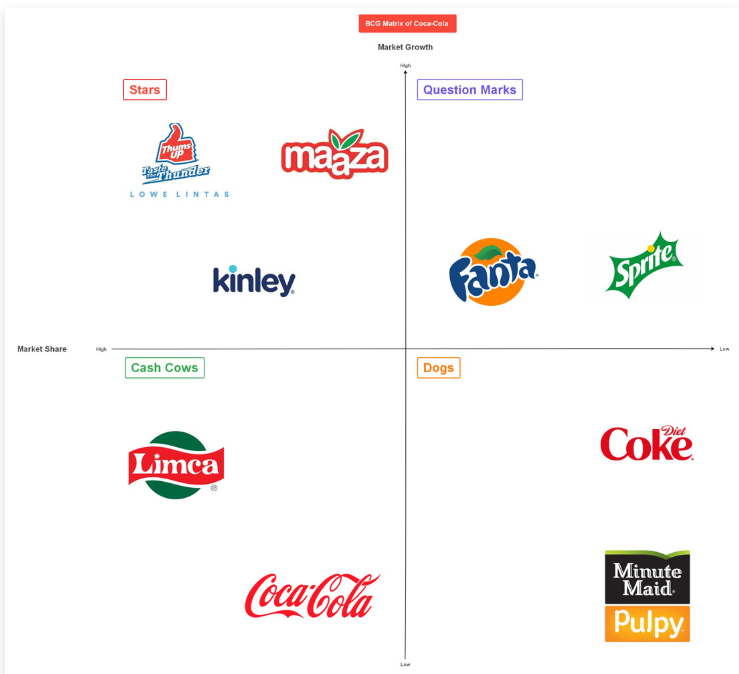

Daily Learnings... • 1y

BCG Growth Matrix is a framework for analyzing a company's product portfolio. There are 4 quadrants, each of which represents a particular product or business, the vertical axis represents market growth (cash generation) and the horizontal axis repr

See More

Karnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreKarthik Sreedharan

Fintech CEO | Revolu... • 1y

Cash flow management and control is one of the biggest pain points of startup founders, stakeholders and CFOs. Would you like try out an AI Copilot that enables you manage and control your cash flows and manage your finance team through approval work

See MoreKarnivesh

Simplifying finance.... • 1m

Slower growth usually sounds like a warning sign. But when I look at profitable companies today, I see something different happening. Many strong businesses are deliberately easing growth to protect margins, cash flows, and balance sheets. FMCG comp

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)