Back

Shivam Bansal

. • 1m

Most startups don’t fail because the idea is weak—they fail because cash stops moving. The Baniya mental model doesn’t obsess over valuation or narratives; it obsesses over daily cash inflow vs outflow. Operations are designed to protect liquidity: buy only against visible demand, rotate inventory fast, shorten receivables, stretch payables, and never lock cash without predictable returns. Credit is used to accelerate rotation, not to subsidize losses, and margins are defended early because unclear margins make scale lethal. For a Baniya, survival is the real moat—if the business can stay alive long enough, it eventually wins. Founder takeaway: track cash weekly, not quarterly; build operations for the worst case, not the pitch deck; treat cash like oxygen, not fuel—because growth is optional, but survival is not.

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 11m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreOnly Buziness

Everything about Mar... • 4m

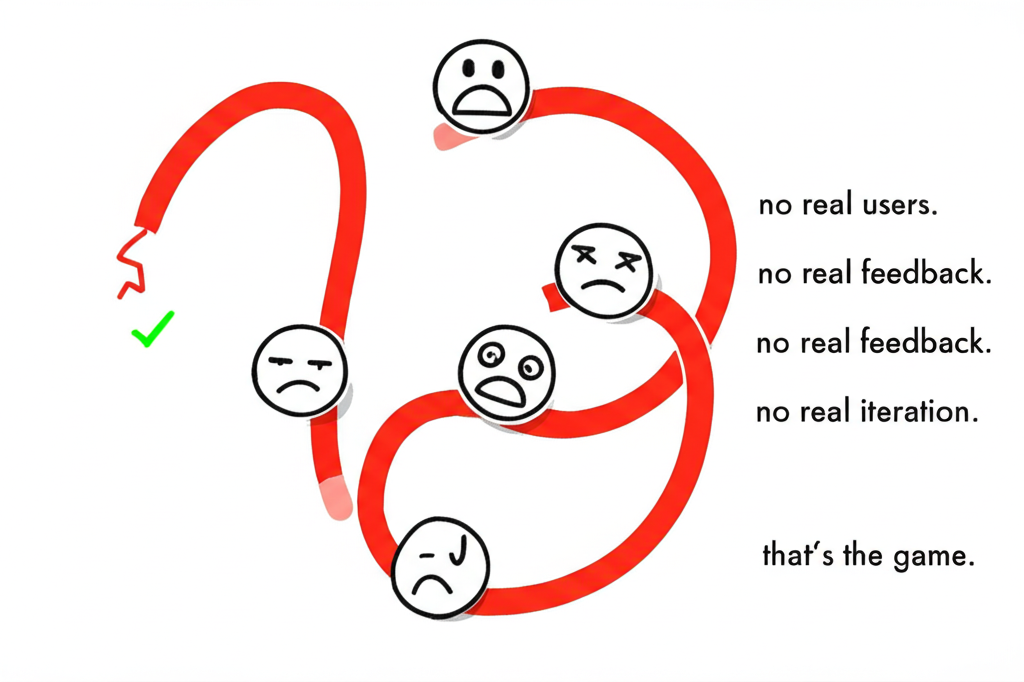

Most startups fail before launch not because of bad ideas, but because of blind optimism. Founders fall in love with the product, not the problem. They spend months perfecting logos, websites, and pitch decks—but never validate whether customers actu

See MoreAshok Prajapat

Take Risk And Build ... • 5m

Most people don’t fail because their idea is bad. They fail because they quit too early. Do you agree — or is this just startup fairy-tale talk?” “I’m convinced that about half of what separates the successful entrepreneurs from the non-successful

See MorePoosarla Sai Karthik

Tech guy with a busi... • 10m

A routine topic - but it's a necessary one. Why Indian Startups Fail in the First 3 Years? A lot of Indian startups don’t fail because the idea is bad, they fail because the fundamentals are overlooked. Founders often build what they like instead o

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)